Invoices are a major component of operating a business. They facilitate effective transactions, have proper documentation, and help trace payments. As a beginner at invoicing or looking to increase your knowledge in this area, this guide aims to equip you with all that you should learn about How to Write an Invoice successfully.

What Is an Invoice?

An invoice is a precise document that is sent by a seller to a buyer. It is a record of goods or services delivered and their price. It usually indicates payment terms, due date, and payment mode. In the case of businesses, invoices play a vital role in cash flow management and correct documentation of finance.

How to Write an Invoice? (Step-by-Step-Guide)

Creating an invoice might seem overwhelming at first, but following a clear structure makes the task straightforward. Here’s how to do it:

- Add Your Business Details: At the top of the invoice, place your business name, address, phone number, and logo to professionalize it.

- Assign an Individual Invoice Number: Each invoice must have a distinct, consecutive number for clear identification and referencing.

- Add Invoice Date and Due Date: Insert the date of invoice release and payment due date to avoid confusion.

- Insert Buyer’s Information: Insert name, address, and contact information of the recipient.

- Insert Products or Services Provided: Use a table or plain layout to outline the products or services, quantity, unit price, and total.

- Calculate Total Amount: Total all the charges, add any tax charges, and indicate the amount to be paid.

- Outline Payment Terms and Method: Clearly outline approved terms and payment method, for instance, early payment discount or late fee charges.

- Insert Any Notes or Instructions: Add personalized messages such as “Thank you for your business” or next steps instructions.

How to Write an Invoice? (Professional Tips)

To produce professional and efficient invoices, observe these best practices:

- Be Clear and Concise: Speak clearly and without ambiguity. Clarifying descriptions serve to add understanding.

- Use a Consistent Format: Keep an identical design across all invoices to ensure brand coherence and professionalism.

- Double-Check for Errors: Double-check for accuracy in numbers, dates, and client information to avoid hold ups or quarrels.

- Send Timely Reminders: Should your client happen to forget about payment, civil reminders ensure that the process continues smoothly.

If you’re creating invoices for international trade, understanding the differences between a Proforma Invoice and a Commercial Invoice is crucial.

How to Make an Invoice Using the Invoice Generator

For simple and convenient invoicing, think about using an invoice generator. It makes it easy and gives you templates for a professional look. Here is how to use it:

- Select a Reputable Platform: Pick a simple invoice generator tool that is suitable for you.

- Enter Your Information: Enter your business and client details in the template offered by the tool.

- Include Items and Charges: Add line items, prices, taxes, and other charges directly onto the form.

- Review and Download: After entering all the information, review for any mistakes and download the invoice in your preferred format, e.g., PDF.

- Send the Invoice: Utilize email or other communication channels for instant delivery.

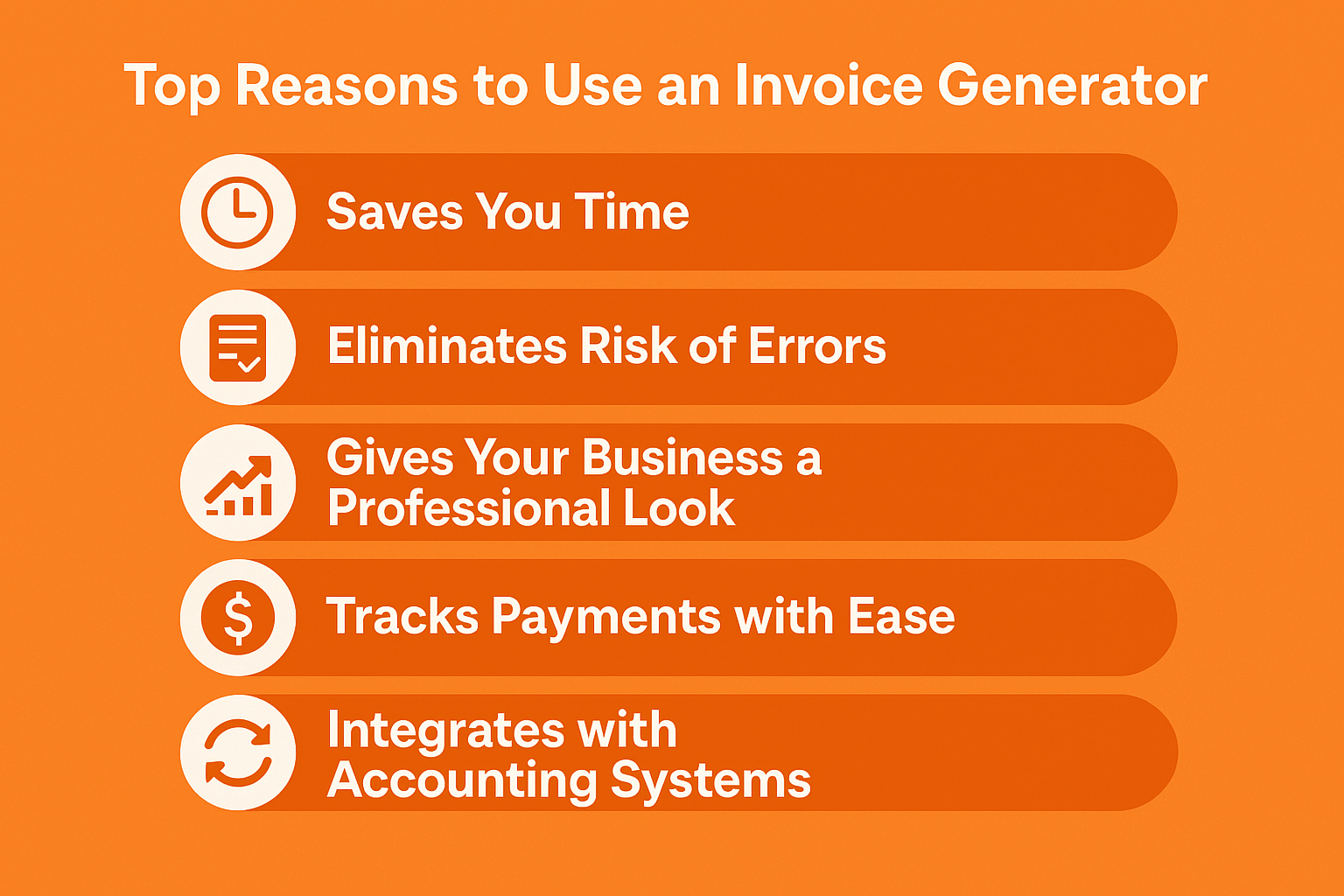

Top 5 Reasons to Use an Invoice Generator for Your Business

Dealing with invoices at times can be a chore, especially when paper piles up or you’re handling tight deadlines. That is where an invoice generator is helpful. Whether you are a businessperson handling more than one client or a freelancer wanting to keep track of your payments, an invoice generator offers some advantages that can make your job simpler and help you receive your money sooner.

These are the key benefits you’ll have with an invoice generator and why installing one could be the best thing you ever do for your business.

Saves You Time

Time is money, and if you’re a freelancer or small business owner, yours is precious. Manually making invoices in word processors or spreadsheets can take hours you might otherwise spend on your art or building your client base.

Invoice generators save time by enabling you to create professional invoices in minutes. Many of them let you reuse client details, save service descriptions, and even set up recurring invoices for long-term projects. For example, if you are a graphic designer with a retainer each month, you will not have to start from scratch every month.

Eliminates Risk of Errors

Human errors, such as typos, miscalculations, or left-out information, may cause delays in payment unnecessarily. Consider accidentally miscalculating a total or neglecting to add your payment terms!

With an invoice generator, errors are minimized. Such software usually comes with auto-calculating software that handles taxes, discounts, and figures for you. Moreover, templates avoid you leaving out important information like due dates or contact numbers. This precision raises your level of professionalism and avoids you not getting paid unnecessarily because of back-and-forth corrections.

Gives Your Business a Professional Look

Your invoice is not just an invoice; it is an expression of your brand. Your ugly, cluttered invoice can be a first bad impression, even if the work is fantastic.

Invoice creators also tend to come with templates that you can personalize so that you provide a crisp, professional look. You can include your business logo, choose a color scheme that will be suitable for your business, and reformat so that it remains standard. For instance, if you are a freelance photographer and you provide a beautiful, branded invoice, you make a good impression and are in line with the quality of your work.

Tracks Payments with Ease

Keeping up with unpaid invoices or due dates can become overwhelming, especially if you’re working on multiple projects. With paper-based invoices or scattered spreadsheets, visibility into your payment statuses can easily get lost.

Invoice generators simplify payment tracking by enabling you to view who paid and who didn’t in a simple dashboard. Some even send automated reminders to clients to pay, so you won’t have to awkwardly chase people. This is especially helpful for freelancers who often depend on timely payments to pay for living costs.

Integrate with Accounting Systems for Easy Management

An invoice generator is not only capable of producing invoices. The majority of them integrate seamlessly with accounting programs like QuickBooks, Xero, or Wave. What this means is that your revenue data can be synced automatically, which simplifies tax season or monthly budgeting so much.

For example, as a small business owner who operates an online shop, you may connect your financial reports and your invoices to inventory. Combining them reduces laborious data typing and keeps your records up-to-date and precise at all times.

What to Include in an Invoice while Writing?

An invoice is an important business document, as it provides clear payment communication and accurate records. The following are what to include in an invoice:

- Header Information: The term “Invoice” clearly marked at the top. Your company name, logo, and address (address, phone number, email). Name and contact details of the recipient (client).

- Invoice Number: A distinct number for the invoice to follow payments and records.

- Invoice Date: The date on which the invoice is sent.

- Payment Due Date: The due date for payment to prevent ambiguity or delay.

- Description of Goods/Services: A comprehensive inventory of the products or services supplied, including the quantities, rate, and all pertinent details.

- Itemized Costs: Itemize the cost per item or service, including the unit price and total price.

- Subtotal: The sum cost prior to tax or extra fee.

- Taxes and Fees: Any taxes involved (e.g., VAT, sales tax) or extra fee, Also, ensure you include the right tax elements as explained in our tax Invoice guide.

- Total Amount Due: Final total amount to be paid by the client in the form of fees and taxes.

- Payment Terms: Identify approved modes of payment (e.g., bank deposit, credit card, PayPal). List late fees for overdue payment or offer an early payment discount.

- Bank or Payment Details: Offer your banking information or payment platform for swift transactions.

- Notes or Additional Information: Attach a thank-you message, terms of service, or other such information.

- Contact for Queries: Provide an address or phone number for questions or concerns regarding the invoice.

Conclusion

The ability to issue clean and professional-looking invoices is a plus for every entrepreneur or independent contractor. With appropriate elements like company details, line item expense, terms of payment, and location, you not only stay on track but also build your clients’ confidence. Good practices like a uniform design, rigorous checks for inaccuracies, and pre-project reminders to facilitate timely completion elude you not.

For added convenience and efficiency, you might also like to experiment with an invoice generator. These can save you time, eliminate mistakes, and give your invoices a clean, professional appearance. With automatic calculations, reusable templates, and payment tracking, invoice generators can streamline your workflow and get paid on time.

With these methods and tools, you can automate your invoicing without compromising on the professional look that represents the caliber of your goods or services. Take charge of your invoicing today and get your business ready for smoother transactions and success tomorrow!

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply