- How to Send an Invoice Complete Process?

- What Are the Different Ways to Send an Invoice?

- What Is the Best Time to Send an Invoice?

- Effective Ways to Follow Up with Clients After You Send an Invoice

- Common Invoicing Mistakes & How to Avoid Them

- How can InvoPilot software help businesses in sending invoices?

- Conclusion

Sending an invoice is a fundamental part of managing the business economy and ensuring timely payments. Whether you are freelancers, small businesses or large companies, a well -structured invoice process improves cash flow and builds professionalism. To send an invoice effectively, you must include complete details such as your business and client information, specified services, payment terms and then deliver it using the most appropriate method – e – post, postal mail or invoicing software.

Let’s divide this into a step-by-step guide optimized for accuracy, clarity and modern billing of best practice.

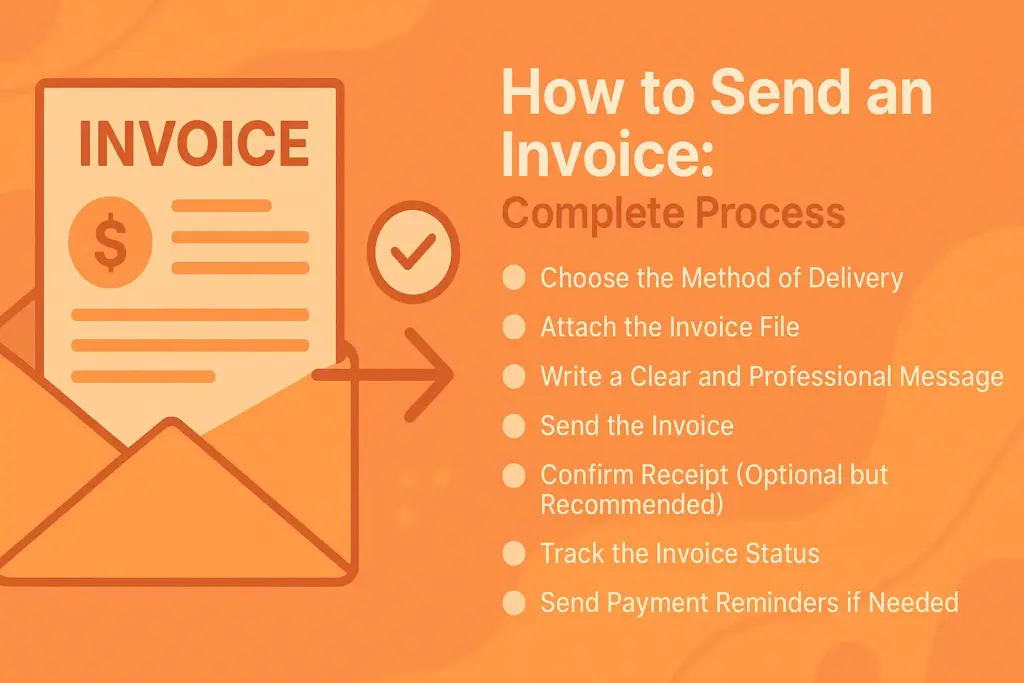

How to Send an Invoice Complete Process?

To send an invoice, you must first write an invoice with important details such as your business information, client information, a list of products or services, and payment terms. Then you can send it via e -mail or online platforms.

If you want to send an Invoice, You should Follow these Steps –

1. Choose the Method of Delivery

Before sending an invoice, decide how you will deliver it to your client or customer. Common methods include:

- Email: It is a very popular and fastest way to send invoices digitally.

- Postal Mail: Physical delivery of printed invoices, used when required or preferred by the client.

- Online Invoicing Platforms: Sending invoices directly through software or platforms designed for invoicing.

- Messaging Apps or Fax: Sometimes used for quick or informal invoice sharing.

2. Attach the Invoice File

Once you know how you’re sending the invoice, attach the invoice document to your message if using email or online systems.

- Use common file formats like PDF to ensure the invoice layout stays intact.

- Make sure the file name is clear, e.g., “Invoice_12345_ClientName.pdf”.

3. Write a Clear and Professional Message

If you are sending your invoice via email or messaging, always include a brief, polite message that clearly states the purpose of the email.

Key Points to Include:

- A polite greeting and address to the client.

- A mention that the invoice is attached with the products or services provided.

- The invoice number or reference.

- The due date for payment.

- A thank you note for their business.

Example: “Dear [Client Name], Please find Invoice #12345 attached for the services we provided in January 2026. The payment is due by February 15, 2026. Kindly let us know if you have any query or doubt. Thanks for your business!”

4. Send the Invoice

After attaching the invoice and writing the message, send it through the chosen method.

- Check the recipient’s email address or mailing address twice to avoid errors.

- If using an invoicing platform, confirm that the invoice is submitted correctly.

- Keep a copy of the invoice to yourself for your records.

5. Confirm Receipt (Optional but Recommended)

Especially for important or large invoices, follow up with your client to confirm they received the invoice.

- Send a polite email or make a quick call a few days after sending.

- Ask if they have any questions or need any additional information.

6. Track the Invoice Status

Keep track of whether the invoice has been opened, viewed, or paid.

- Use email read receipts or invoicing software that notifies you when the invoice is viewed.

- Mark invoices as paid once payment is received.

- Keep a calendar reminder for the payment due date to follow up if necessary.

7. Send Payment Reminders if Needed

If the payment due date has passed and payment has not been received:

- Send a polite reminder email or message referencing the original invoice.

- Include details such as the invoice number, amount, and due date.

- Offer to assist if there are any issues causing the delay.

What Are the Different Ways to Send an Invoice?

Invoices can be delivered by email, sent using invoicing software, or mailed through traditional postal services. Email is generally considered the fastest and most practical option, while invoicing software can automate the process. Physical mail can be used for customers who prefer not to receive electronic invoices.

Here’s a complete detailed look at each way to send an Invoice:

1. Email

Sending an invoice via e -post is the most common and widely used method. After creating the invoice, add it as a PDF or link and send it directly to the client’s e -mail address. E-mail allows fast delivery, easy tracking, and provides digital mail for both the sender and the recipient. Many billing tools automate this process, making it faster and more professional.

2. Postal Mail (Physical Mail)

This traditional method involves printing the invoice and sending it through postal services. It is often used when clients prefer or require a hard copy, or when working with official or legal documentation. Although slower than digital methods, postal mail can add a formal touch and is useful in regions or industries where digital communication is less common.

3. In-Person Delivery

In some cases, invoices are physically submitted during a meeting or after delivery of goods/services. This method is direct and ensures immediate receipt of the client. It is useful for small businesses, local suppliers or service providers who meet customers face to face. It also opens up for immediate discussion if any clarification is needed.

4. Online Client Portals

Many companies use online portals where clients can log in, see, download and pay their invoices. This method streamlines communication and keeps all billing information centralized. The client receives a notice (usually via email) that the invoice is ready on the portal, and encourages timely payment and easy access to previous invoices.

5. Messaging Apps or Platforms

With the emergence of instant messages, some companies send invoices through platforms such as WhatsApp, Slack or Microsoft team. This method is convenient for fast sharing and informal communication with clients who prefer to use these apps. It is especially useful for freelancers or small businesses working in more random surroundings.

6. Fax

Although it is less common today, some companies still send invoices with fax, especially in industries where fax is standard or legally required. Faxing provides a paper track and confirmation of receipt, but is generally slower and less effective than digital methods.

7. Through Third-Party Payment Platforms

Some invoicing is done via payment platforms such as PayPal, Stripe or Square, where the invoice is sent directly through the platform’s system. This integrates invoicing with payment collection, offers convenience for both parties and reduces delays in payment processing.

What Is the Best Time to Send an Invoice?

The best time for sending an invoice varies based on your business type, the nature of the goods or services provided and the agreed payment terms. As a general rule, invoices should be issued immediately after delivery of goods or completed services. For ongoing or recurrent work, it is common to invoice a fixed plan for example weekly, two-week or monthly. In certain situations, especially for large projects or when a prepayment is necessary, it may be appropriate to send an invoice before the work begins.

Here’s a more detailed breakdown:

1. Immediately After Project Completion or Product Delivery

This is the best time to act because the service or product is still fresh in the client’s mind. There’s no confusion about the work done or goods delivered. It is best for Freelancers, consultants, service-based professionals, and custom orders. It helps to Increase chances of quicker payments, Reduces client forgetfulness or disputes and shows professionalism and efficiency

2. On a Specific Day of the Week – Typically Tuesday or Wednesday

Research shows that invoices sent mid-week (especially Tuesdays and Wednesdays during business hours) are more likely to be seen and processed faster. It is best for businesses that send recurring invoices or have ongoing contracts. It has several benefits like, it Avoids the Monday email rush and Friday fatigue, it has higher open and response rates and it is more likely to be processed in weekly financial review cycles

3. At the Start of the Month

Many companies review budgets and approve payments at the beginning of the month. Sending invoices early aligns with their accounting cycles. It is best for B2B businesses, retainers, monthly services, SaaS, or subscriptions. It ensures inclusion in monthly accounts payable. It reduces the chance of delay due to end-of-month financial closures and helps with predictable cash flow.

4. Immediately After Milestone Completion

For long-term projects, invoicing after each milestone ensures partial payments and keeps cash flow steady. It is best for agencies, construction, IT projects, legal services, or multi-phase deliverables. It maintains momentum in payment cycles. It prevents over-reliance on final payment and reduces risk of payment disputes.

5. End of the Week (With Caution)

Sending invoices on Friday morning can be strategic if your client processes payments before the weekend. It is best for Clients with Friday payment runs or urgent, fast-turnaround jobs. Emails sent late Friday may be ignored until Monday and it Could be missed if recipients are wrapping up their week.

6. Before the Client’s Payment Cycle

Some businesses have fixed payment cycles (e.g., bi-weekly or NET 30). Sending your invoice just before their cut-off ensures faster processing. It is best for Regular clients or enterprises with formal accounts payable departments. It synchronizes with internal approval systems. It avoids missing payment windows and enhances professionalism and predictability.

7. Immediately After Signing a Contract (For Deposits or Retainers)

When your work requires an upfront deposit or retainer, invoicing right after agreement signing sets clear expectations and secures your position. It is best for creative professionals, consultants, and project-based businesses. It secures commitment, funds your initial effort and reduces last-minute cancellations

8. On Agreed Recurring Dates (for Subscription or Retainer Models)

For ongoing work or services, invoicing on a consistent, recurring schedule (e.g., the 1st or 15th of each month) keeps everything predictable for both parties. It is best for agencies, subscription services, marketing firms, and managed IT services. It helps in Streamlined accounting, Fewer follow-ups needed, and clients become accustomed to the rhythm.

| Time to Send Invoice | Best For | Key Benefit |

| Immediately after work is done | Freelancers, consultants | Faster payments, fresh in mind |

| Tuesday or Wednesday (mid-week) | Most businesses | Higher response rate |

| Beginning of the month | B2B clients, monthly services | Matches client payment cycles |

| After milestone completion | Project-based services | Keeps cash flow steady |

| Friday morning | Fast-turnaround clients | Potentially quick processing before weekend |

| Before client’s payment cycle | Corporates and enterprises | Faster inclusion in accounts payable |

| Right after contract for deposits | Retainers, creatives | Secures upfront payments |

| Recurring fixed date | Subscriptions, ongoing contracts | Predictability and consistency |

Effective Ways to Follow Up with Clients After You Send an Invoice

To follow up with clients after sending an invoice, requires a balance of professionalism, persistence. To improve your chances of receiving timely payment, start with a polite reminder and gradually escalate your approach if necessary.

Here is a detailed step-by-step guide to help you through this process:

1. Initial Reminder (Within a Few Days of the Due Date)

Send a professional reminder email shortly after the due date passes. Clearly reference the invoice number, amount due, and original due date.

- Subject Line: Use a straightforward subject such as:

“Reminder: Invoice [Invoice Number] Due” - Email Body: Keep your message concise and respectful. Mention:

- The outstanding balance

- The due date

- Available payment methods

- Any applicable late fees (if outlined in your payment terms for a late invoice)

- Attachment: Include the original invoice again for the client’s convenience.

2. Second Follow-Up (If No Response)

If the initial email goes unanswered, increase the urgency without compromising professionalism.

Phone Call: Reach out via phone to personally address the unpaid invoice. This allows for a direct conversation and the opportunity to resolve any issues or misunderstandings.

Firmer Email (If a Call Isn’t Possible): Send a more direct and assertive email. Reiterate:

- The overdue status of the invoice

- The payment due amount and terms

- The potential consequences of continued delay

- A reminder of the available payment options

Offer help or flexibility if the client is facing payment difficulties.

3. Escalation (If Payment Is Still Outstanding)

If previous follow-ups fail to prompt payment, consider taking more formal steps.

Offer Payment Arrangements: For clients struggling financially, propose a structured payment plan or a small discount for immediate or partial payment. This can increase the likelihood of collecting the balance.

Send a Formal Notice: Issue a written notice warning of late fees, service interruptions, or other contractual penalties. Make sure to remain professional and factual.

Pursue Legal Action (As a Last Resort): If all efforts are exhausted and the invoice remains unpaid, consult legal counsel and consider pursuing legal action or involving a collections agency.

Key Tips:

- Maintain a professional tone throughout all communications.

- Document all follow-up attempts for your records.

- Be flexible when appropriate, but firm in enforcing your payment terms.

By following these structured steps, you can increase your chances of resolving overdue invoices while preserving professional relationships.

Common Invoicing Mistakes & How to Avoid Them

Many businesses make avoidable mistakes that lead to delayed payments, disputes, or even loss of clients. By ensuring timely submission, clear payment terms, multiple payment options, and accurate records, you can streamline your invoicing process and get paid faster. Using digital invoicing software greatly minimizes errors and boosts overall efficiency.

Common Invoices Mistakes to Avoid are:

1. Delayed Invoice Submission

Waiting too long to send invoices can lead to delayed payments. Always issue invoices immediately after delivering goods or completing services to keep your payment top-of-mind for clients.

2. Incorrect or Missing Invoice Details

Incomplete or incorrect information may lead to client confusion and result in payment delays. Ensure every itemized invoice includes Correct client details, Unique invoice number, Date of issue, Itemized list of products/services and Payment terms and due date.

3. Unclear Payment Terms

Be explicit with your payment terms. Use clear phrases such as “Net 15” or “Payment due within 10 days of invoice date” to avoid misunderstandings.

4. Lack of Professionalism

Invoices reflect your brand. Use a clean, professional design with easy-to-read fonts, accurate calculations, and polite language. A well-formatted invoice enhances trust and credibility.

5. Adding Hidden or Unexpected Fees

Avoid surprising your clients with extra charges. Be upfront about all fees to maintain transparency and avoid disputes.

6. Not Offering Multiple Payment Options

Offer flexible payment options such as credit cards, mobile payments, bank transfers, PayPal, and digital wallets. Providing more choices makes it easier for clients to pay promptly.

7. No Digital Backup

Always maintain a secure digital backup of your invoices. This safeguards data from loss caused by hardware failure, accidental deletion, or physical damage.

8. Failing to Follow Up on Overdue Invoices

Don’t assume clients will remember due dates. Send gentle reminders and follow-up emails to prompt payment for outstanding invoices.

9. Not Using Digital Invoicing Software

Manual invoicing increases the risk of human error. Digital invoicing tools automate calculations, store client data, track payments, and send automatic reminders—saving time and ensuring accuracy.

10. Inconsistent Invoicing Practices

Use a standardized format and process for all invoices. Maintaining consistency minimizes confusion and helps convey a more professional appearance.

11. Ignoring Tax Requirements

Always include applicable taxes and comply with local tax regulations. Failing to do so may result in penalties or issues with tax authorities.

12. Overlooking International Invoicing Rules

If you work with international clients, understand their local invoicing laws, currencies, tax systems, and compliance requirements to avoid delays and legal complications.

13. Poor Invoice Design and Formatting

Avoid cluttered layouts or tiny fonts. A well-organized, visually clean invoice improves readability and helps clients process payments faster.

14. Relying on Manual Invoicing Systems

Manual processes are prone to errors and inefficiencies. Transition to a digital invoicing platform to automate recurring tasks, minimize mistakes, and speed up your billing cycle.

Want to streamline your invoicing process?

How can InvoPilot software help businesses in sending invoices?

Invopilot helps companies send invoices quickly and professionally by offering a user -friendly platform with customizable templates, automated features and secure payment integration. It streamlines the entire invoicing process – and allows users to create, send and track real -time invoices while supporting multiple currencies, tax formats and brand options. With cloud -based access, automated reminders and insightful reporting tools, Invopilot not only saves time, but also improves the cash flow and payment accuracy. It is ideal for freelancers, small businesses and growing businesses looking for a reliable invoicing solution.

Conclusion

When you send an invoice, you’re doing more than completing a routine task—you’re taking a vital step toward maintaining cash flow, building professional relationships, and ensuring business success.

By following the step-by-step process outlined in this guide—choosing the right delivery method, attaching a clear and accurate invoice, crafting a professional message, and tracking payment—you can streamline your billing workflow and improve client communication. Avoid common mistakes, understand the best times to invoice, and know how to follow up effectively further increase your chances of timely payments.

And if you’re looking for a smarter, more efficient way to manage your invoicing, InvoPilot offers everything you need—from automated reminders and real-time tracking to customizable templates and multi-currency support. With tools like InvoPilot, invoicing doesn’t just become easier—it becomes a competitive advantage.

Start sending invoices the right way today, and build a faster, more reliable payment cycle for your business.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply