Late invoices are not just a small problem — they can cause big issues for businesses of all sizes. Every year, a huge number of invoices are paid late, which creates cash flow problems and financial stress for many companies. For small business owners, freelancers, and entrepreneurs, keeping track of late payment trends is important to keep their business running smoothly and to build strong relationships with clients.

In this blog, we’ll share important facts and numbers. You’ll learn how Late invoice payment impact businesses and discover the main patterns and reasons behind delays. By understanding this information, you can make smarter financial decisions and protect your business.

What Is A Late Invoice?

A Late invoice, also called a past due or overdue invoice, occurs when a customer fails to pay within the specified timeframe stated on the invoice. For businesses, it can lead to cash flow disruptions, making it harder to cover operational costs like salaries or inventory.

They may also strain client relationships if payment delays persist. Common reasons for late invoices include unclear payment terms, client financial difficulties, or disorganized billing processes. To address this issue, businesses can set clear payment terms, send timely reminders, and use tools like automated invoice generators to streamline the invoicing and payment follow-up process.

Late Invoice Statistics: A Global Snapshot

The numbers speak for themselves — late payments are not only common but growing in severity: Here’s a breakdown of some key statistics:

- 54% of SMEs expect payments to arrive past the due date.

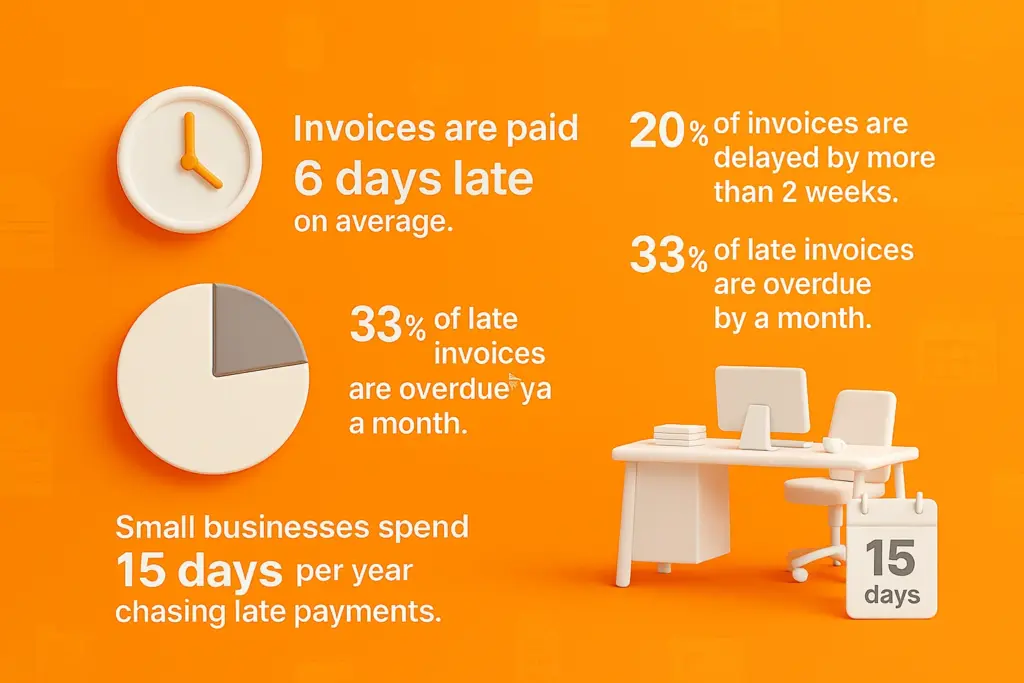

- On average, invoices are paid 6 days late, with 20% of invoices delayed by more than 2 weeks.

- 33% of late invoices are overdue by over a month, and 20% are 60+ days late.

- A separate study reveals that only 6% of manual invoices are paid within 30 days, while 94% are paid after 30–60 days.

- According to Amalto, 61% of late payments result from invoice errors.

- 11% of clients never receive the invoice at all.

- Over 40% of businesses admit they lack the time to follow up on unpaid invoices.

- On average, a small business spends 15 days annually chasing late payments.

- 4 hours per week are spent by SMEs dealing with overdue payments.

- 12% of SMEs hire a dedicated employee solely to follow up on delinquent invoices (unpaid invoices).

- In the UK, this chasing process costs businesses over £2 billion annually.

- 30% of SMEs say late payments negatively affect their investment plans or operations.

- In Europe, 1 in 10 small businesses experiences chronic late payments. In the UK alone, the government estimates £23.4 billion in overdue invoices.

- Over 10% of invoices are never paid and are written off as bad debt.

- SMEs in the U.S. report losing 51.9% of the value of their B2B payments that remain unpaid 90 days past the due date.

Country-Specific Trends

- Hong Kong: Late payments arise by 4%, which indicates an increase in delayed financial transactions.

- India: 17% late payments highlights growing payment delays in the region.

- Thailand: Late payments have increased by 16%, which reflects a concerning trend in delayed settlements.

- Philippines: A 5% increase in late payments. It suggests a moderate rise in payment delays.

- Canada: 70% of invoices are paid late, and the trend is continuously moving forward.

- USA: Between 39% and 45% of invoices are late, it gets delayed by about 7 days.

- Russia, UK, Poland: Late invoice rates range from 4% to 6.5% which shows relatively stable but present delays.

- Africa: 31% of invoices face late payments which indicates a most widespread issue.

- South Africa: Late payments have skyrocketed to 63.9%, a dramatic rise from 15.3% the previous year.

- Ireland: 67% of SMEs report experiencing late payments which showcase a persistent challenge for small businesses.

- Japan: Companies pay invoices six days early on average.

- Australia, Mexico, South Africa: Rank among the slowest players, averaging a month late.

The Impact of Automation on Payment Timeliness

- Businesses using automated invoicing see 33% of invoices paid on time, compared to 24% with paper-based invoicing.

- 42% of automated invoices are paid promptly, versus 25% of manual ones.

- Despite technological advances, 55% of invoices in the U.S. are still paid late.

- 22% of business owners expect no improvement in late payment trends.

Late Invoice Statistics: The Hidden Costs to Businesses

- As per Small Business Insights Research, On average, U.S. small businesses receive payments 8 days late.

- SMEs spend about 14 hours weekly handling overdue invoices — nearly 2 hours and 48 minutes per workday.

- 38% of small businesses fail within their first year, largely due to financial struggles.

- In Australia, small business owners lose $6,000 to $30,000 annually to late payments.

- In the UK, 25.2% of all invoices are paid late.

- 25% of EU companies go bankrupt because of late payments.

- 28% of business owners pause hiring due to unpaid invoices.

- Automating invoicing can improve accounts payable processing by 60% to 75%.

- According to Research of Atradius, only 36% of U.S. invoices are paid on time, while 9% are written off completely.

- 57% of U.S. businesses report an increase in payment duration over the last year.

- 99% of U.S. businesses are small business qualified, meaning late payments affect nearly half the national workforce.

- 65% of U.S. SMEs (with 25–200 employees) spend 14 hours weekly on payment follow-ups.

- Forbes Small Business Reports that 38% of small businesses fail due to cash flow issues.

- $30,000 is the average amount owed to small U.S. businesses in unpaid invoices.

- As per Creditor Watch Survey, In the second half of 2023, over 80% of Australian businesses dealt with late invoices, with 37% receiving payments more than 30 days late.

- As per Payment and cash flow report, The UK Department for Business and Trade found that 25.2% of invoices are overdue.

- 50% of UK small businesses regularly deal with late payments — out of 5 million UK Small Businesses, that’s 3 million companies face issues of getting late payments.

- As many as 50,000 UK small businesses close each year due to cash flow problems.

- As per the European Commission report, 1 out of 2 invoices in Europe are paid late or not at all, leading to 25% of all bankruptcies.

- In 2023, the EC proposed a new regulation to cap payment terms at 30 days (previously up to 60+ days).

- The World Bank Report highlights insufficient financial resources as a top barrier to SME growth.

- Even large companies aren’t immune. 24% of global CEOs (PwC survey) fear major financial losses due to inflation and payment delays.

- According to Xero Research, late payments directly contribute to increased business loans.

- Across five years and five countries (U.S., Australia, UK, Canada, New Zealand), small businesses borrowed a combined $4,418.2 billion due to unpaid invoices.

- 28% of business owners (Nerdwallet) report pausing recruitment because of overdue payments.

- According to Allianz Trade, over 50% of global B2B invoices were paid late in 2024, with sectors like construction, manufacturing, and energy most affected.

- The Prompt Payment Code in the UK mandates 95% of invoices be paid within 30 days.

- In the U.S., similar initiatives aim to accelerate payments to small vendors and contractors.

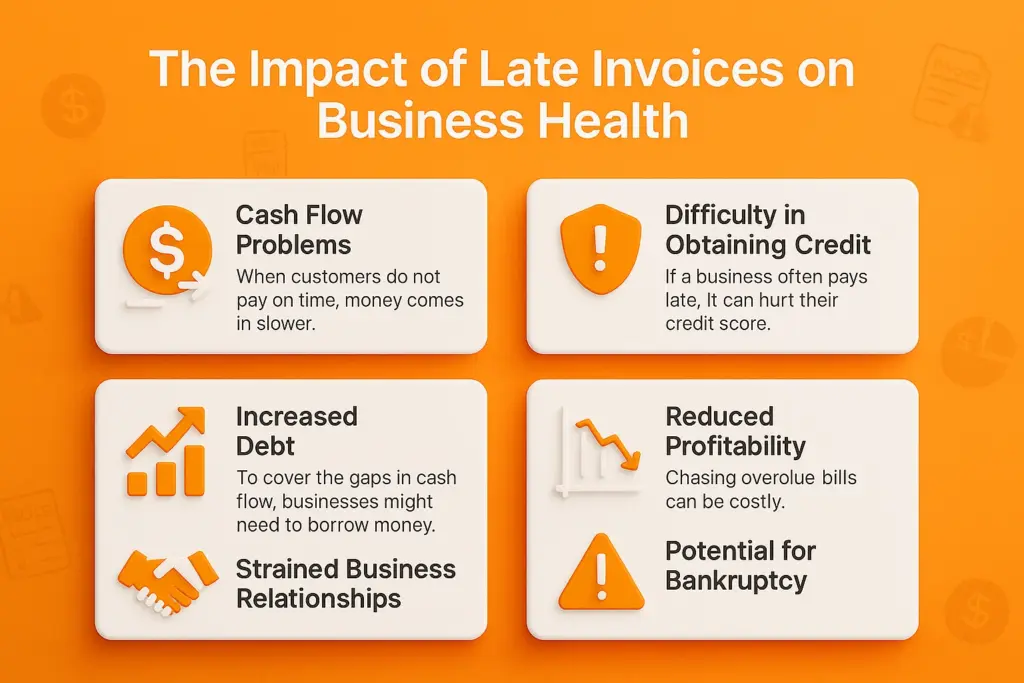

The Impact of Late Invoices on Business Health

Late Invoices have a huge impact on Business Health far-reaching consequences. Here’s a more detailed look at the consequences:

Cash Flow Problems

When customers do not pay on time, money comes in slower. This can cause trouble when paying suppliers, employees, and other late bills.

Increased Debt

To cover the gaps in cash flow, businesses might need to borrow money. This leads to higher interest payments and more financial stress.

Strained Business Relationships

Late payments can harm relationships with clients and suppliers. It can make them lose trust and lead to fewer future business opportunities.

Difficulty in Obtaining Credit

If a business often pays late, it can hurt their credit score. This makes getting loans or other financing more difficult.

Reduced Profitability

Chasing overdue bills can be costly. Businesses may also have to cut costs, leading to lower profits.

Potential for Bankruptcy

Serious cash flow issues from late payments can risk pushing businesses into bankruptcy.

How to Prevent and Manage Late Invoice?

Here are effective strategies to manage and minimize late payment issues:

Set Clear Payment Terms

Include due dates, accepted payment methods, and average late fee for invoices.

Send Prompt and Accurate Invoices

Invoice immediately after work is completed. Ensure all information is correct to avoid disputes.

Automate Billing and Reminders

Use invoicing software to schedule follow-ups and enable online payments for faster processing.

Offer Early Payment Incentives

A small discount (e.g., 2%) for early payments can encourage clients to pay promptly.

Charge Late Fees

Including a late fee clause discourages payment delays and reinforces professional boundaries.

Build Strong Client Relationships

Clients who trust and respect your work are more likely to pay on time.

Follow Up Regularly

Don’t hesitate to send polite reminders when payments are approaching or past due.

Consider Invoice Factoring

In cases of extreme cash flow pressure, factoring services can provide up to 90% of the invoice amount upfront.

Conclusion

Late invoices are more than just small problems. They can cause serious money and management issues for businesses of all sizes. Late invoice statistics show how common payment delays are and how they hurt cash flow, damage client relationships, and weaken the overall health of a business. By understanding common patterns, causes, and regional rules like maximum invoice late fees by state, businesses can take smart steps to reduce risks. Using clear payment terms, sending invoices automatically, and following up regularly with the help of data can help reduce late invoice payments and build better trust with clients. Taking action early against late invoices is important for keeping your business financially strong, growing steadily, and staying competitive in today’s market.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply