- Why Invoice Statistics Matter for Your Business?

- Top 45 Invoice Statistics –

- General Invoicing Statistics

- Invoicing Automation Statistics

- Business Size Invoicing Statistics

- Accounts Payable Stats

- Accounts Receivable Stats

- Late Invoice Stats

- Automation Trends and Strategic Impact

- Invoice Management

- Late Invoice Practices: Global Statistics

- Trends in Invoice Automation and Digitization

- The Impact of Invoice Statistics on Small Businesses

- Actionable Insights to Streamline Your Invoice Process

- How Invopilot Can Transform Your Workflow?

Invoices might seem like a routine part of business, but they play a vital role in cash flow and operations. They also help build trust with both clients and vendors. No matter if you are managing a small business or supervising the operations at a multinational organization, invoicing is key, even though many people still see invoicing as a tedious or unpleasant part of doing business.

They teach us some hard facts: the average business touches approximately 500 invoices each month and, ironically enough? Spending several days each week just to process a single invoice! Manual data entry, paper-based workflows, and approval delays may seem like minor issues, but they often become major hurdles—wasting time, money, and resources.

We know this from Invopilot As this data is so eye opening of where businesses struggle , this guide goes into lots of detail on the most predominant invoice statistics – processing times & automation trends etc. Rather than numbers, these are urban legends that will greatly enhance the accuracy of your endpoints in a fast paced world of invoicing.

Why Invoice Statistics Matter for Your Business?

Invoices are the heart and soul of business transactions. They capture the transaction of goods and services for cash and thereby assist you to efficiently deal accounts payable as well as receivable. Then what is the big importance of invoice statistics, then?

It comes down to speed, wisdom and progression. Once you start to look at the stats, you spot areas where your processes fall down, know where your industry sits and can make data-driven decisions on technology overhauls – like automation.

Take this one for example — did you know the average business sees 500 invoices processed per month? It is a very large volume and without good processes in place, mistakes soon pile, along with delays. Invoice Statistics gives you visibility and more importantly helps you find ways to cut costs and improve your output.

Top 45 Invoice Statistics –

General Invoicing Statistics

- Most businesses handle up to 500 invoices monthly.

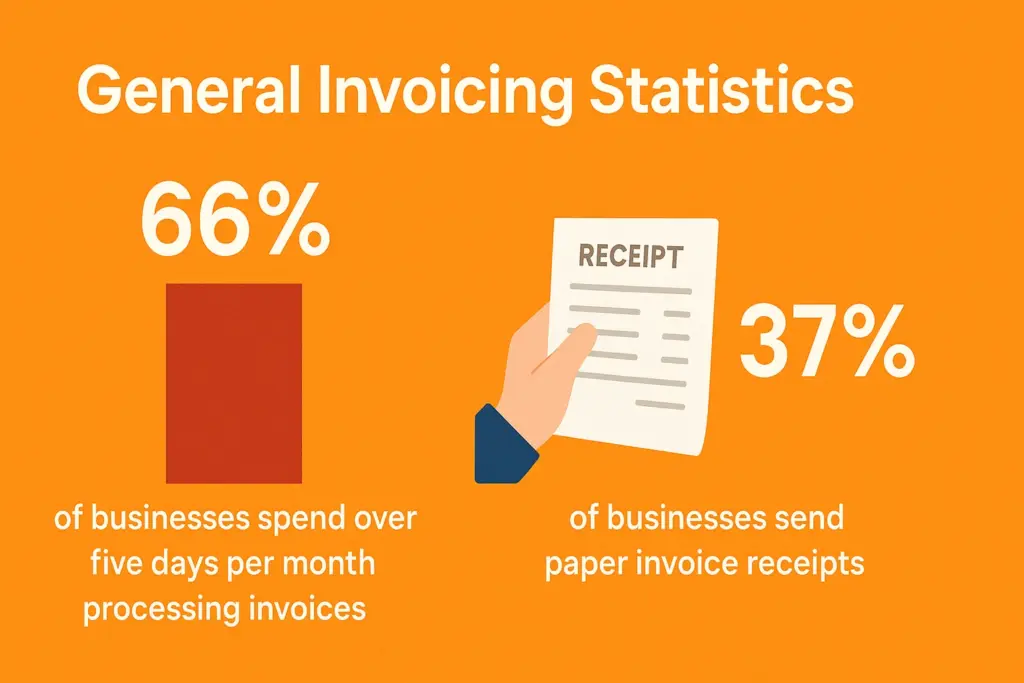

- 66% of businesses spend over five days per month processing invoices.

- Only 52% Electronic invoice are received; the rest are paper-based.

- 37% of businesses send paper invoice receipts.

- 57% of the invoice data is entered manually.

- 49% of businesses require 2-3 people to approve an invoice; 22% require six or more.

- 11% of customers never receive their invoices.

Invoicing Automation Statistics

- Automation is seen as the leading e-invoicing trend for 2023 by 71% of respondents.

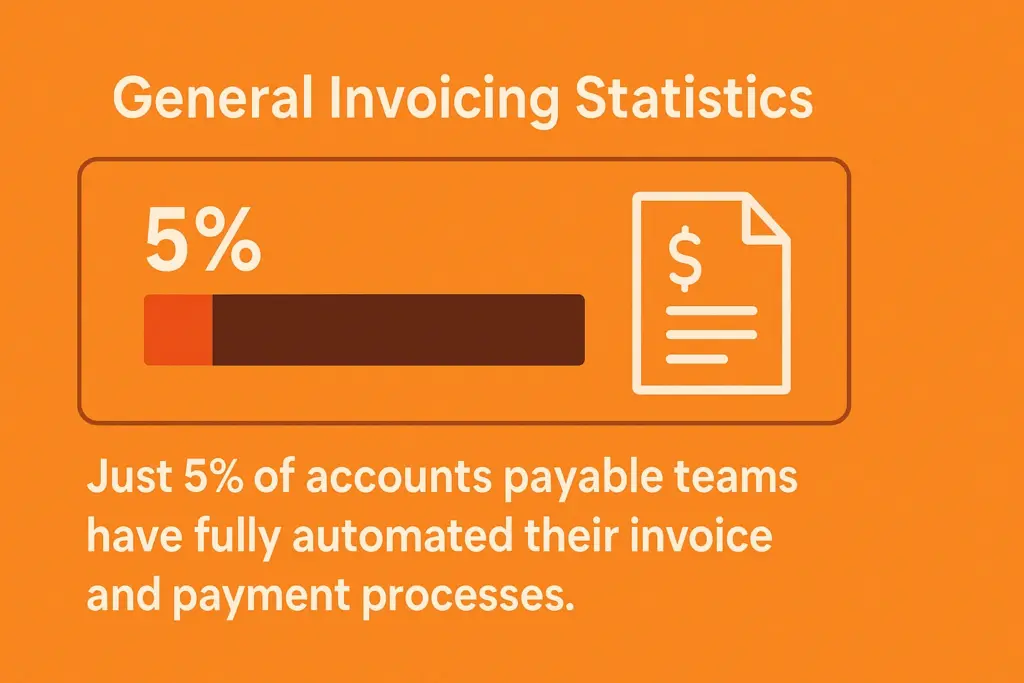

- Just 5% of accounts payable teams have fully automated their invoice and payment processes.

- 26% of businesses aim for fully automated invoice processing by 2024.

- 41% of businesses with partial automation have automated invoice approvals.

Business Size Invoicing Statistics

- Small and medium-sized enterprises (SMEs) account for the highest share of paper invoice receipts, at 48%.

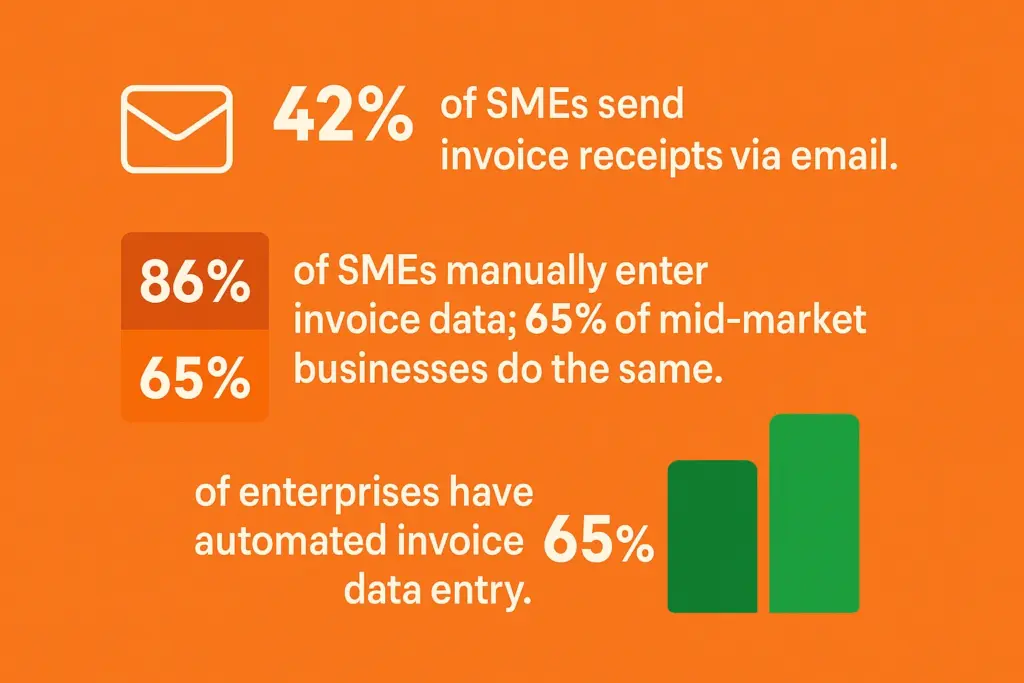

- 42% of SMEs send invoice receipts via email.

- 86% of SMEs manually enter invoice data; 65% of mid-market businesses do the same.

- 65% of enterprises have automated invoice data entry.

- Enterprises are most likely to require six or more approvals and take 3-4 weeks to approve invoices.

Accounts Payable Stats

- More than 378,750 accounts payable specialists are employed in U.S.

- Approximately 79% of accounts payable associates are women, and the average age in this profession is 51

- The leading challenges include slow invoice approvals (47%) and exceptions to invoicing standards (45%).

- Improved reporting and data analytics are a top priority for 48% of accounts payable teams.

- Only 56% accounts payable teams use e-payments.

- Document scanning is utilized by 77% of teams.; 33% plan to adopt e-invoicing within 12-24 months.

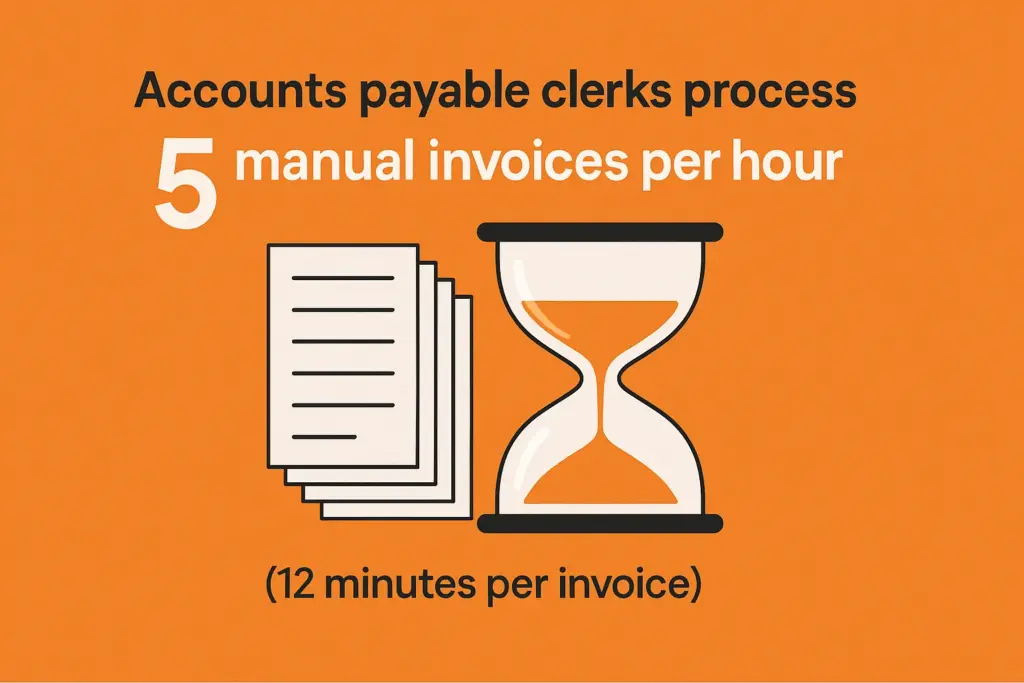

- Accounts payable clerks process 5 manual invoices per hour (12 minutes per invoice).

Accounts Receivable Stats

- More than 515,000 accounts receivable specialists are employed across the United States.

- Women make up 82% of accounts receivable specialists, with an average age of 45.

- Late payment management and Automation and are top challenges.

- Real estate accounts receivable teams spend over seven hours weekly on invoicing.

Late Invoice Stats

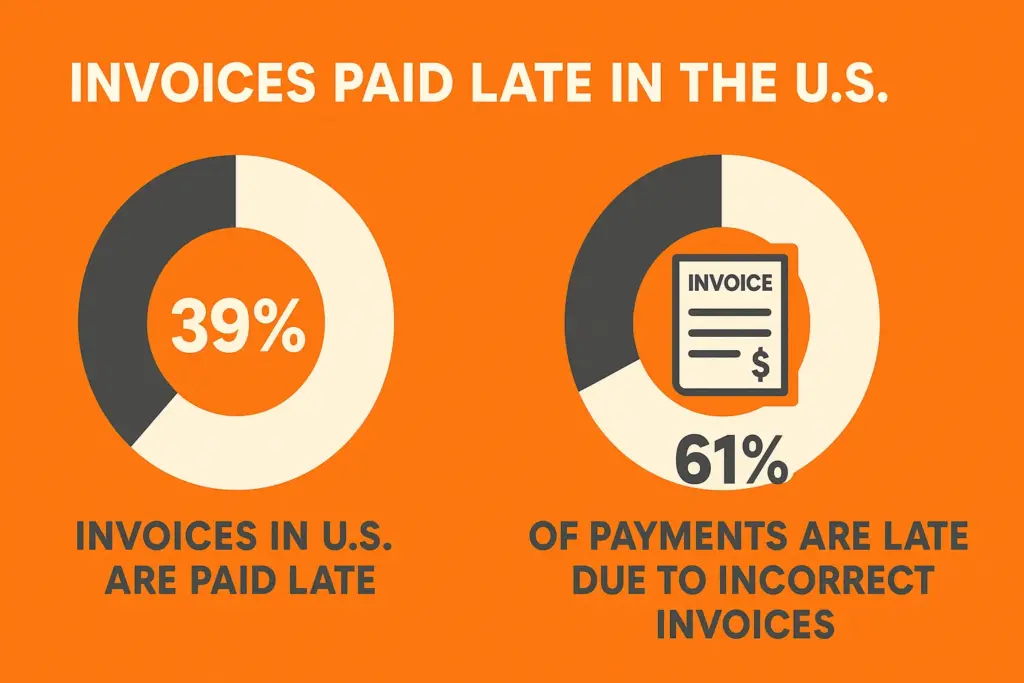

- 39% invoices in U.S. are paid late; 61% of payments are late due to incorrect invoices.

- 87% of businesses receive payments after the due date; 35% are paid over 30 days late.

- Companies with over 500 employees are most likely to receive late payments.

- As Per Research done by Atradius shows, 55% of invoices in the U.S. are paid late; 36% are paid on time, and 9% are written off.

- Small businesses in the U.S. receive payments eight days past the deadline.

- SMEs spend 14 hours weekly chasing late payments.

- As per Forbes small business statistics, 38% of small businesses fail due to financial challenges caused by late payments.

Automation Trends and Strategic Impact

- Fully automated AP teams have doubled in two years (9% now fully automated).

- 41% of businesses plan to automate payables within 12 months.

- 88% believe automation would free finance teams for strategic initiatives.

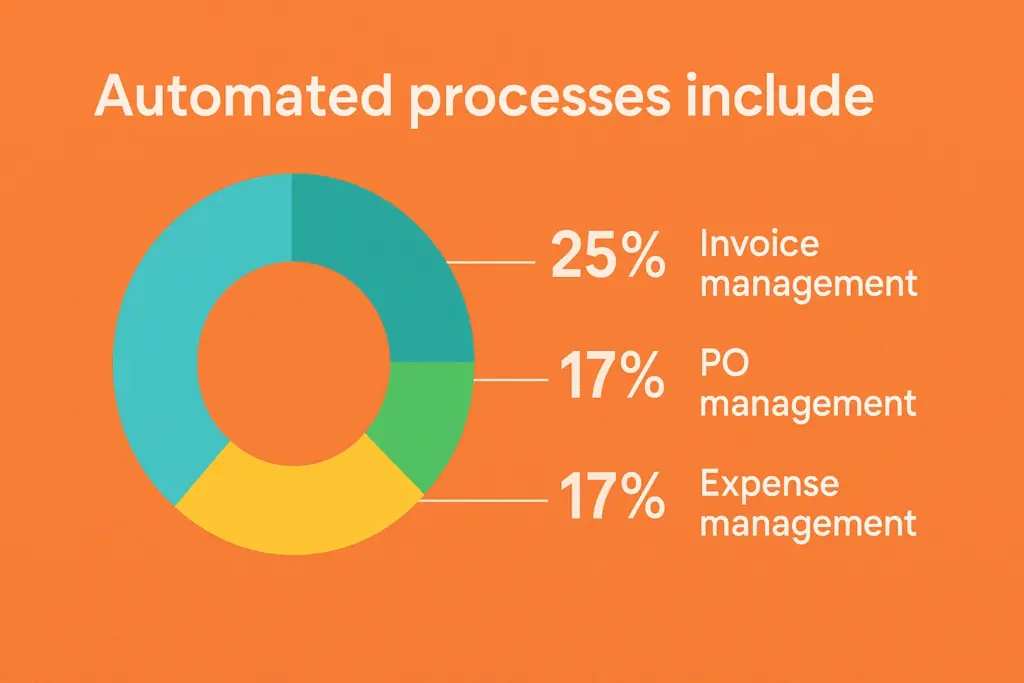

- Automated processes include invoice management (25%), PO management (17%), and expense management (17%).

Invoice Management

- Transitioning to e-invoicing can save up to £10 per invoice.

- E-invoicing across the U.S. federal government could save $450 million annually.

- Fully automated systems allow AP staff to process 23,333 invoices annually, compared to 6,082 manually.

Late Invoice Practices: Global Statistics

- A survey done by Creditor Watch found that 80% of Australian businesses struggle with late payments; small businesses lose $6,000-$30,000 annually.

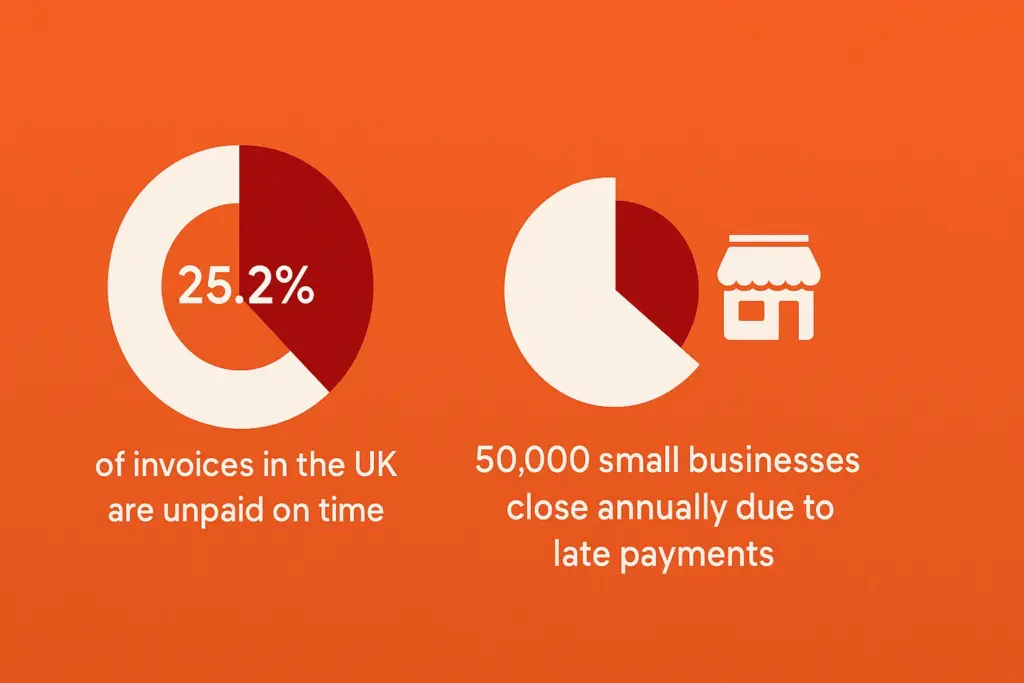

- As per Payment and cash flow review report by UK Department, 25.2% of invoices in the UK are unpaid on time; 50,000 small businesses close annually due to late payments.

- Acc. to European Commission Report, 50% of EU invoices are paid late; 25% of bankruptcies are caused by late payments.

- Late payments lead to financial hardships, operational issues, and hiring freezes.

Trends in Invoice Automation and Digitization

Invoice digitization has seen immense growth as businesses shift from the outdated manual processes. Here are some of the top trends shaping today’s Invoicing World.

Rise of Cloud-Based Solutions

Cloud invoicing platforms have become very popular with SMEs Invoicing platforms that help companies to issue, send and keep their invoices in a nice secure place on cloud. They are available everywhere, making them ideal for remote teams or businesses with global operations.

Integration with Enterprise Resource Planning (ERP)

Many businesses are now integrating invoice processing with ERP systems. This allows seamless communication between accounting, procurement, and financial management, further optimizing workflows.

Focus on Mobile-Friendly Tools

Mobile invoicing solutions allow business owners or freelancers to send invoices and track payments or chase overdue accounts directly via their smartphone. This is particularly beneficial for businesses constantly on the move or without access to a dedicated finance team.

The Impact of Invoice Statistics on Small Businesses

For small business owners, invoice statistics carry additional weight because even small inefficiencies can add up. Consider this example:

- Manual Entry: SMEs often rely on manual invoice generation and data entry, with 86% manually entering invoice data. Transitioning to even basic automation can cut this figure drastically, saving valuable time.

- Paper vs. Digital: SMEs disproportionately use paper (48%) for both sending and storing invoices. Digitizing invoices reduces clutter, accelerates cash flow, and provides better record-keeping for compliance.

- Approval Times: While large enterprises often deal with lengthy approval chains, SMEs still face occasional bottlenecks in approval workflows. Digitized systems can speed up this process without the need for exhaustive resources.

Actionable Insights to Streamline Your Invoice Process

- Adopt E-Invoicing: Switching to electronic invoices for your business so that you can save time, spend less money and lower errors. A considerable number of platforms contain designs to be able to customise for your sector.

- Leverage Automation: Automate the Repetitive tasks of creating invoice, tracking & reminding to save time with correct reporting.

- Improve Data Analytics: Apply invoice statistics to find processing time bottlenecks, approval chains or in paying tardiness. Over time with these metrics, you can continuously increase.

- Simplify Payment Methods: Offering various pay options (like credit cards, digital wallets and bank transfer ) can quicken payment timelines.

- Set Clear Terms: Make sure to inform clients about Invoice Payment Terms and due dates from starting. Cash flow can also be supported by late fees or early payment incentives.

How Invopilot Can Transform Your Workflow?

At Invopilot, we’re here to turn invoicing into an effortless process. Say goodbye to stacks of paper and endless follow-ups for payments. Here’s what we bring to the table:

- Efficient Automation: Wave goodbye to manual data entry and hours chasing errors. We’ll help you replace outdated methods with streamlined processes.

- Faster Approvals: Quick, smooth workflows reduce the lag in multi-level approvals, so your invoices get greenlit faster.

- On-Time Payments: Minimize late payments with our intelligent systems that reduce errors and misplaced invoices.

- Digital Domination: With the global movement toward digitization, adopt e-invoicing and improve how your business does billing.

It’s Time to Pilot Your Growth with Smarter Systems. Don’t wait for inefficiencies to pile up. With Invopilot’s expertise in simplifying invoicing, we’ll help you focus on what matters most – growing your business. Upgrade to modern invoicing today and experience the difference it makes.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply