Each time a commercial transaction is introduced, Invoice is an important document that records the goods or services provided and any outstanding loan. The insurance of clear Invoice payment terms and conditions for this not only provides better cash flow, but also reduces the risk of misunderstanding or delay in the payment. Either masters of small businesses or a member of a large enterprise, knowledge and practical challenge practice can change the ‘change’ in the context of financial stability.

What Are The Invoice Payment Terms?

The Invoice payment terms define the terms that your customers are obliged to pay for the goods or services provided by you. The purpose of these sections is to ensure that all individuals know about their financial obligations, including the date, method and punishment for any outstanding loan.

“Net 30” is a general invoice designation which means the customer has to pay the entire invoice amount within 30 days of the Invoice date.

On the other hand, matters that are “paid by recognition” and quick payment are compulsory.

Conditions with accurate and unclear payments are favorable for both businesses and consumers as they promote professionalism and trust. They help you reduce the fight, maintain a stable stream of money and set expectations for everyone.

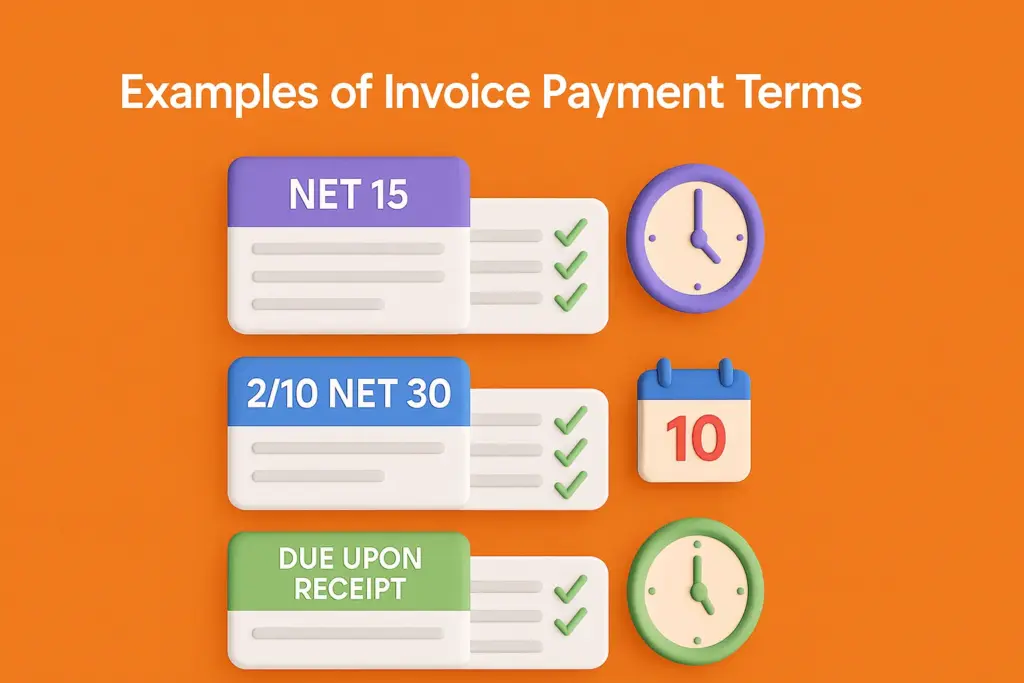

Examples of How Invoice Payment Terms Work

To gain a better understanding of invoice payment terms, let’s examine some real-life scenarios:

Net 15 Terms: Suppose you are a freelance graphic designer. You send out an invoice with “Net 15” payment terms to a client upon the completion of a project. The invoice date is October 1, and thus the client has to pay their dues within October 16. If the client extends the payment date beyond that, it could mean late charges.

2/10 Net 30 Terms: This is an incentive term based on reward commonly applied by wholesalers or suppliers. A buyer gets an invoice with the conditions “2/10 Net 30,” that is, they can pay 2% less if paid within 10 days. If not, the total invoice value must be paid within 30 days. This stimulates quicker payments as well as a reward for timely customers.

Due Upon Receipt: An example is a caterer providing service for an occasion and sending over an invoice tagged “Due Upon Receipt.” Paying is simply expected as soon as the bill is received, simplifying payments.

By being specific about the terms on an invoice, a company can expect that it lays down expectations, decreasing confusion and establishing better relationships between companies and their clients.

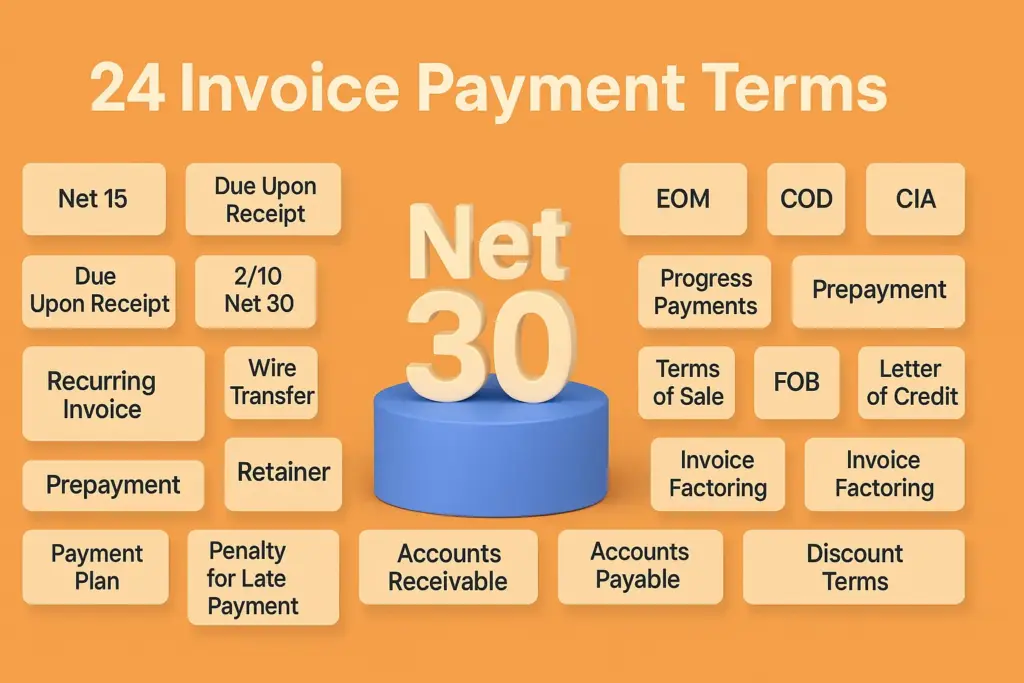

24 Invoice Payment Terms – Business Owner Should Know

Invoice Payment Terms are essential for managing cash flow and maintaining good relationships with clients and suppliers. Here’s a quick breakdown of 24 key terms that every business owner should know.

1. Net 30: It means the client has 30 days from the date the invoice is issued to make the payment.

2. Net 15: It is similar to Net 30, but payment is due within 15 days of the invoice date. It’s often used in industries where quicker payments are typical.

3. Due Upon Receipt: It indicates the payment is due immediately once the invoice is received. It’s best for businesses that want to avoid delays in cash flow.

4. 2/10 Net 30: Clients get a 2% discount if they pay within 10 days. Otherwise, the full payment is due within 30 days. This encourages early payments.

5. EOM (End of Month): The payment is due by the end of the month, regardless of when the invoice was issued. It’s straightforward and easy for clients to track.

6. COD (Cash on Delivery): Payment must be made at the time of delivery of goods or services. It’s often used in retail or logistics businesses.

7. CIA (Cash in Advance): Customers must pay before the goods or services are delivered. This protects the seller but may deter some clients.

8. Progress Payments: These are partial payments made over the course of a project or service delivery. It’s common in construction or long-term projects.

9. Recurring Invoice: It is used for ongoing services or subscriptions, this allows for invoicing at regular intervals, such as monthly or annually.

10. ACH: Short form of Automated Clearing House, it refers to payments made electronically through bank transfers. It’s fast, secure, and cost-effective.

11. Wire Transfer: A direct, electronic payment from one bank account to another. It’s reliable but can involve higher fees.

12. Prepayment: This requires customers to pay in full before work begins. It’s great for reducing risk but can be off-putting for new clients.

13. Retainer: A set amount of money paid upfront, often for ongoing services. It’s common in industries like law, consulting, and design.

14. Partial Payment: A portion of the invoice is paid upfront, with the balance due later. It’s often used when both parties want to share the risk.

15. Terms of Sale: This is the broader agreement outlining payment terms, including due dates, discounts, and penalties for late payments.

16. FOB (Free on Board): This term determines who is responsible for shipping costs. It can affect when payments are triggered based on delivery terms.

17. Letter of Credit: A payment guarantee issued by a bank, ensuring the seller gets paid if certain conditions are met. It’s often used in international trade.

18. Invoice Factoring: This involves selling invoices to a third party (a factor) for immediate cash. The factor collects payment from the client later.

19. Bill of Exchange: A binding document in international trade where the buyer agrees to pay a fixed amount on a set date, simplifying cross-border transactions.

20. Payment Plan: This arranges for payment to be made in installments over time, making large purchases more manageable for clients.

21. Penalty for Late Payment: This clause specifies additional charges or interest if the payment is late. It encourages timely payments and protects the seller’s interests.

22. Accounts Receivable: These are amounts owed to a business by clients for goods or services delivered but not yet paid. It’s a key part of cash flow management.

23. Accounts Payable: This refers to the money a business owes to suppliers or vendors for goods and services already received.

24. Discount Terms: These offer a certain percentage off the invoice for early payment (e.g., “5% off if paid within 7 days”). It motivates clients to pay quicker.

Tips for Making Your Invoice Payment Terms More Effective

Enforcing invoice payment terms isn’t about just selecting one of the above terms. Use the following advice in practice:

- Set Clear Expectations: Simplify your terminology when writing terms for your invoices. Avoid using jargon and refer to due dates, late fees, and methods of preferred payments beforehand.

- Customize Terms: All clients are not the same. What may be satisfactory to one, i.e., “Net 30,” may not be satisfactory to others, i.e., “Due Upon Receipt” or milestone payments. Check your payment terms as per the special needs of each client.

- Detail Late Payment Penalties: Impose late fees or interest charges on late payment, e.g., “5% of the due amount will be charged 10 days from due date.” This will prompt clients to pay early.

- Use Automated Invoice Software: Utilize invoicing software for sending reminders, tracking payments, and automatic reminding. Most have features for bringing terms into prominent view.

- Early Payment Discounts: Incentivise clients by providing discounts for paying early. This will result in faster transactions and better cash flow.

- Payment Options: Make payment easy for clients by showing preferred payment methods on your invoice, such as credit cards, bank transfers, or electronic payments like PayPal or Stripe.

- Prior to Work: Settle and negotiate terms of payment upfront to avoid conflict later. Document these terms in agreements or contracts.

- Communicate Frequently: Follow up from time to time with late payment reminders. A phone call or email will often remind a client without escalating to disputes.

- Digital Signatures: To ensure clients agree to your terms, use a digital signature tool before sending out invoices. It formalizes the payment agreement.

- Work With Legal Professionals: For larger deals, collaborate with legal experts in developing payment conditions that protect your interests and adhere to local regulation.

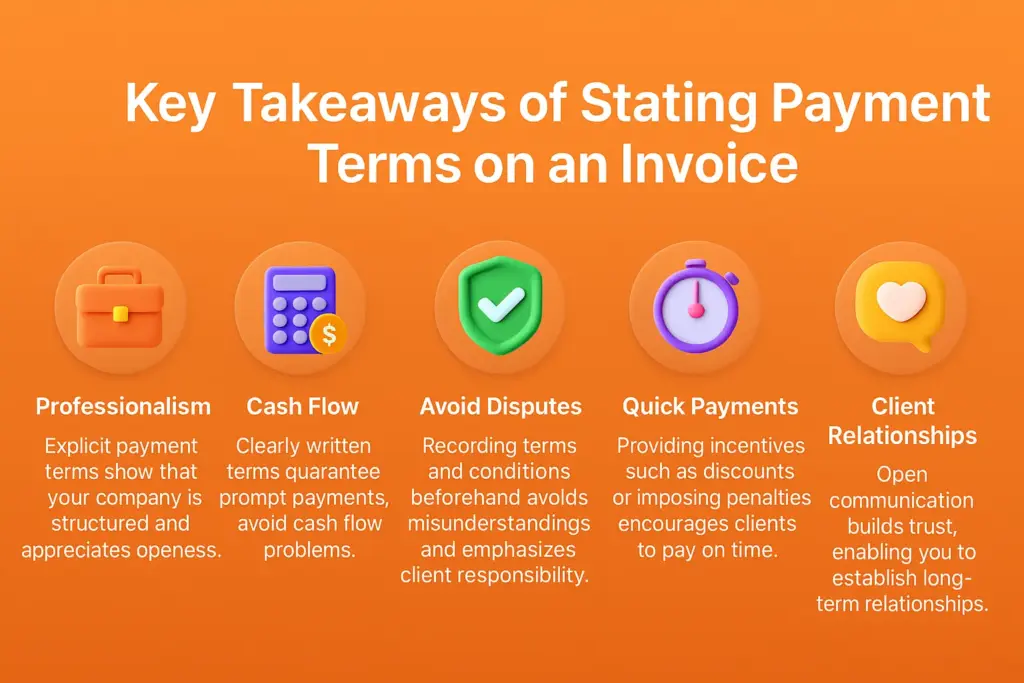

Key Takeaways of Stating Payment Terms on an Invoice

Putting payment terms on an invoice is not merely formal; it actually determines how you conduct your business. These are the important points to remember:

Professionalism

Explicit payment terms show that your company is structured and appreciates openness.

Cash Flow

Clearly written terms guarantee prompt payments, avoid cash flow problems.

Avoid Disputes

Recording terms and conditions beforehand avoids misunderstandings and emphasizes client responsibility.

Quick Payments

Providing incentives such as discounts or imposing penalties encourages clients to pay on time.

Client Relationships

Open communication builds trust, enabling you to establish long-term relationships.

Common Challenges With Invoice Payment Terms

While essential, implementing invoice payment terms can come with challenges. Here’s how to address them:

- Late Payments: Even with clear terms, some clients may not adhere to deadlines. If this happens frequently, consider requiring advance payments or enforcing late fees.

- Conflicting Terms: Contracts signed before invoicing might already include payment terms that clash with your invoice. Always ensure consistency and alignment in agreements.

- Misunderstandings: Ambiguous or overly complex terms can lead to confusion. Simplify language and break down instructions to make them easier to understand.

- Transactions: Currency differences, international taxes, and varying payment regulations can complicate invoicing for overseas clients. Use invoicing software to streamline this process.

- Overdue Accounts: Chasing payments can strain your resources. Automating reminder emails or partnering with collection agencies can alleviate the burden.

- Non-Payment Scenarios: Despite your best efforts, non-payment can occur. Have a clear process in place, such as legal action, to recover overdue payments.

Conclusion

Having tight invoice terms and conditions is not only best practice—it’s crucial to your ability to manage a successful enterprise. By stipulating due dates, payment terms that are accepted, and fines for lateness, you’re ensuring smooth money exchanges and securing your interests.

You’re either just starting or streamlining existing billing procedures, use this roadmap to establish equitable, professional, and enforceable policies of payment.

Pro Tip: Always keep your terms flexible according to your business model, cash flow requirements, and type of client. And don’t forget to come back and alter your terms occasionally as your business changes.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply