- Try InvoPilot Free Gross Pay And Net Pay Calculator

- What Is Gross Pay?

- What Is Net Pay?

- Components of Gross Pay

- Components Not Included in Gross Pay

- How to Calculate Gross Pay

- How to Calculate Net Pay

- Differences Between Gross Pay and Net Pay

- Factors That Affect Your Net Pay

- Gross Pay vs. Net Pay: Why It Matters More Than You Think

- How to Improve Your Net Pay: Smart Strategies for 2025

- Final Thoughts

Have you ever wondered why the salary figure in your job offer seems much higher than what actually lands in your bank account? You are not alone! This confusion comes from the difference between gross pay and net pay. While gross pay represents your total earnings before deduction, your net pay is the actual “take home” amount you receive after tax, insurance, and other contributions. Understanding this distinction is not just about curiosity, it is crucial for effective budgeting, financial planning, and making decisions about your career and compensation also.

At InvoPilot, we believe in strengthening you with clear financial knowledge. This comprehensive guide will break down everything you need to know about gross pay and net pay, from their individual components and calculation methods to the various factors that affect your final take-home amount. In addition, to make things even easier, we have developed a free Gross Pay and Net Pay Calculator that will help you see how much you earn before and after deduction. Dive in to truly understand your full compensation and what you bring home each pay cycle!

Try InvoPilot Free Gross Pay And Net Pay Calculator

Try this Gross and Net Pay Calculator to see how much you earn before and after deduction. It will show you the total earnings (gross pay) and your actual take-home amount (net pay) after tax and other deductions. This tool helps you to understand your full compensation and what you bring home with each pay cycle.

What Is Gross Pay?

Gross pay refers to the entire income an employee receives before deduction or withholding is made. It includes not only employee’s basic salary or hourly rate, but also any additional income such as overtime compensation, bonuses, commissions and other monetary incentives accrued during a certain salary period.

For employees paid hourly, gross wages are determined by multiplying the hours that are worked on the hourly wage, and then adding any additional income such as overtime or shift differentials.

For salaried workers, it usually denotes that their contracted annual salary is spread over the total wage periods during the year.

Total earnings do not constitute a deduction such as federal and state income taxes, contributions to social security, Medicare, health insurance premiums, pension plan contributions or other necessary or optional withholding.

Taking gross wages is crucial as it forms the basis for determining an employee’s net pay, which is the final amount they take home in the paycheck. It also plays an essential role in financial planning, assesses tax responsibilities and analyzes job proposals or wage packages.

What Is Net Pay?

Net pay refers to the sum of money an employee receives after all deductions are removed from their gross income. It is commonly called “take-home pay” since it reflects the real amount transferred to the employee’s bank account or obtained as a paycheck.

Deductions from gross pay may consist of required withholdings like federal and state income taxes, Social Security and Medicare payments, in addition to optional deductions such as health insurance costs, retirement plan payments, union fees, and various benefits or garnishments. The sum of these deductions is taken away from the gross pay to calculate the net pay.

For instance, if a worker’s gross earnings for a pay period are $1,000 and the deductions total $100, their net earnings would equal $900.

Grasping net pay is crucial for efficient budgeting and financial planning, as it represents the real income accessible for expenditure, saving, and fulfilling individual financial responsibilities. Gross pay reflects an employee’s overall income, whereas net pay offers a more accurate view of their spendable amount, making it an essential concept for employees and employers alike.

Components of Gross Pay

Gross pay components are all the factors that constitute an employee’s overall earnings prior to any deductions being made. These elements may differ based on the job type, pay structure, and perks offered by the employer. Here are the components that constitute gross pay:

Fixed Components

1. Basic Salary or Wages

The fundamental element of an employee’s remuneration is the basic salary. It is established and serves as the foundation for several other benefits and allowances, including gratuity and provident fund. Usually, it represents 30% to 50% of the overall compensation. It is entirely taxable and compensated each month.

2. Dearness Allowance (DA)

Dearness Allowance is provided to counteract the effects of inflation on workers. It is mainly provided to employees in government and the public sector, and it is updated regularly according to the cost of living index. DA is entirely taxable and constitutes a portion of the gross salary in relevant employment agreements.

3. House Rent Allowance (HRA)

HRA assists workers in managing rental housing costs. The sum varies based on the city of living, generally greater for metropolitan areas. A part of HRA could be exempt from taxation under section 10(13A) of the Income Tax Act, depending on the rent paid and the basic salary. It differs depending on the employer.

4. Conveyance/Transport Allowance

This allowance includes regular travel costs between home and the office. Employers frequently offer a set monthly sum. Prior to reforms in standard deductions, up to ₹1,600 monthly was exempt from taxes under previous regulations. It often constitutes a minor section of the overall compensation package.

5. Medical Allowance

Medical allowance is a consistent monthly part provided to employees to assist with their healthcare costs. It can be organized as compensation for real invoices or as a fixed monthly sum. Previously, up to ₹15,000 annually was tax-free, but this advantage has now been substituted with a standard deduction.

6. Special Allowance

Special allowance is the remaining part of the salary once all other fixed components are established. It equilibrates the overall Cost to Company (CTC). It can differ significantly among employees and companies. In contrast to other allowances, special allowance is completely taxable and not associated with particular expenses or reimbursements.

Variable Components

1. Bonuses

Bonuses are extra compensation given to workers as recognition for meeting certain objectives or for the overall performance of the company. These can be yearly, celebratory, or optional. Bonuses are typically subject to taxation and differ according to the company’s regulations. They enhance employee morale and acknowledge efforts that extend beyond standard responsibilities.

2. Commissions

Commissions are earnings based on performance, typically awarded to roles in sales or business development. They are usually determined as a percentage of sales produced or revenue earned. Commissions connect pay to outcomes, motivating greater productivity. This variable compensation element is entirely taxable and usually disbursed on a monthly or quarterly basis, contingent upon performance.

3. Overtime Pay

Overtime pay is remuneration for hours worked in excess of the regular working hours. It is typically computed at an elevated rate—frequently 1.5 to 2 times the standard hourly pay. Regulated by labor regulations, it encourages extra work and assists in meeting pressing deadlines. Overtime compensation is entirely taxable and counted as part of gross income

4. Performance-Linked Incentives

Performance-based incentives (PBIs) are rewards tied to the accomplishment of individual, team, or organization-specific objectives. They can be provided on a monthly, quarterly, or yearly basis. PLIs are designed to promote exceptional performance and are linked to quantifiable metrics. These are entirely taxable and constitute a variable part of the employee’s total salary.

5. Arrears

Arrears denote payments of salary or wages for an earlier time frame resulting from postponed increases, adjustments, or retroactive changes. For example, if a salary increase is granted retroactively, the discrepancy is compensated as back pay. These sums are included in gross income when disbursed and are liable for taxes.

Other Benefits / Perquisites

1. Perquisites (Perks)

Perquisites are additional benefits that employers offer beyond salary, and they are not in cash. These can encompass company vehicles, housing assistance, subsidized lending, club memberships, or equity options. Certain perks are taxable according to their worth, whereas others might be tax-free up to a certain threshold. They significantly improve the total compensation package and employee contentment.

2. Leave Travel Allowance (LTA)/Leave Travel Concession (LTC)

LTA/LTC is a benefit given to reimburse travel costs within India while an employee is on leave. It is possible to travel by oneself and family members. It is tax-free two times within a four-year period, contingent upon certain criteria. Exemption applies solely to real travel expenses

3. Leave Encashment

Leave encashment refers to the financial payment given for the earned leaves that were not utilized. It can be offered during service or upon retirement/resignation. During employment, leave encashment is completely taxable, but payments received at retirement are tax-exempt up to a specified limit under the Income Tax Act for non-government workers and entirely exempt for government workers.

4. Employer’s Contribution to Provident Fund (PF)

Employers invest a set percentage (typically 12%) of an employee’s basic salary and DA into the Employees’ Provident Fund. This amount is included in total earnings and is intended to aid retirement savings. Annual contributions up to ₹7.5 lakh (including additional funds) are tax-exempt; amounts above that are subject to tax

5. Pension (Employer’s Contribution)

The employer’s input into pension plans such as the Employees’ Pension Scheme (EPS) is included in retirement benefits. Usually, a segment of the PF contribution is allocated to EPS. This is not taxed right away but offers lasting financial stability after retirement. It is regarded as a component of gross income for accounting principles, even though it is not earned monthly.

Components Not Included in Gross Pay

Here are some common components generally not included in gross pay:

1. Reimbursements

Reimbursements are payments provided to employees for legitimate costs incurred while performing official tasks, including travel, meals, or mobile expenses. These are not classified as gross pay since they represent expense recoveries rather than income. They are generally tax-exempt when backed by legitimate invoices and adherence to employer policies.

2. Gratuity (at retirement or resignation)

Gratuity is a one-time payment given to employees as a sign of gratitude for extended service, usually upon retirement or resignation. It is regulated by the Payment of Gratuity Act and is not a standard income. Therefore, it is not included in gross pay and is calculated separately when it comes due

3. Leave Travel Concession (LTC) / Leave Travel Allowance (LTA) (if paid as reimbursement and not part of regular salary)

When LTA/LTC is repaid according to actual travel costs, it is considered an expense reimbursement rather than ordinary income. Hence, it is excluded from gross pay. Tax exemption is granted under particular circumstances. If given as a set allowance, it might be part of gross earnings instead.

4. Free meals or snacks provided by the employer

Food, snacks, or drinks offered at the workplace are typically regarded as non-cash perks. They are excluded from gross pay unless they surpass the tax-exempt limits established by law. These are considered supplementary benefits and frequently meet criteria for exclusions based on expense, occurrence, and type of offering.

5. Leave encashment at the time of retirement/resignation

Leave encashment obtained during retirement or resignation is not considered monthly income and is therefore omitted from gross pay. It is a single payment acknowledging unutilized leave. For government workers, it’s entirely tax-free; for others, it is tax-exempt up to a certain limit as per Section 10(10AA) of the Income Tax Act.

6. Certain fringe benefits (depending on tax laws and specific benefit)

Certain fringe benefits such as complimentary housing, subsidized loans, or gifts may not be part of gross income. Their inclusion relies on the way the benefit is designed and taxed. If deemed as benefits according to tax regulations, they could be taxed independently and assessed according to established guidelines, excluding them from total income.

Note: Deductions (such as income tax, employee PF contribution, professional tax, etc.) are withheld from gross pay, but are not excluded from its calculation.

How to Calculate Gross Pay

To calculate gross pay, you usually add:

- Basic salary or hourly pay

- Overtime Pay (if applicable)

- Bonuses or commissions

- Other earnings (e.g., shift differentials, allowances, holiday pay)

For Hourly Employees:

Step 1: Determine Hours Worked

Keep a record of both regular and overtime hours worked during the pay period.

Step 2: Calculate Regular Pay

Multiply the number of regular hours worked by the hourly wage.

Step 3: Calculate Overtime Pay

Multiply the number of overtime hours by the overtime pay rate, which is typically 1.5 times the regular hourly wage.

Step 4: Calculate Total Gross Pay

Add regular pay and overtime pay: Gross Pay = (Regular Hours × Hourly Wage) + (Overtime Hours × Overtime Pay Rate)

For Salaried Employees:

Step 1: Identify the Annual Salary

This is the employee’s agreed yearly compensation.

Step 2: Calculate Regular Gross Pay

Divide the annual salary by the number of pay periods in a year (e.g., 12 for monthly, 26 for bi-weekly).

Step 3: Include Other Compensation

Add any bonuses, commissions, or other earnings received during the pay period.

How is Gross Pay Calculated for Hourly Employees?

Hourly employees receive pay according to the number of hours they work and their agreed-upon hourly wage.

Formula: Gross Pay = (Hourly Wage × Number of Regular Hours) + (Overtime Pay Rate × Number of Overtime Hours)

- Hourly Rate: What the employee earns per hour

- Regular Hours: Typically up to 40 hours/week

- Overtime Hours: Work hours exceeding the regular schedule, compensated at 1.5 times the standard pay rate (“time and a half”).

Example:

- Hourly Rate: $20

- Regular Hours: 40

- Overtime Hours: 5

- Overtime Rate: $20 × 1.5 = $30

Calculation: (40 × $20) + (5 × $30) = $800 + $150 = $950 Gross Pay

How is Gross Pay Calculated for Salaried Employees?

Salaried employees are paid a fixed yearly salary, no matter how many hours they work.

Formula: Gross Pay = Total Annual Salary ÷ Total Number of Pay Periods in the Year

- Annual Salary: The total compensation per year

- Pay Periods: Frequency of pay (e.g., 12 for monthly, 26 for bi-weekly)

Example:

- Annual Salary: $60,000

- Pay Frequency: Monthly (12 pay periods)

- Calculation: $60,000 ÷ 12 = $5,000 Gross Pay per month

Add bonuses, commissions, or other one-time earnings to the period’s gross pay when applicable.

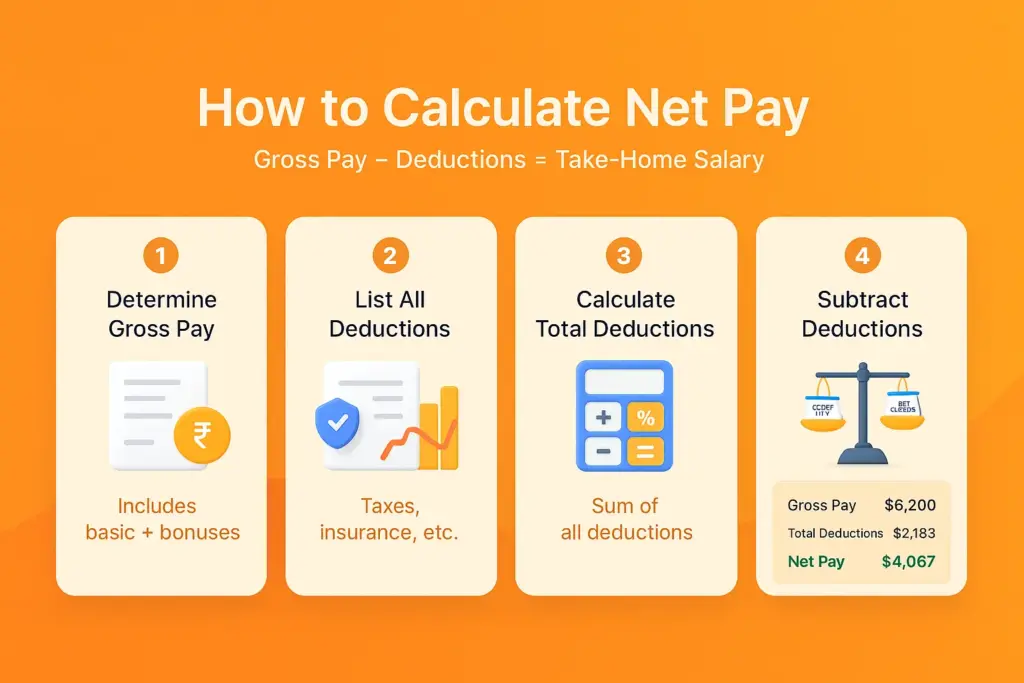

How to Calculate Net Pay

To calculate the net pay, you deduct all current amounts such as taxes, insurance premiums, and retirement contributions from the gross pay.

Follow these steps to calculate Net Pay:

1. Determine Gross Pay

Begin by identifying the employee’s total earnings before deduction. This includes basic salary or hourly pay, bonuses, overtime and any additional compensation.

2. Identify All Deductions

Deductions are generally divided into two main types: mandatory and voluntary. Mandatory deductions are required by law and usually include federal income tax, state income tax (where applicable), Social Security tax, and Medicare tax.

Voluntary Deductions are optional and vary based on the employee’s benefit selections or financial planning. Examples include Health insurance premiums, Retirement contributions (e.g., 401(k) or pension plans), Life insurance premiums, Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA) and Union dues or charitable contributions.

3. Calculate Total Deductions

Add up all mandatory and voluntary deductions.

4. Subtract Deductions from Gross Pay

Use the following formula to calculate net pay: Net Pay = Gross Pay – Total Deductions

Example:

Scenario: An employee earns a gross monthly salary of $6,200. The following deductions apply:

- Federal income tax: $900

- State income tax: $300

- Social Security & Medicare: $473

- 401(k) retirement contribution: $250

- Health insurance: $180

- Life insurance: $30

Total Deductions = $900 (Federal Tax)

- $300 (State Tax)

- $473 (Social Security & Medicare)

- $250 (401k)

- $180 (Health Insurance)

- $30 (Life Insurance)

= $2,133

Net Pay = $6,200 – $2,133 = $4,067

Final Net Pay: $4,067

This is the exact amount the employee will take home in their bank account for the month.

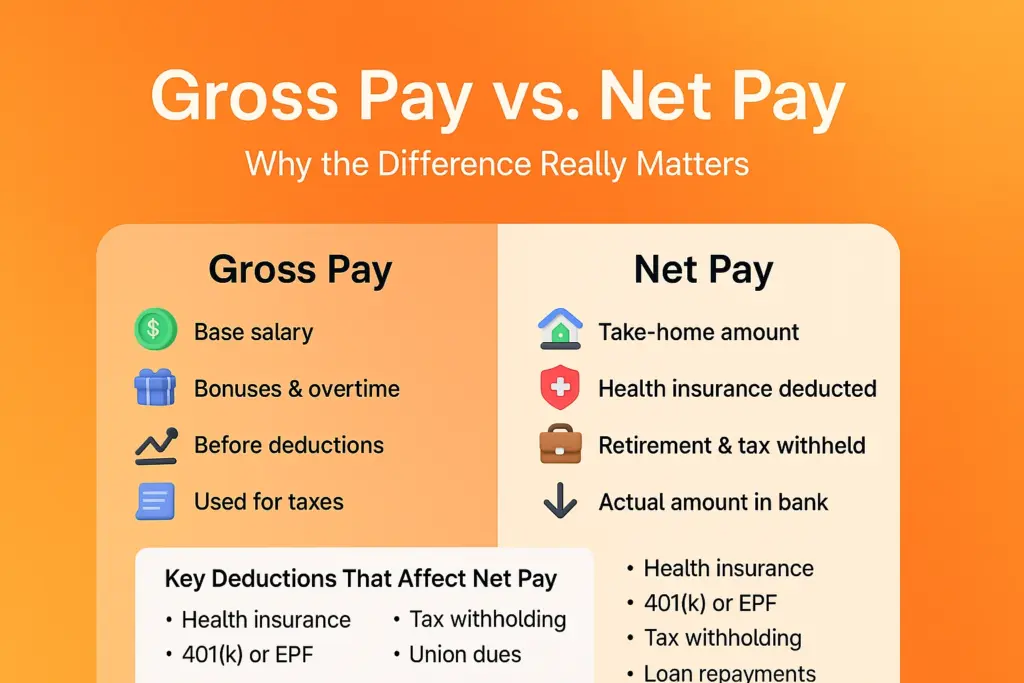

Differences Between Gross Pay and Net Pay

Understanding the difference between gross pay and net pay is essential for personal finance management and comprehending your total compensation as an employee.

| Aspect | Gross Pay | Net Pay |

|---|---|---|

| Definition | Total earnings before deductions | Take-home pay after deductions |

| Deductions Applied | No | Yes |

| Includes Bonuses | Yes | Sometimes |

| Tax Withheld | Not subtracted | Subtracted |

| Insurance Premiums | Not deducted | Deducted |

| Retirement Contributions | Not deducted | Deducted |

| Overtime Included | Yes | Yes |

| Reported on Pay Stub | Yes | Yes |

| Used for Loan Applications | Sometimes | Often |

| Employer Contribution | Not included | Not included |

| Use in Budgeting | Not ideal | Ideal |

| Visible in Offer Letter | Yes | Rarely |

| Amount | Higher | Lower |

| Shows Earning Potential | Yes | No |

| Fixed/Variable | Fixed (base + extras) | Variable (post-deductions) |

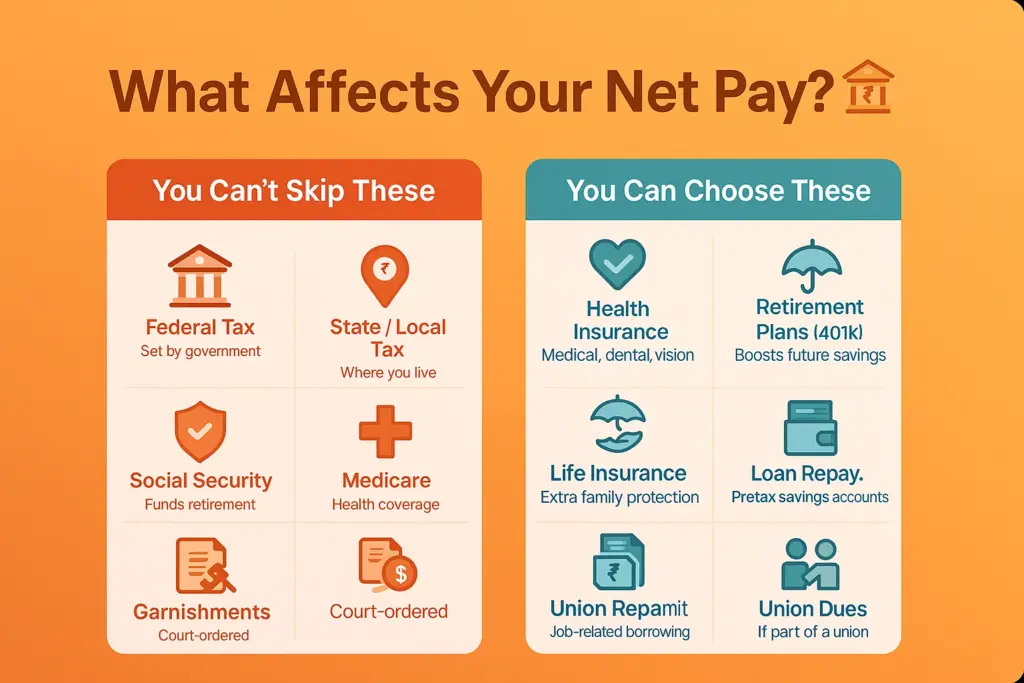

Factors That Affect Your Net Pay

Ever look at your paycheck and wonder where all your money went? You’re not alone. It can be a little confusing, but once you get the hang of it, it starts to make sense. Basically, a few things come out of your paycheck before you even see the money—and not all of them are optional. Let me break it down.

Mandatory Deductions

Some things are taken out of every paycheck because the government says so. Your employer doesn’t really have a choice—they have to do it, and so do you. Here’s what usually gets pulled out:

- Federal Income Tax – This depends on how much you make and what you filled out on your W-4.

- State Income Tax – Not every state takes this, but many do. It changes depending on where you live.

- Local Tax – Some cities or counties also take a cut. Not everywhere does, but if you live in one that does, you’ll see it.

- Social Security – This goes toward retirement and disability programs. We all pay into it while we work.

- Medicare – This helps cover health care for older folks and some people with disabilities.

Voluntary Deductions

Now, other things are optional. You might decide to have them taken out if you want certain benefits, like health insurance or retirement savings. Not everyone picks the same things—it depends on your situation. Here are some examples:

- Health Insurance – Covers doctor visits, dental work, and maybe even vision care.

- Retirement Plans – You can put some money aside now, like into a 401(k), so you’ll have it later.

- Life Insurance – Some jobs offer this, and you might choose extra coverage.

- Disability Insurance – Helps if you can’t work because you get sick or hurt.

- FSAs or HSAs – These are special accounts that let you use pre-tax money for health or childcare costs.

- Loan Payments – If you borrowed from your employer, they might take payments straight from your check.

- Union Dues – If you’re in a union, dues might come out regularly.

- Garnishments – This one’s court-ordered—like if you owe child support, taxes, or other debts.

Gross Pay vs. Net Pay: Why It Matters More Than You Think

When payday comes around, your paycheck shows two key numbers: gross pay and net pay. While both relate to your earnings, they’re not the same—and knowing the difference can help you take better control of your money.

1. It Helps You Create a Realistic Budget

Gross pay is your full salary before anything gets taken out. But you don’t take home that full amount—net pay is what actually lands in your bank account after deductions like taxes and insurance. If you budget using your gross pay, you might think you have more to spend than you really do.

2. You Can Make Smarter Financial Plans

Understanding both figures gives you a clearer picture of what you earn and what you can afford. Whether you’re setting savings goals or planning big purchases, knowing the difference helps you make more informed decisions.

3. It Prepares You for Tax Season

Your gross income is the number the government uses to calculate your taxes. Knowing your gross pay helps you estimate how much you might owe—or get back—when it’s time to file. It also helps you plan ahead if you want to adjust your withholdings.

4. You’ll Understand Where Your Money Goes

The gap between gross and net pay is due to deductions. These may include:

- Health insurance – Premiums for medical, dental, or vision coverage

- Retirement contributions – Money you set aside in plans like a 401(k)

- Life insurance – Premiums for coverage through your job

- Union dues – Payments if you’re a member of a union

- Loan repayments – Payments for any workplace loans

- FSAs or HSAs – Pre-tax savings for health or dependent care expenses

Seeing these deductions helps you understand the true value of your benefits.

5. You Can Negotiate Pay More Effectively

When discussing salary, many people focus on gross pay—but what really matters is what you take home. Asking about benefits, taxes, and other deductions during negotiations gives you a clearer idea of your actual earnings.

6. It Makes It Easier to Catch Payroll Errors

If you know how your gross pay turns into net pay, you’re more likely to notice if something’s off. Maybe some hours weren’t counted, or a deduction looks wrong. Either way, understanding your pay helps you fix mistakes faster.

How to Improve Your Net Pay: Smart Strategies for 2025

Looking to boost your take-home pay? Whether you’re employed full-time or juggling side gigs, increasing your net pay means more money in your pocket at the end of the day. These proven methods help you to improve your earnings by maximizing income and minimizing deductions—without overcomplicating your finances.

1. Increase Your Gross Income

Before taxes and deductions, your gross income is the starting point. Improving this number is the most direct route to a better net pay.

- Ask for a Raise or Promotion

- Negotiate Your Salary When Switching Jobs

- Start a Side Hustle or Freelance Project

- Sell Unused Items

2. Optimize Your Tax Situation

Taxes are often your largest deduction. By making informed decisions, you can legally lower your taxable income.

- Adjust Your W-4 Withholding (U.S.-Specific)

- Use Pre-Tax Benefits

- Make Country-Specific Tax Strategies

3. Reduce Other Deductions and Personal Expenses

Non-tax deductions and high personal expenses can shrink your take-home pay. Take control by reviewing your spending habits.

- Evaluate Your Healthcare Plan

- Claim Work-Related Reimbursements

- Eliminate Unnecessary Subscriptions or Services

- Pay Off High-Interest Debt

- Save Your Raise

Final Thoughts

Understanding personal finance begins with recognizing your income, and the difference between gross pay and net pay is likely the most essential concept. As we’ve discussed, gross pay represents your overall earning capacity, showcasing your effort and the worth you contribute. Net pay, however, represents the tangible reality – the sum you genuinely have availablefor your everyday expenses, savings, and investments.

For workers, grasping these numbers enables you to budget wisely, prepare for upcoming financial objectives, and negotiate your salary in a more strategic manner. For employers, understanding gross and net pay promotes transparency and builds trust within the team.

Keep in mind that various elements affect your net income, ranging from required tax deductions to optional contributions. Using resources such as our complimentary Gross Pay and Net Pay Calculator on InvoPilot, you can achieve immediate understanding of your income. Equipped with this understanding, you can make more informed financial choices, enhance your earnings, and ultimately gain increased control over your financial health.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Invoice Generator

Leave a Reply