Imagine you received a bill that says “services Rendered – $400.” It’s Confusing, am I right? Now Imagine a proper organised breakdown, which shows what exactly was done, how much and what cost – suddenly, everything starts making sense. That’s the power of an Itemized Invoice.

For Businesses, Itemized Invoices are not just useful or helpful, they are essential and important also. They minimize confusion, prevent disputes between buyers and sellers and build trust in them. Whether you are offering various services or selling a variety of products, itemized invoices makes you sure that you are on the same page. In this blog we are going to cover all the details about Itemized Invoice.

What is An Itemized Invoice?

An itemized invoice is a comprehensive bill that includes the price, quantity, and rate of each individual good or service that was purchased. In essence, it gives the customer transparency by breaking down the entire cost. An itemized invoice explains each charge, as opposed to a standard invoice that might display the total amount due.

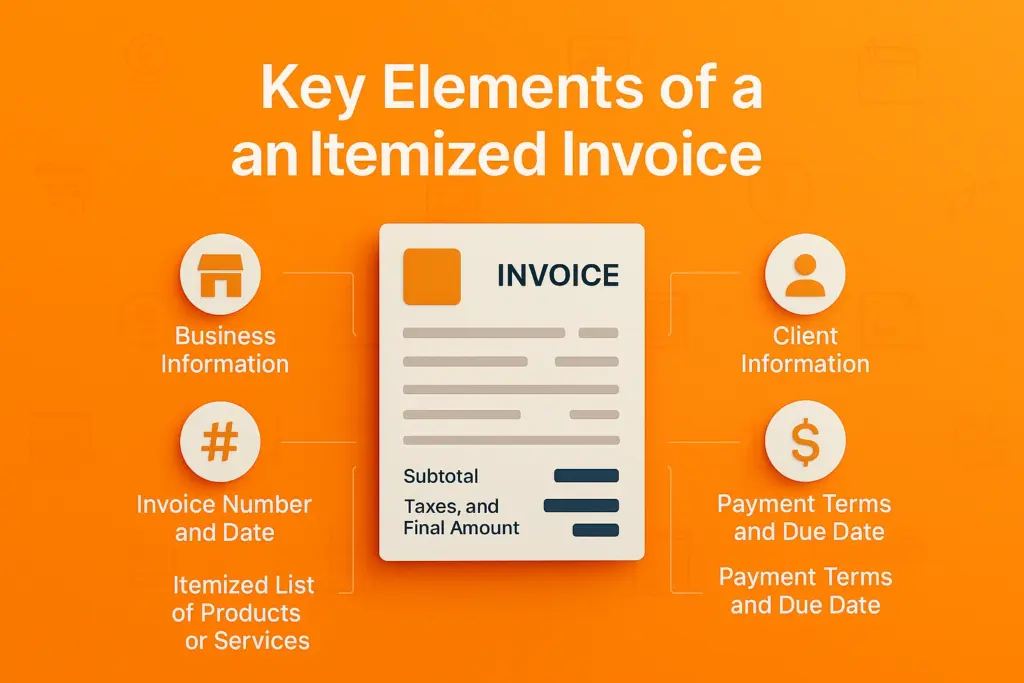

Key Elements of An Itemized Invoice

An itemized invoice include a detailed Information of products or services, Client’s Information, Invoice Number and Date, Itemized List of Products or Services, Payment Terms, and Due Date. Let’s unpack each key element of an Itemized Invoice.

1. Business Information

- This section includes all the essential details about your business. It helps the client identify who the invoice is from and ensures professionalism.

- What to include:

- Business name

- Address (physical or mailing)

- Contact information (phone number, email)

- Website (if applicable)

- Business logo (optional but adds credibility)

- Tax identification number (if required by law)

2. Client Information

- This section specifies who the invoice is for. It ensures the invoice is directed to the correct person or organization.

- What to include:

- Client’s name or company name

- Address

- Contact information (email, phone number)

- Any client-specific reference number (if applicable)

3. Invoice Number and Date

- These details are crucial for tracking and record-keeping.

- Invoice Number:

- A unique identifier for the invoice (e.g., INV-001, 2026-INV-123).

- Helps both you and the client reference the invoice easily.

- Invoice Date:

- The date the invoice is issued.

- Important for determining payment deadlines.

4. Itemized List of Products or Services

- This is the heart of the invoice, providing a detailed breakdown of what the client is being billed for.

- What to include for each item:

- Quantity: The number of units or hours of service provided.

- Unit Price: The cost per unit or hourly rate.

- Description: A clear and concise explanation of the product or service (e.g., “Graphic design services for March 2025”).

- Total Cost per Item: Multiply the quantity by the unit price to calculate the total for each item.

5. Subtotal, Taxes, and Final Amount

- This section summarizes the financial details of the invoice.

- Subtotal:

- The total cost of all items before taxes or discounts.

- Taxes:

- Any applicable taxes (e.g., sales tax, VAT). Clearly mention the tax rate and amount.

- Final Amount:

- The total amount the client owes, including taxes and any additional fees or discounts.

6. Payment Terms and Due Date

- This section outlines how and when the client should pay.

- Payment Terms:

- Specify the accepted payment methods (e.g., bank transfer, credit card, PayPal).

- Mention any late payment penalties or early payment discounts.

- Due Date:

- The deadline for payment (e.g., “Payment due within 30 days of invoice date”).

- Helps avoid confusion and ensures timely payments.

7. Notes and Terms & Conditions

- This section provides additional information or clarifications.

- Notes:

- A thank-you message to the client (e.g., “Thank you for your business!”).

- Any specific instructions (e.g., “Please include the invoice number in your payment reference”).

- Terms & Conditions:

- Legal or contractual terms (e.g., “All sales are final,” “Refunds are not applicable after 30 days”).

- Any policies related to disputes, cancellations, or warranties.

Why Use an Itemized Invoice?

Itemized invoices promote openness and clarity in billing, for the advantage of both the provider and the customer. They clearly state what is being charged for goods or services, which helps instill confidence and minimize disagreements. For customers, itemized invoices help track expenses for taxation and budgeting purposes, while for providers, they provide clear documentation and may simplify the payment process.

By breaking down each service and its cost, itemized invoices offer clarity and help in building stronger relationships with clients. Let’s discuss why to use an Itemized Invoice.

1. More Clarity and Less Confusion

When a client knows exactly what they’re paying for, things just go smoother. Itemized invoices spell out what’s delivered and how much each part costs, which is important when pricing can vary or the work is complex.

For example, if you’re a contractor working on a kitchen remodel, you could just write “Kitchen Renovation – $10,000.” But a clearer version might look like this:

- Cabinets – $4,200

- Countertops – $2,000

- Labor (40 hours @ $50/hour) – $2,000

- Paint and Supplies – $800

- Disposal Fees – $200

That kind of detail reassures your client that the quote is fair. It shows you’re organized and professional—something every client appreciates.

2. Fewer Billing Disputes

Various payment issues come down to misunderstanding. If someone doesn’t know what they’re being charged for, they’re more likely to push back. But when everything’s laid out clearly, those money talks can often be avoided.

Think, you’re a freelance designer billing $1,500. If your invoice just says “Design Services,” the client might wonder where that number came from. Instead, try breaking it down like this:

- Logo Design (concepts & revisions) – $1,000

- Social Media Banners – $300

- Print Consultation – $200

Now, if they have a question, it’s easy to reference specific line items. You come across as fair and transparent, and they feel more comfortable paying the bill.

3. Easier Bookkeeping (For Everyone)

Clear invoices don’t just help your clients—they make your own accounting a whole lot simpler.

Let’s suppose you run a bakery and cater a big event. If the invoice just says “Event Catering – $2,000,” your bookkeeper might be left guessing what that includes. But if you send this:

- 100 Cupcakes – $500

- 50 Sandwiches – $750

- Staffing (5 hours @ $150/hour) – $750

…it’s way easier to track income, calculate profits, and organize expenses. Come tax time, having that kind of detail on hand is a lifesaver.

4. Builds Trust with Your Clients

Being upfront about costs builds confidence. Clients want to know they’re getting what they paid for—and an itemized invoice makes that obvious.

Take a personal trainer billing $500. If the invoice just says “Training,” a new client might hesitate. But break it down like this:

- 5 Personal Training Sessions @ $80 – $400

- Personalized Workout Plan – $100

…and suddenly it’s clear where the value lies. Clients feel better about the purchase, and they’re more likely to stick around—or recommend you to their friends.

Industries That Commonly Use Itemized Invoices

Industries like Retail and E-commerce, Freelancers and Consultants, Healthcare Providers, Construction and Contracting, Hospitality and Event Services Providers commonly use itemized invoices. These invoices detail each service or product provided, helping with compliance, documentation, and claims. Here’s how itemized invoicing is crucial in various industries:

1. Freelancers and Consultants

Solo professionals—consider writers, graphic designers, programmers, and marketing experts—usually work on projects consisting of several tasks. A clear invoice allows them to present the entirety of their work in a manner that’s easy for the client to grasp.

For instance, a freelancer designer can segregate fees into initial ideas, several rounds of revisions, and ultimate handovers. Most freelancers also add expenses that they have incurred personally, such as traveling, stock assets, or software subscriptions, so an itemized method ensures nothing is left behind.

2. Retail and E-commerce

For companies selling tangible goods, especially in bulk, itemized invoices are crucial. They typically contain each product’s name, quantity, unit price, tax, and total price.

This degree of detail not only serves for tracking within a company’s inventory, but also makes life simpler for consumers. If a person must return a product, have it replaced under warranty, or simply see what they paid for, it’s all documented clearly.

3. Healthcare Providers

Medical billing tends to be complicated, with multiple services, tests, treatments, and medications. Itemized bills are essential in segmenting each part of a patient’s visit or treatment.

Hospitals and clinics utilize these invoices to itemize consultations, procedures, laboratory tests, and prescriptions. On the patient’s side, it is convenient having this breakdown when submitting insurance claims or when checking charges.

4. Construction and Contracting

Construction projects usually take weeks or months, and several teams and costs are involved. Without careful invoicing, it is easy to lose sight of expenses or exceed budget.

Contractors usually charge in stages, e.g., upon the completion of site prep, foundation, framing, etc. Every invoice could have line items for labor costs, materials, rental equipment, permits, and subcontractor charges, presenting customers with a good idea of how their money is being spent.

5. Hospitality and Event Services

From weddings and meetings to company retreats, events have many moving pieces—and expenses. An itemized bill guarantees customers know precisely what they’re paying for.

In hotel and hospitality use, this could refer to isolating room charges, dining, minibar use, spa service, or late departure fees. To event organizers, venue rental, catering, décor, entertainment, and staff costs can each be itemized individually. It keeps everything above board and easy for the client to budget.

How to Create an Itemized Invoice?

Creating an itemized invoice doesn’t have to be complicated. Whether you prefer doing it manually or using an online tool, here’s a quick guide to help you get started with both methods:

1. Manual Method: Using Word or Excel

If you like full control and customization, creating your invoice manually using Word or Excel is a great option. Here’s how you can do it:

Using Microsoft Word

- Open a blank Word document.

- Add a header with your business name, logo, and contact information.

- Include the client’s details such as name, address, and contact info.

- Add the invoice number, date, and payment terms.

- Create a table to list the itemized details:

- Columns: Item Description, Quantity, Unit Price, Total Price.

- Add a new row for each item or service provided.

- Columns: Item Description, Quantity, Unit Price, Total Price.

- Below the table, calculate the subtotal, applicable taxes, and the final total amount due.

- Save the document as a PDF and send it to your client.

Using Microsoft Excel

- Open a blank spreadsheet in Excel.

- Use the top rows to add your business and client information.

- Insert a table for the invoice items:

- Columns: Item Description, Quantity, Unit Price, Total Price.

- Use formulas to automatically calculate totals (e.g., =B2*C2 for quantity × unit price).

- Columns: Item Description, Quantity, Unit Price, Total Price.

- Add rows for subtotal, tax, and total payable amount using formulas.

- Save the file as a PDF and share it with your client.

2. Online Invoice Generator: Try InvoPilot.com

For a faster and more efficient option, online invoice generators like InvoPilot.com make the process hassle-free. Here’s how to use it:

- Go to InvoPilot.com.

- Choose a pre-designed invoice template or start from scratch.

- Enter your business information, client details, and invoice number.

- Fill in the itemized section — add product/service descriptions, quantities, unit prices, etc.

- The tool automatically calculates the subtotal, taxes, discounts, and total amount.

- Customize the look by adding your logo and choosing brand colors.

- Download the invoice as a PDF or send it directly to your client via email.

Best Practices for Creating Itemized Invoices

A well-crafted invoice not only ensures timely payments but also strengthens your professional image. Here are four simple but essential practices to follow:

1. Be Clear and Descriptive

Avoid vague terms. List exactly what you provided—e.g., “10 hours of marketing strategy” instead of just “consulting.” Break down each item or service with quantity, rate, and total. Adding dates helps your client track what was done and when.

2. Use Consistent Formatting

Stick to a clean, professional layout. Reuse a standard invoice template with clear sections and branding elements like your logo and colors. Keep invoice numbers sequential for easy tracking.

3. Double-Check Everything

Errors slow down payments. Review client names, service details, totals, and dates. Make sure your payment terms and due dates are correct and easy to understand.

4. Include Complete Contact Info

Always add your business name, address, phone, and email. If possible, list a specific contact person for billing questions. Clear contact info builds trust and speeds up communication.

Common Invoicing Mistakes to Avoid

Mistakes in invoicing can lead to confusion and delays in payments. Common errors include missing or incorrect details, sending invoices late, unclear payment terms, using unprofessional templates, failing to itemize products or services, adding unexpected fees, and neglecting to follow up on overdue payments.

To prevent these issues, double-check that all information is accurate and complete. Send invoices promptly to avoid delays. Be transparent by clearly outlining payment terms and ensuring no hidden charges are included. Use professional templates to make a positive impression and properly itemize each product or service for clarity. Finally, stay proactive by following up on any unpaid invoices to keep your cash flow steady. Here are four common mistakes to watch out for, and how to fix them:

1. Missing Tax Information

Failing to include taxes or calculating them incorrectly can cause delays and legal issues.

Fix it: Understand your local tax laws, use software that handles taxes automatically, and clearly show tax amounts on your invoice.

2. No Due Date

An invoice without a due date invites late payments.

Fix it: Always include a clear deadline (e.g., “Due in 14 days” or a specific date), and align it with your standard payment terms like “Net 15” or “Net 30.”

3. Vague Descriptions

Unclear item details can lead to disputes or payment delays.

Fix it: Be specific—mention the service, hours worked, dates, quantities, and rates. The more clarity, the better.

4. No Invoice Number

Skipping invoice numbers makes tracking payments a mess.

Fix it: Use a unique, sequential number for each invoice. Invoicing software can help automate this step.

Final Words

An itemized invoice is more than a bill — it’s a clear, professional way to communicate with clients. By listing each product or service along with its cost, it removes confusion, promotes transparency, and builds trust.

Whether you’re a freelancer, retailer, or service provider, itemized invoices help streamline your workflow and present a more professional image. To get the best results, be clear and detailed, keep your format consistent, and double-check for mistakes. Include tax info, due dates, full contact details, and a unique invoice number.

A well-crafted invoice speeds up payments and strengthens client relationships. Start using itemized invoices today and see the impact it makes.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply