- What Is Invoice Reconciliation?

- Why Is Invoice Reconciliation Important for Businesses?

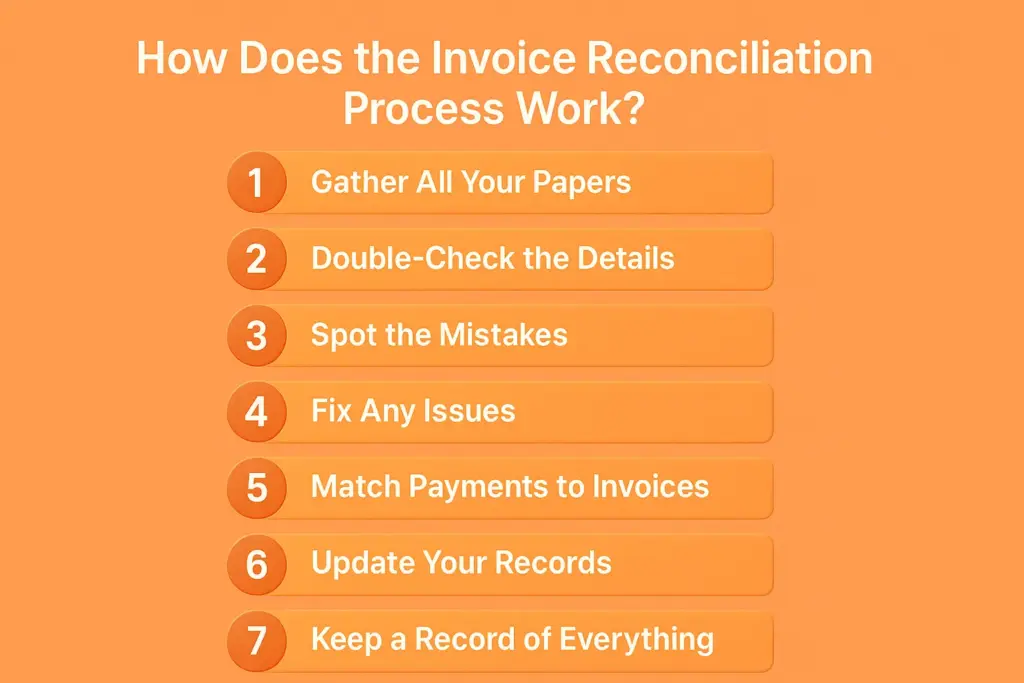

- How Does the Invoice Reconciliation Process Work?

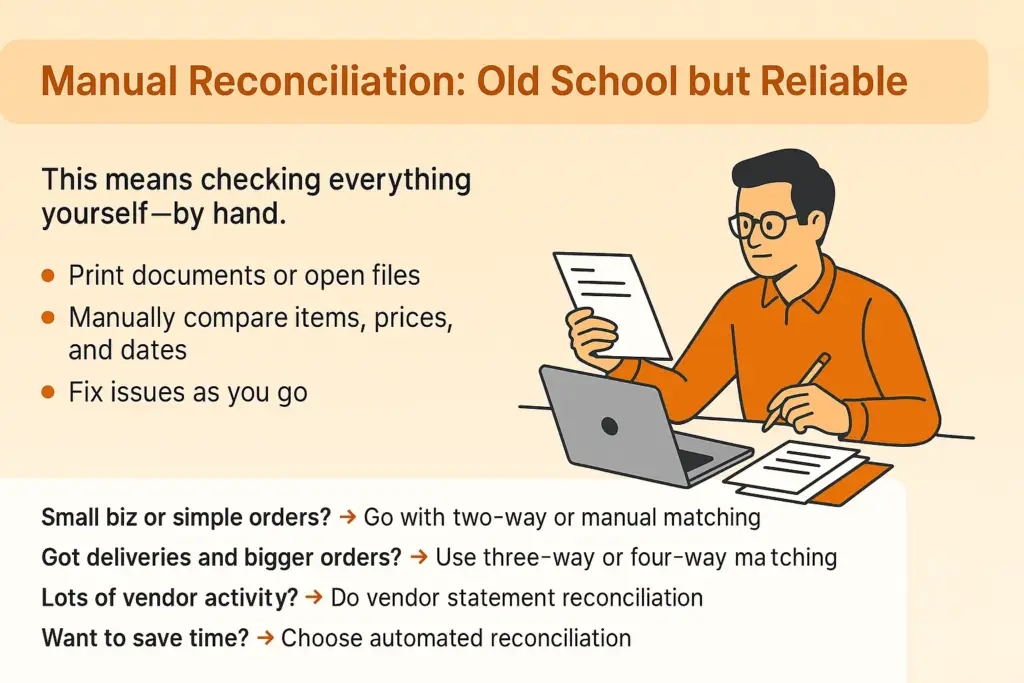

- Types of Invoice Reconciliation Explained

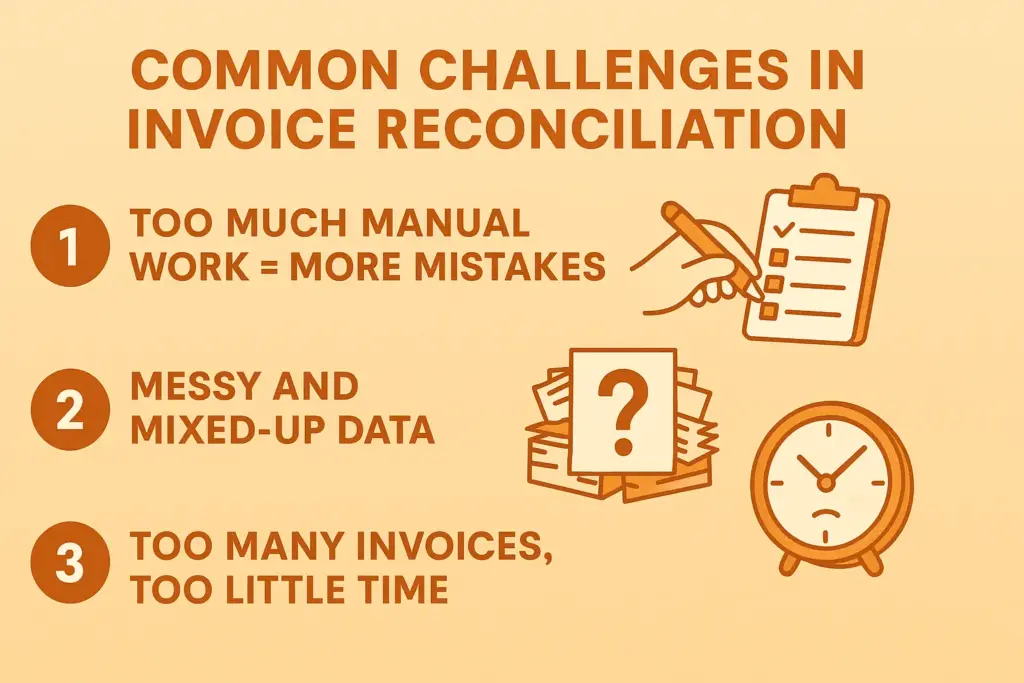

- Common Challenges in Invoice Reconciliation

- Manual vs. Automated Invoice Reconciliation

- Top Benefits of Automating Invoice Reconciliation

- Tips for Accurate and Efficient Invoice Reconciliation

- How InvoPilot Simplified Invoice Reconciliation

- Conclusion

Keeping the business economy in check can sometimes feel like solving a difficult puzzle – especially when it comes to invoices! This is where an invoice reconciliation comes in. Think of it as your financial double check system that ensures that each bill matches what you ordered and received. It is a smart way to catch errors, avoid paying too much and keeping the cash flow healthy. Whether you are a small start -up or a growing business, mastering invoice reconciliation can save you time, money and a lot of headaches. Let’s dive into what it is and how you can make it easy and efficient!

What Is Invoice Reconciliation?

Invoice reconciliation is a very important step in accounting that helps companies double -check their expenses. This means comparing invoices (the bills you receive) with other items such as purchasing orders, delivery receipts and bank statements to ensure that everything matches.

Why is it done? To ensure that the company only pays for what it actually ordered and received. It helps to catch errors, avoid paying too much and keeping the business economy accurate and organized. Think of it as a final check before money goes out the door!

Why Is Invoice Reconciliation Important for Businesses?

Invoice reconciliation is important for businesses because it is like a financial check for your business. It ensures that all your bills and payments are perfect, which keeps your money safe and that your business goes smoothly. When you reconcile invoices, you avoid costly errors such as paying twice, missing errors or even fall victim to fraud.

This process helps you save money by capturing any wrong costs or over payment early. In addition, it keeps your cash flow even, so you always know exactly where your money is going. On top of that, it builds trust and strong relationships with your suppliers because everything is clear and accurate.

Here’s a complete look on Invoice Reconciliation Importance:

Keep Your Finances Spot-On

Double checking your invoices (aka reconciling) helps you ensure that all your business transactions are recorded correctly. This means no missing payments, no surprise errors – just clean, accurate financial records. When your amounts are correct, it is easier to make smart business decisions and plan for the future with confidence.

Take Control of Your Cash Flow

By reconciling invoices, you make sure you only pay for what you actually ordered and received – no more, no less. It means no random overpayments and fewer financial surprises down the line. It also helps you plan payments carefully, so your money flows in and out to just the right times. It is especially useful when every dollar counts!

Catch Mistakes and Stop Fraud Early

Invoice reconciliation acts as a safety net. There are errors such as incorrect billing amounts, duplicate invoices or even scams before damaging the bottom line. By comparing invoices with purchasing orders and receipts, you keep your business safe and your books clean.

Build Better Vendor Relationships

Vendors love getting paid on time and without mistakes – and who doesn’t? When you reconcile invoices correctly, it shows that you are reliable and professional. This can lead to stronger partnerships, better service and even friendlier payment terms in the long term.

Boost Your Team’s Efficiency

No more wasted time to trace the lack of info or fix payment errors. Invoice reconciliation makes the payment process smoother and faster. You can detect and solve problems faster and keep operations running without delays.

How Does the Invoice Reconciliation Process Work?

Invoice reconciliation may sound like a big term, but it’s actually a simple process when you break it down. It’s about making sure the details match what you were billed, what you ordered and what you received.

Simple Steps to Reconcile Invoices:

1. Gather All Your Papers

Start by collecting everything you need like invoices, purchase orders, delivery slips, and bank statements. These are the puzzle pieces for your reconciliation process.

2. Double-Check the Details

Take each invoice and compare it with the matching documents (purchase order, delivery receipt, etc.). Make sure the amounts, quantities, and product names all line up.

3. Spot the Mistakes

Look closely for anything that doesn’t match like wrong prices, missing items, or incorrect quantities. These little things can cause big headaches if missed!

4. Fix Any Issues

If you find something wrong, dig into it. Contact the supplier if needed, fix any errors, and adjust the payment accordingly. Don’t move forward until everything looks right.

5. Match Payments to Invoices

Check that each vendor payment matches the correct invoice. Nothing should be overpaid, underpaid, or missed entirely.

6. Update Your Records

Once everything is sorted, log all changes and payments into your accounting system. Keep your books neat and up to date!

7. Keep a Record of Everything

Save all the documents you used, note the issues you found, and record how you solved them. This helps avoid confusion in the future and keeps your audit trail clean.

Types of Invoice Reconciliation Explained

Invoice reconciliation might sound technical, but it just means making sure all your bills match what you ordered and received. This helps avoid overpaying, underpaying, or missing anything important. There are several ways to do this, some are quick and easy, others more detailed. Let’s break them in the simplest way::

Two-Way Matching: Quick & Basic

Think of this like a two-point checklist. You compare the invoice with the purchase order (PO).

- Did you order this?

- Is the price right?

This is perfect for small businesses or simple purchases.

Three-Way Matching: Add a Delivery Check

This method adds a 3rd step: the receiving report. So now you check:

- Purchase Order

- Invoice

- Delivery/Receiving Report

You’re making sure you ordered it, got billed for it, and actually received it. It is best for businesses who deal with physical products.

Four-Way Matching: All-in-One Quality Control

The most detailed method! Along with the PO, invoice, and receiving report, you also check a quality or inspection document. Perfect for companies where quality really matters, like construction projects or large manufacturing orders.

Vendor Statement Reconciliation: Monthly Checkup

Vendors often send a monthly statement showing everything you owe. In this method, you compare their statement with your records:

- All invoices

- Payments made

- Any credits or adjustments

It’s super helpful when you have lots of orders with the same supplier.

Automated Reconciliation: Let Software Do the Work

Why do it all by hand? Use smart software to automatically:

- Match invoices with purchase orders and receipts

- Flag any differences

- Save time and reduce human error

Ideal for growing businesses or large operations.

Manual Reconciliation: Old School but Reliable

This means checking everything yourself—by hand.

- Print documents or open files

- Manually compare items, prices, and dates

- Fix issues as you go

It’s more time-consuming, but works well for small volumes or when you want full control.

- Small biz or simple orders? → Go with two-way or manual matching.

- Got deliveries and bigger orders? → Use three-way or four-way matching.

- Lots of vendor activity? → Do vendor statement reconciliation.

- Want to save time? → Choose automated reconciliation.

Keeping your invoices in check keeps your business on track!

Common Challenges in Invoice Reconciliation

Invoice reconciliation means checking and matching invoices with your records to make sure everything adds up. Sounds simple, right? But in reality, it can be a real headache! It can cause misunderstandings, slowdowns, and expensive mistakes. That’s why many businesses are now looking for smarter, automated ways to handle it.

A Closer Look at the Invoice Reconciliation Challenges:

1. Too Much Manual Work = More Mistakes

- Takes a lot of time and effort: Manually checking and matching invoices means tons of paperwork and typing, which can easily lead to errors like wrong numbers, repeated invoices, or missed deadlines.

- Hard to track and analyze: When things are done by hand, it’s tough to see where an invoice stands, which ones are unpaid, or if there are any issues—making it harder to make smart decisions.

- No automation = slow payments: Without the help of smart tools, the accounting team can get buried in paper. This slows everything down and could even hurt your cash flow.

2. Messy and Mixed-Up Data

- Different formats from different places: Invoices may come by email, post, or digital systems—and each looks different. Tracking them all is like putting together a puzzle with missing pieces.

- Data mismatches: Typos in invoice numbers, GSTIN/PAN, or other details can cause confusion and delay the whole process.

- Complex transactions: Dealing with multiple currencies, payment gateways, or timing differences makes things even harder—especially when manual errors get in the way.

3. Too Many Invoices, Too Little Time

- Takes too much time and energy: When you’re dealing with hundreds or thousands of invoices, checking each one manually is exhausting and eats up your team’s time.

- More invoices = more chances to make mistakes: The more you have, the higher the risk of missing something or entering wrong data.

- Hard to stay accurate: Without the right tools in place, keeping things accurate and efficient becomes a daily struggle.

Manual vs. Automated Invoice Reconciliation

| Aspect | Manual Reconciliation | Automated Reconciliation |

| What It Is | You check each invoice one by one against bank statements and records yourself. | Special software does the checking for you automatically. |

| How It Works | Manually matching invoice amounts and payment dates with bank entries to make sure everything adds up. | Software scans invoices, bank statements, and purchase orders, quickly spotting any mismatches. |

| Accuracy | Mistakes can happen easily since humans are doing all the work, which can cause wrong payments or missing records. | Much more accurate because the software avoids human errors. |

| Speed & Efficiency | Slow and takes a lot of time and effort, especially if you have many invoices. | Super fast — saves tons of time and lets your team focus on other tasks. |

| Cost | Can be expensive due to the hours spent and potential costly errors. | Usually cheaper over time, especially when handling lots of invoices. |

| Handling Growth | Hard to keep up when your business grows and you get more invoices. | Easily handles lots of invoices and grows with your business. |

| Best For | Small businesses with few invoices or when software isn’t an option. | Medium to large businesses wanting speed, accuracy, and less hassle. |

| Extra Benefit | Gives you full hands-on control but requires patience and attention. | Improves cash flow management by speeding up payment checks and collections. |

Top Benefits of Automating Invoice Reconciliation

- Fewer Mistakes: When computers handle invoice matching, human errors like typos or wrong entries almost disappear. This means your records stay clean and reliable.

- Saves You Time: Automation works fast—much faster than doing it by hand. This gives you more free time to focus on important things like growing your business or helping customers.

- Better Cash Flow: By quickly spotting any mismatches or problems with invoices, automation helps you fix issues right away. This keeps your money moving smoothly and avoids surprises.

- More Accurate Records: Automated systems double-check everything to make sure your financial data is spot-on. This reduces chances of paying too much or too little.

- Runs More Efficiently: Automation organizes and speeds up the whole reconciliation process, so your team can get more done without extra effort.

- Stays Compliant: Keeping your financial records accurate with automation also helps you follow important accounting rules and regulations, avoiding costly penalties.

Tips for Accurate and Efficient Invoice Reconciliation

To keep your invoices accurate and efficient invoice reconciliation, make sure everything adds up right, it’s important to stay organized from the start. Use helpful technology to automate the process, check your invoices often, fix mistakes quickly, and keep clear records of everything. Doing this makes it easier to spot any errors or differences, keeps your numbers accurate, and helps you avoid losing money.

Here’s a simple guide with easy tips to make your invoice reconciliation smooth and error-free:

1. Organize Invoices Right Away

As soon as you get an invoice—whether on paper or in your email—sort it out and put it in the right place. Create a simple system to track which invoices are paid, which are partly paid, and which still need payment. This way, nothing gets lost or forgotten.

2. Use Technology to Make Life Easier

There are smart tools and software that can do the boring stuff for you, like matching invoices with payments or pulling data automatically. Using these tools saves time and cuts down mistakes, so your team can focus on more important work.

3. Reconcile Regularly

Make it a habit to check and match invoices with payments on a regular basis—ideally every month or even more often. This ensures your records stay organized and allows you to identify issues early.

4. Fix Errors Quickly

If you spot a mistake, don’t wait! Fix it right away by contacting the vendor or correcting the entry. The faster you deal with errors, the less trouble they cause later.

5. Keep Clear Records

Write down everything you do during reconciliation—steps taken, what you found, and how you fixed any problems. Keeping good records helps everyone stay on the same page and makes future checks easier.

6. Match Invoices Carefully

Use methods like two-way, three-way, or four-way matching, which means comparing invoices with purchase orders, delivery reports, and other documents. This guarantees that the invoice is correct and aligns with the items that were ordered and delivered.

7. Train Your Team Well

Make sure your team knows the basics of invoicing, how to spot common mistakes, and how to keep proper records. Good training means fewer errors and smoother processing.

8. Review Your Process Often

Check your invoice handling and reconciliation steps regularly. Look for ways to make it faster or more accurate, and keep an eye out for new tools or better methods to improve your system.

9. Collect and Organize All Documents

Always gather all related paperwork—like invoices, purchase orders, delivery notes, and bank statements—and keep them neatly organized. This makes it quick and easy to verify information when needed.

10. Separate Responsibilities

Don’t let one person do everything related to invoices and payments. Splitting tasks between team members helps prevent mistakes and reduces the risk of fraud.

Why Follow These Tips?

By doing all this, your business will handle invoices smoothly and correctly. That means better control over money coming in and going out, fewer mistakes, and clearer financial reports. It’s a simple way to keep your business running smart and safe.

How InvoPilot Simplified Invoice Reconciliation

InvoPilot has completely changed the game by making invoice reconciliation simple, fast, and accurate. Here’s how:

InvoPilot uses smart technology to automatically compare the invoice details with your purchase orders and payments. No more manual checking line by line! This saves hours of work and removes human mistakes.

Instead of getting lost in piles of paperwork or complicated spreadsheets, InvoPilot shows you everything you need on one simple, clean dashboard. You can see which invoices are paid, pending, or have any issues — all in one place.

If something doesn’t match or there’s a missing payment, InvoPilot immediately alerts you. This helps businesses fix problems quickly before they turn into bigger headaches.

InvoPilot easily connects with your existing accounting and ERP systems. This means your invoice data flows smoothly without extra effort, making the whole process seamless and stress-free.

By simplifying and speeding up invoice reconciliation, InvoPilot helps businesses avoid costly errors and late payments. This enhances cash flow while also fostering stronger relationships with suppliers.

Conclusion

Invoice reconciliation might seem like a small task, but it’s actually a powerful tool that keeps your business running smoothly and your finances accurate. By making sure every invoice matches your orders and payments, you protect your money, prevent errors, and build stronger relationships with your vendors. Whether you do it manually or use smart software like InvoPilot, staying on top helps you stay organized, save time, and focus on growing your business. So, start reconciling today and watch your financial health thrive!

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply