- What Is the Invoice to Cash Process?

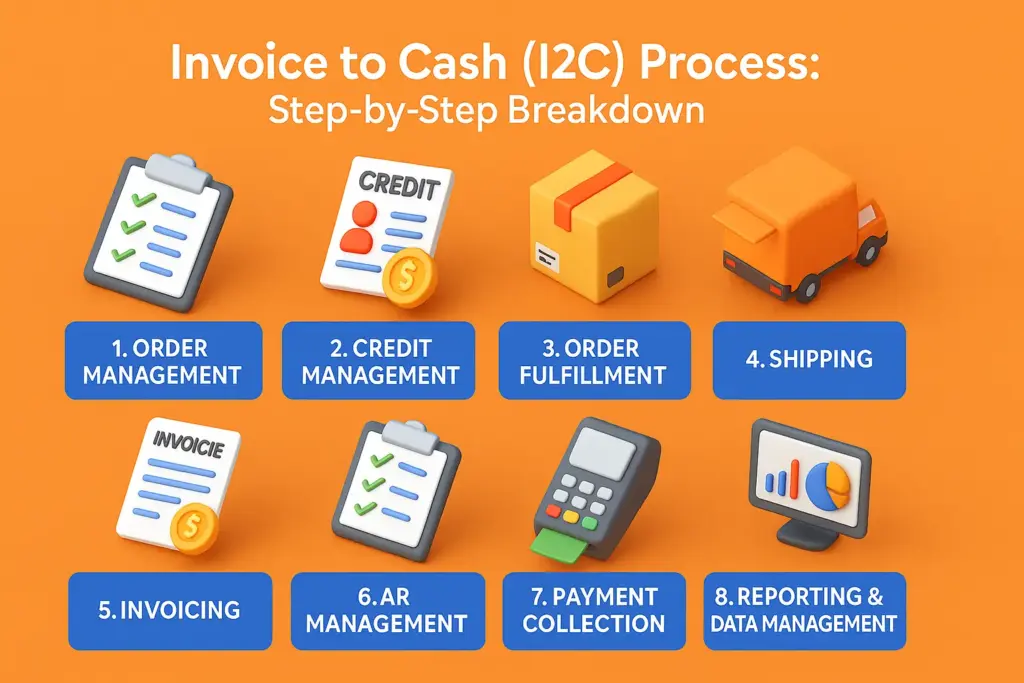

- Invoice to Cash (I2C) Process: Step-by-Step Breakdown

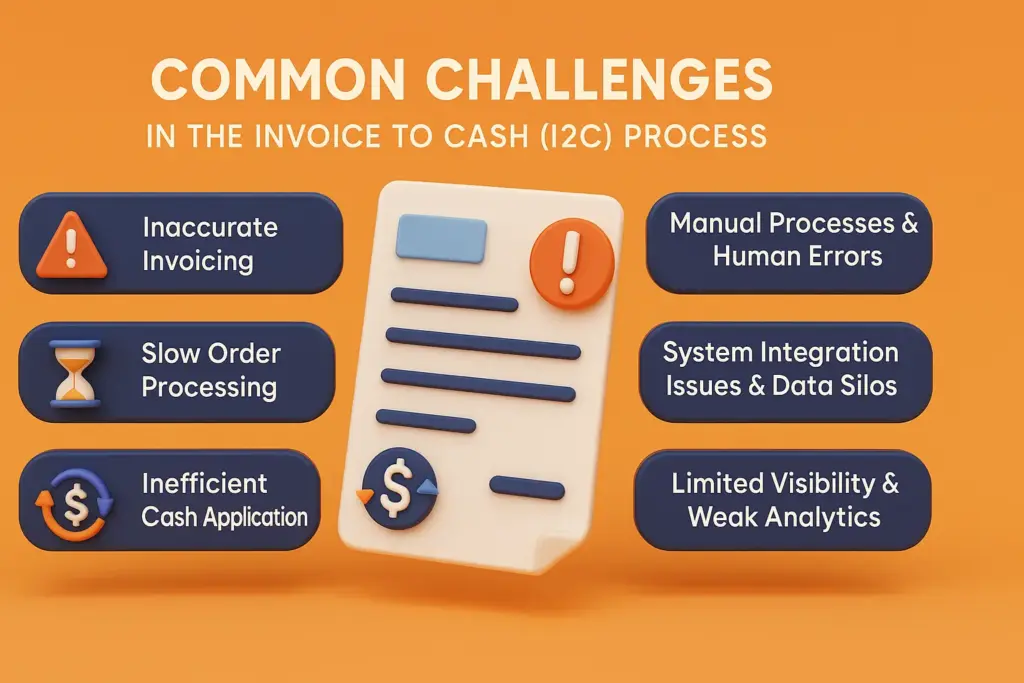

- Common Challenges in the Invoice to Cash (I2C) Process & How They Impact Your Business

- Benefits of Streamlining Your Invoice to Cash Cycle

- Technologies That Can Optimize Invoice to Cash

- How InvoPilot Can Simplify Invoice To Cash

- Conclusion

Cash flow is the life nerve in any business, and optimization of it starts to master the invoice to Cash (I2C) process. From order fulfillment to payment collection, each step in the I2C cycle plays a critical role in ensuring that your business remains economically healthy, efficient and scalable. Nevertheless, many companies face challenges such as delayed payments, billing errors and data silos that interfere with this important flow.

In this comprehensive guide, we will guide you through the complete invoice to cash process – from receiving an order to collect payment – explains each step in detail. You will also detect common pitfalls, the benefits of streamlining the cycle and powerful technologies that can help automate and optimize each step. Whether you are a start -up, a growing SMB or a company, improvement of your i2C process can lead to faster cash flow, reduce costs and improve customer satisfaction.

What Is the Invoice to Cash Process?

The Invoice to Cash (I2C) process refers to the complete journey from sending a customer an invoice to actually receiving payment. It’s not just about invoicing – it’s all about handling cash flow, customer relationships and financial health.

In a moment it starts by fulfilling an order, followed by sending the invoice, tracking the payment, handling any delays or disputes, and eventually using the cash in your accounting system. Because the cash flow is king. If you do not collect payments effectively, you will have problems – even if you sell. A broken I2C process leads to late payments, poor visibility and lost revenue.

Invoice to Cash (I2C) Process: Step-by-Step Breakdown

The Invoice to Cash (I2C) process is a critical financial workflow that covers everything from receiving a customer order to collecting the final payment. It affects your cash flow, customer experience and general financial health directly. Let’s explore each step in this process in detail to understand how it works and how to optimize it for better results.

1. Order Management

Effective order management lays the foundation for a smooth transaction. This is where the I2C process begins. It includes:

- Receive new purchasing orders from customers.

- Confirmation of the order details such as product types, quantities, prices and shipping instructions.

- Ensure that all order information is entered accurately in your system.

2. Credit Management

Proper credit evaluation helps to reduce the risk of bad debt. Before fulfilling the order, it is important to evaluate the customer’s ability to pay. This step includes:

- Consider the customer’s credit history and financial status.

- Define credit limits and set payment terms (such as net 30 or net 60).

- Ensure risk reduction by validating customer profiles and financial reliability.

3. Order Fulfillment

Reliable fulfillment ensures faster delivery and improved customer satisfaction Once credit is approved, it’s time to process the order. This involves:

- Check the availability of inventory.

- Pack and prepare your goods for delivery.

- Coordination internally to ensure that the order is completed and accurate.

4. Shipping

Shipping on time helps build trust and strengthens customer relationships. The delivery stage is crucial for timely customer service. This includes:

- Choose the right delivery partners or shipping methods based on customer needs.

- Sending the products and sharing tracking details with the customer.

- Monitor delivery timelines to avoid delays or errors.

5. Invoicing

Accurate invoices minimize disputes and speed up the payment cycle. Once the order is sent, an invoice is generated. Important billing tasks include:

- Create an invoice that clearly outlines products, quantities, prices, taxes and payment terms.

- Send the invoice immediately to the customer via e -mail or integrated billing platforms.

- Secure all details match the original order and contract.

6. Accounts Receivable (AR) Management

Strong AR management helps maintain a steady cash flow and reduces DSO (day’s sale outstanding). Now the scene comes to monitor and manage outstanding payments:

- Tracking which invoices are unpaid or partially paid.

- Send reminders before and after maturity.

- Maintain healthy customer communication to prevent overdue accounts.

7. Payment Collection

This stage ensures that your business gets paid for its services without straining customer relationships. If your payment is overdue, it’s important to:

- Contact customers through follow-up, email reminders or telephone calls.

- Offers various payment options for clients to pay easily.

- Use consistent and professional collection strategies.

8. Reporting & Data Management

Good data management drives continuous process improvement. Data is the key to refining your I2C process. This last step entails:

- Monitoring of KPIs such as invoice aging, average collection period and dispute rate.

- Generate reports to evaluate performance and uncover process bottlenecks.

- Use insight to improve forecasts, credit policy and cash flow strategies.

Common Challenges in the Invoice to Cash (I2C) Process & How They Impact Your Business

Many companies face ongoing challenges in this cycle that lead to delays, disputes and poor cash flow performance. Let’s dive deeper into the most common challenges that affect the i2C process and understand how they affect your business.

1. Inaccurate Invoicing

Invoice errors are among the most frequent obstacles in the i2C cycle. These errors often originate from manual processes and lack of standardization. These errors cause unnecessary back and forth communication, delayed payments and strained client relationships. Common problems include:

- Human error in data registration: typing errors, incorrect billing amounts or missing information can delay payments and damage the customer’s confidence.

- Duplicated invoices: sending the same invoice more than once can lead to confusion or even duplicated payments.

- Incomplete transfer details: When payment information is unclear or omissions, it becomes difficult to reconcile incoming payments with open invoices.

2. Slow Order Processing

Efficient order processing is the foundation of a smooth I2C cycle. Many companies depend on outdated or manual systems that slow down things. Delays in the processing of orders interfere with the entire income cycle and push payments further out and reduce the availability of working capital. Key challenges include:

- Manual order entry: Paper -based or spreadsheet -driven ordered systems are exposed to delays and errors.

- Stock problems: Poor inventory visibility or stock shortage can postpone order fulfillment.

- Delayed credit approval: If credit checks and approvals are not streamlined, orders may be stopped and cause late invoicing and payment.

3. Inefficient Cash Application

Cash application – the process of matching incoming payments to customer invoices – is often complex, especially when working with different payment methods. Slow and inaccurate cash applications can lead to incorrect financial items and delayed income recognition. Pain points include:

- Difficulty matching payments to invoices: Lack of references or unmatched payment amounts slows down.

- Exception handling: Overpayments, short payments and unidentified transactions require manual intervention and time.

- More payment sources: Managing checks, thread transfers, digital wallets and more can complicate the reconciliation process.

4. Manual Processes & Human Errors

Too much addiction to manual tasks leads to inefficiency and errors throughout the I2C cycle. Manual processes reduce the team’s productivity, increase operating costs and introduce unnecessary delays. Challenges face:

- Time -consuming tasks: Manual invoice generation, tracking and data registration take up valuable resources.

- Exposed to mistakes: People make mistakes – especially under pressure or without proper validation systems.

- Lack of automation: Without digital tools and workflows, the process lacks speed, scalability and predictability.

5. System Integration Issues & Data Silos

Many companies operate with a variety of platforms (CRM, ERP, accounting tools) that do not communicate effectively with each other. Inefficiency in data flow increases the processing time and reduces operating views. Common problems include:

- Misified systems: CRM, invoicing and not synchronized financial systems lead to fragmented data.

- Manual data transfer: When automation is missing, employees are forced to move data manually between systems – and increase the risk of errors.

- Limited visibility across departments: Lack of integration makes it difficult to track invoice status or real -time payment history.

6. Limited Visibility & Weak Analytics

Without proper tracking and reporting tools, companies are struggling to understand where delays occur and how to optimize the I2C operation. Lack of visibility leads to slow decision -making and lost chances of improving the process. Main problems include:

- Poor cash flow forecasts: Without access to real time invoicing, it is difficult to predict future cash positions.

- No process transparency: It will be difficult to find bottlenecks, which causes trouble to be unsolved.

- Lack of action rich insight: Companies miss the opportunity to limit their processes due to poor analysis.

Benefits of Streamlining Your Invoice to Cash Cycle

Optimization of the invoice to cash (I2C) process, also known as the order to cash (O2C) cycle, is crucial for modern businesses who want to improve financial results and customer satisfaction. This end-to-end process-which starts from order placement and ends with payment collection, directly affects cash flow, efficiency and scalability.

By making each step more efficient, companies can accelerate income cycles, reduce costs and provide a better experience for their customers. Let’s explore the biggest benefits of streamlining your I2C workflow:

1. Faster Cash Flow and Stronger Liquidity

Improving the invoice to the cash cycle means that your business is paid faster. When payments come in faster:

- You increase your cash flow and give you more working capital.

- Liquidity is improved, so you can handle daily operations evenly.

- You can reduce Days Sales Outstanding (DSO)—a key metric that shows how long it takes to collect payment after a sale.

- With faster access to funds, you can invest in growth, pay suppliers in time, and avoid cash crunches.

2. Lower Operating Costs and Higher Profit Margins

A streamlined I2C process is cut down on manual work and repetitive tasks. When removing inefficiency from the workflow:

- You save time on invoice generation, approval and payment tracking.

- Automation tools reduce human errors, accelerate tasks and minimize rework.

- Your team can focus on more important, strategic tasks instead of chasing payments.

- The result is cost savings, which are directly translated into increased profitability for your business.

3. Better Customer Experience and Trust

Customers expect fast service and clear communication. A smooth order for the cash cycle helps you deliver just that:

- Orders are processed quickly, invoices are accurate and payment options are ready.

- Openness in billing and payment updates builds customer confidence.

- When your customers experience fewer problems and faster service, satisfaction increases, as is their loyalty to your brand.

4. Improved Scalability and Business Agility

As your business grows, the volume and complexity of transactions also increase. A well-optimized I2C process lets you:

- Handle multiple orders without increasing the number or making bottlenecks.

- Adaptation to changed market conditions or customer requirements.

- Use digital tools and automation platforms to scale operations evenly.

- Be prepared for growth without compromising on quality or service.

Technologies That Can Optimize Invoice to Cash

Thanks to modern technologies, companies can now streamline all steps – from invoice creation to final payment – making the entire cycle faster, more accurate and more efficient. Below are the most important technologies that transform the invoice-to-cash process:

1. Automated Invoice Generation Tools

Manual invoice creation is time -consuming and incorrectly exposed. Automated invoicing software allows businesses to generate and send invoices immediately with predefined templates, customer data and tax rules. This not only speeds up invoicing, but also reduces errors and delays.

2. Optical Character Recognition (OCR)

OCR technology extracts text and data from scanned invoices, PDFs and images. This allows for fast data introduction and document processing, especially when working with paper -based or third -party invoices. It helps to reduce manual workload and human error.

3. Accounts Receivable Automation Platforms

AR Automation Solutions administers the entire claims workflow – from invoice delivery to payment reminders and invoice reconciliation. These platforms are integrated with ERP systems and customer portals to improve transparency, improve communication and reduce the risk of late payments.

4. E Invoicing and EDI (Electronic Data Interchange)

Electronic invoicing (e – Invoicing) and EDI allow companies to exchange invoice data directly between systems in standardized formats. This eliminates the need for printing, scanning or e -mail invoices and enables faster treatment and validation.

5. Customer Portals and Self-Service Dashboards

Providing a self -service customer portal enables clients to view invoices, download payment stories, raise disputes and make payments online. This improves the customer experience and shortens the cash conversion cycle significantly.

6. AI-Powered Cash Flow Forecasting

Artificial intelligence can analyze historical billing and payment data to predict cash flow trends and payment behavior. This insight helps to finance the teams to plan better, manage working capital effectively and identify potential delays early.

7. Payment Gateway Integrations

Integration of secure and flexible payment portals (such as PayPal, Stripe or UPI) with billing platforms allows customers to pay invoices quickly by using their preferred method. This reduces the friction in the payment process and accelerates the cash flow.

8. Robotic Process Automation (RPA)

RPA robots can handle repetitive tasks such as invoice matching, computer validation and sending reminders. They operate 24/7 with high accuracy, reduce human involvement and ensure faster treatment time.

9. Cloud-Based ERP Systems

Modern ERP systems offer cloud-based invoice and claim management. These solutions provide real-time visibility in each step of the invoice-to-account cycle and can be scaled easily as business needs grow.

10. Blockchain for Invoice Verification

Blockchain offers safe, tamper-based items that can be used to confirm invoice authenticity and prevent fraud. While they are still emerging, blockchain-based invoicing solutions in industries that require high confidence and transparency.

How InvoPilot Can Simplify Invoice To Cash

Creating invoices does not need to be complicated or consuming time. With Invopilot you can generate elegant, professional invoices with just a few clicks. Whether you are a freelancer, the owner of small businesses or an entrepreneur, there is no need for design skills or technical knowledge – just fill in the details and you are good at going. It is the fastest way to send flawless invoices and keep the billing process on the track.

Try it now: Explore the InvoPilot Invoice Generator and see how easy it is to manage your invoicing from start to finish.

Conclusion

is not just a back-office feature-it is a strategic driver for profitability, customer satisfaction and business growth. By streamlining order management, credit checks, invoicing and payment collection, companies can unlock faster cash flow, reduce manual errors and build stronger client relationships.

Modern tools such as automation platforms, e-invoicing and AI-driven forecasts make it easier than ever to manage your billing cycle with precision and speed. And with intuitive solutions like Invopilot, it becomes seamless to generate and manage professional invoices – and helps you stay up to date on the cash flow without extra stress.

Ready to take control of your cash flow? Start optimizing the invoice to cash process today and put your business on the way to financial efficiency and long-term success.

Leave a Reply