- Key Mobile Payment Statistics (2023–2030)

- Mobile Payment Statistics of Global Usage

- Mobile Payment Security Stats

- Mobile Payments in Hospitality & Retail

- Popular Mobile Payment Methods & Apps

- Mobile Payment Growth by Region

- QR Code & eWallet Statistics

- Crypto Wallet Adoption

- Mobile Payment User Demographics (2026)

- Why Businesses Must Accept Mobile Payments

- The Future of Mobile Payments

- Conclusion

Is there a future for mobile payment transactions? With the rise of technology, the way we handle money is changing much faster than ever. Mobile payment is more than only one facility; They are telling how we shop, eat, and even travel. From tapping your smartphone in checkouts to scan the QR code for coffee, these innovations are becoming a daily criteria.

But how big this change is, and what does it mean to us? This blog 2026 and beyond the mobile payment industry shapes the eyes and dives into trends. Whether you are a business master who wants to remain competitive or a curious consumer eager to understand the latest technology, this is your ultimate guide.

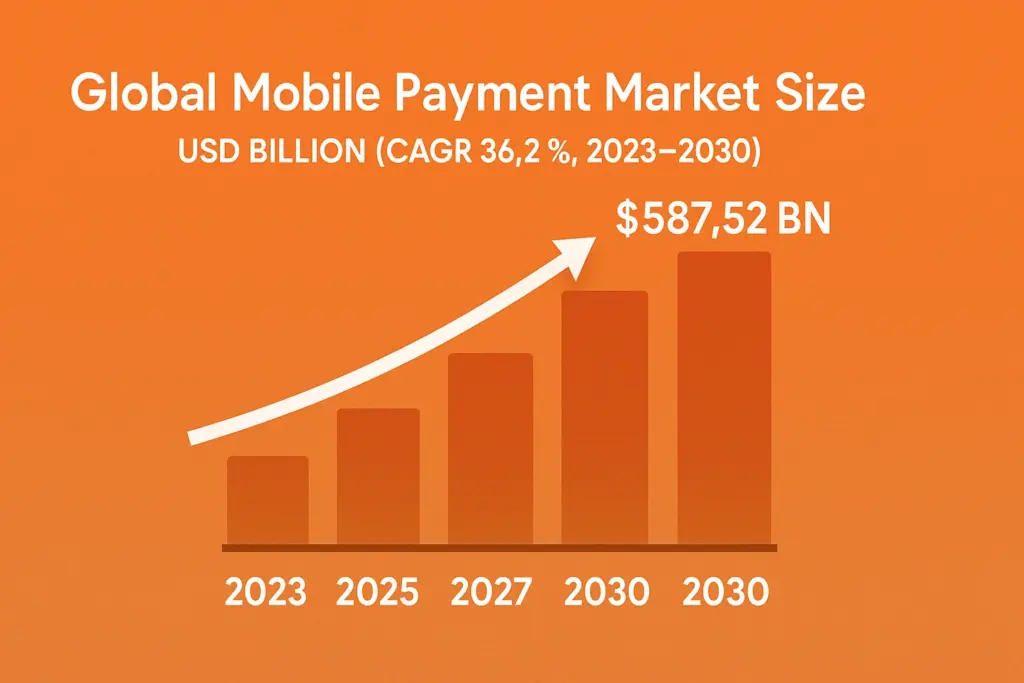

Key Mobile Payment Statistics (2023–2030)

- The global mobile payment market size is expected to reach $587.52 billion by 2030, growing at a CAGR of 36.2% from 2023 to 2030.

- In 2022, the market was valued at $67.26 billion, and by 2030, it is forecast to reach $221.92 billion, with a 15% CAGR. (Statista)

- By 2024, the global mobile payment transaction volume is estimated at $2.1 billion, a 27% increase compared to 2020.

- Mobile payments are projected to make up 79% of all digital transactions by 2026, up from 71% in 2021. (Juniper Research)

- The worldwide mobile payment market is predicted to grow to $3 trillion by 2024 and $27.81 trillion by 2032, with a 28.2% CAGR. (Custom Market Insights)

- Over 60% of global financial institutions now offer mobile payment services, a sharp increase from just 38% in 2018. (World Bank)

Mobile Payment Statistics of Global Usage

- By 2026, there will be 4.8 billion mobile wallet users globally. (Boku)

- China leads the mobile payment revolution, with 81.5% of smartphone users using mobile payments, compared to 46% in South Korea and 43% in the U.S. (eMarketer)

- In the U.S., 53% of consumers prefer digital wallets over cash or physical cards. (Forbes Advisor)

- During the COVID-19 pandemic, mobile payment usage surged, increasing from 29% in 2019 to 43% in 2021 in the U.S.

- As of 2023, India recorded over 75 billion UPI-based mobile payment transactions, making it a global leader in digital transaction volume. (NPCI)

- Mobile payments are especially popular among younger users:

- Gen Z: 62%

- Millennials: 53%

- Baby Boomers: 21% (Morning Consult)

- 73% of Gen Z respondents say mobile payments are their default way to pay in-store and online. (PYMNTS.com)

Mobile Payment Security Stats

Despite growing popularity, security remains a top concern:

- 69% of users believe mobile payments might be less secure than traditional methods.

- 47% of cybersecurity experts express doubt about mobile payment security.

Top concerns

- Public Wi-Fi risks: 26%

- Lost or stolen devices: 21% (ISACA)

- 70% of Americans cite security concerns as a reason for avoiding mobile payments. (Pew Charitable Trusts)

- Biometric authentication, including fingerprint and facial recognition, is now used by over 80% of mobile payment platforms, helping to reduce fraud risks. (Statista)

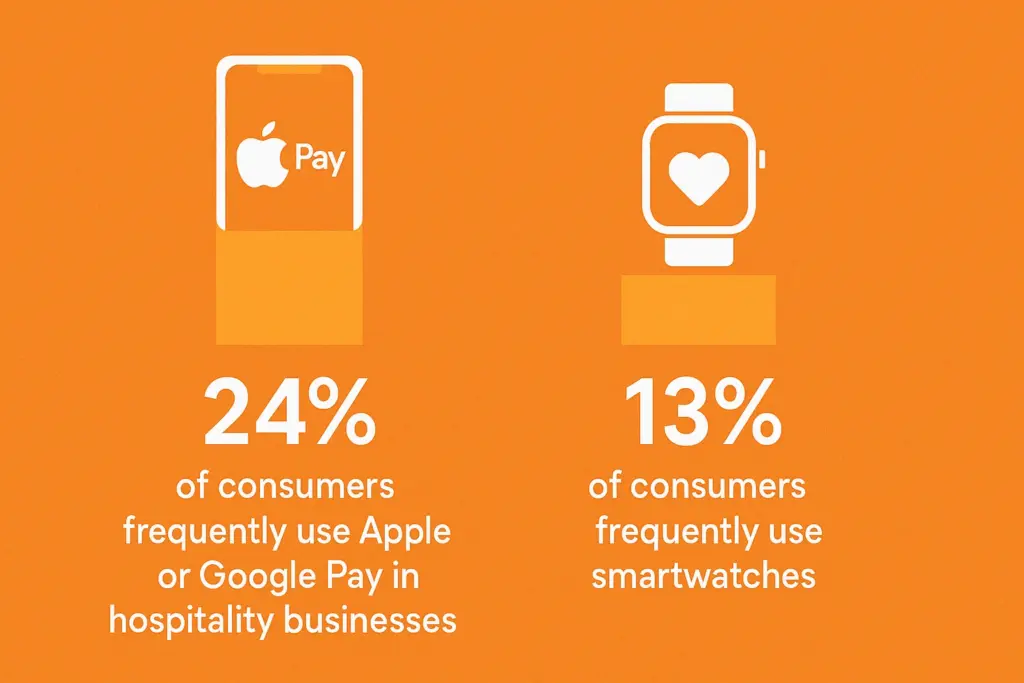

Mobile Payments in Hospitality & Retail

Mobile payments are transforming the hospitality sector:

- In 2023, 66% of restaurants in the U.S. and Canada accepted mobile payments—more than credit (63%) and debit cards (38%). (TouchBistro)

- In 2019, 30% of hotel bookings used mobile wallets—higher in branded, urban hotels. (PhocusWire)

- 24% of consumers frequently use Apple or Google Pay in hospitality businesses, while 13% use smartwatches. (Zonal, CGA)

- 80% of retailers in North America now accept mobile payments, citing faster checkout times and improved customer experience. (Retail Dive)

Popular Mobile Payment Methods & Apps

Top Mobile Payment Apps (U.S. & Worldwide)

- AliPay: 1.3 billion users globally; 40% of total mobile payments (Merchant Machine)

- Apple Pay: 55.8 million U.S. users in 2023 (Oberlo)

- PayPal, Venmo, Zelle, Google Pay, and Cash App remain top choices in the U.S.

- PayPal is preferred 5x more than Apple Pay in a 2021 survey

Country-Specific Leaders

- U.S.: Apple Pay, PayPal, Google Pay

- India: PhonePe, Google Pay, Paytm

- China: AliPay and WeChat Pay dominate

- In Europe, Revolut, Klarna, and Barclays Mobile Banking are gaining popularity.

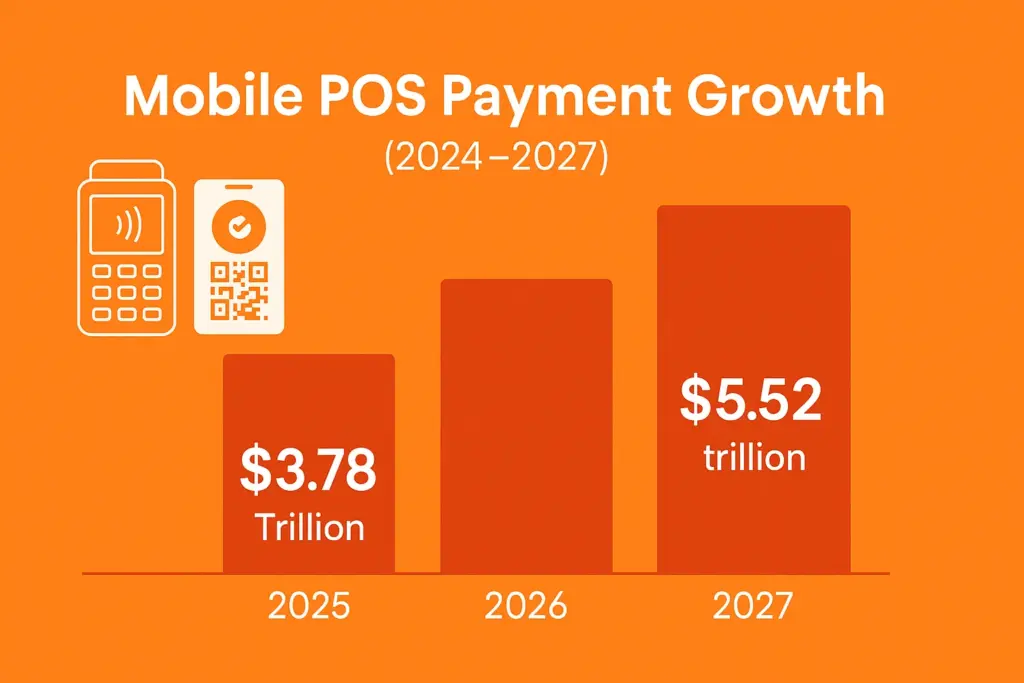

Mobile Payment Growth by Region

Worldwide

- Global mobile POS payments are expected to hit $3.78 trillion in 2024 and $5.52 trillion by 2027 at a 13.45% CAGR.

- Number of global POS mobile payment users projected to reach 1.9 billion by 2027.

Asia-Pacific

- Region contributes 50% of digital payment transactions globally.

- Transaction value to hit $2.68 trillion by 2027.

- High adoption rates in China, India, and South Korea.

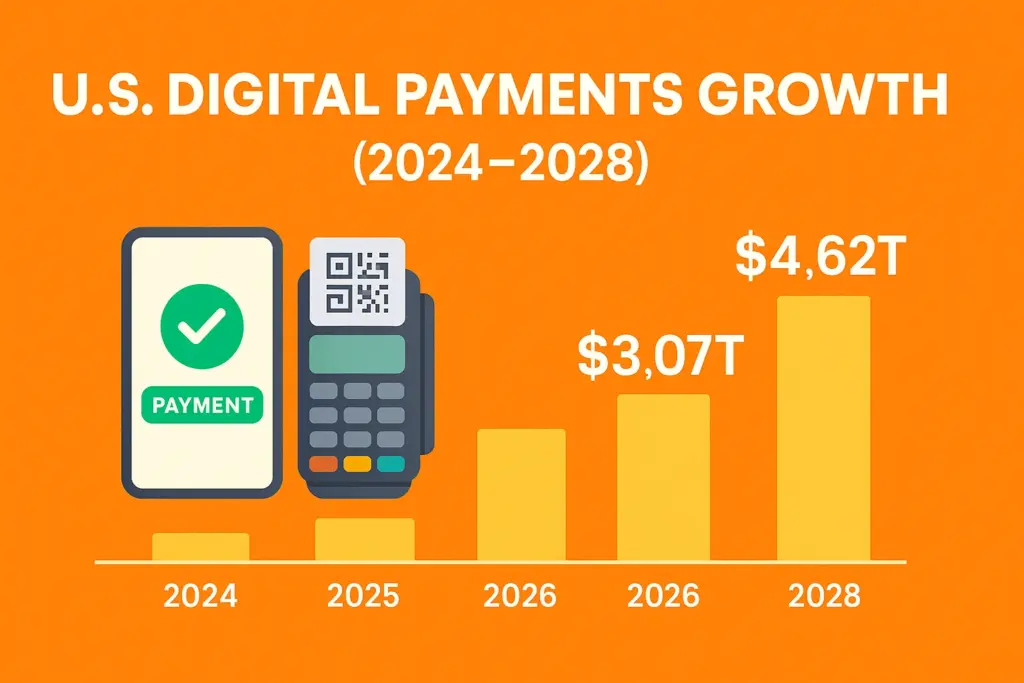

America

- U.S. digital payments transaction value projected at $3.07 trillion in 2024, growing to $4.62 trillion by 2028 at 14.66% CAGR.

Europe

- Mobile payments in Europe are expected to grow at a CAGR of 17.2% between 2023 and 2030.

- Scandinavian countries like Sweden and Denmark lead in mobile-first payment infrastructure.

QR Code & eWallet Statistics

QR Code Payments

- QR payments are projected to grow 25% from 2022 to 2026, reaching $3 trillion in value.

- 100M+ U.S. users expected by 2026.

- QR code use grew 11% in the U.S. post-pandemic.

- India’s BHIM and UPI-based QR codes dominate peer-to-peer mobile payments.

eWallet Adoption

- 51.7% of global e-commerce payments are expected through mobile wallets in 2024.

- Mobile wallets are expected to dominate Asia-Pacific POS transactions with 47.9% share by 2024.

- Millennials and Gen Z are primary drivers of eWallet adoption.

- In Latin America, mobile wallet usage grew by 34% YoY in 2023.

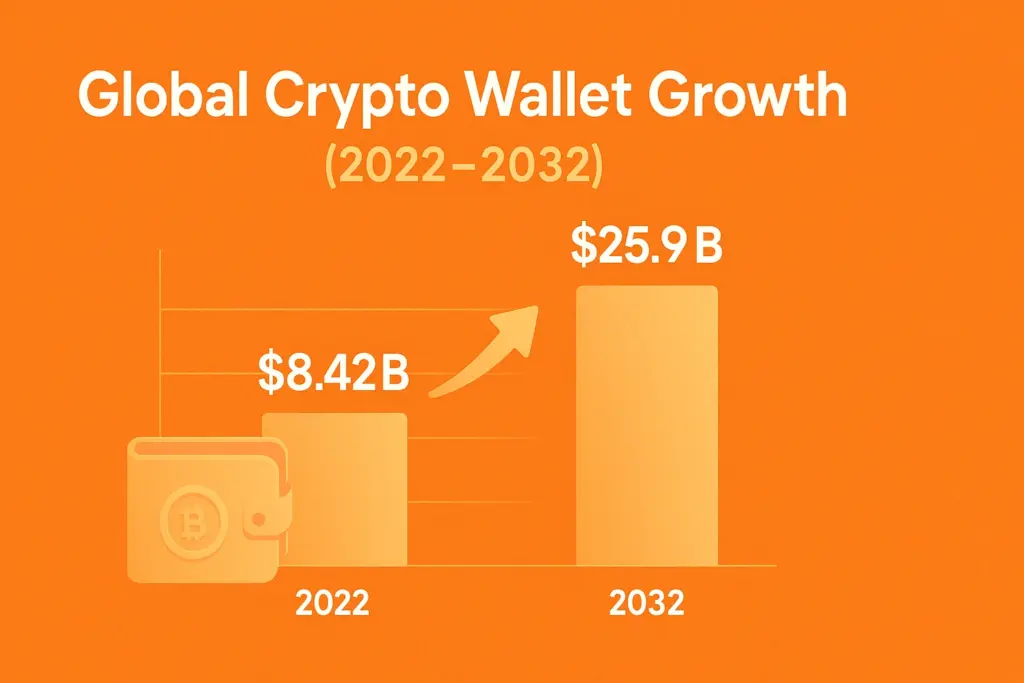

Crypto Wallet Adoption

- Global crypto wallet market to grow from $8.42B in 2022 to $25.9B by 2032, at a 29.8% CAGR.

- Users grew to 84 million in 2022, up from 76 million in 2021.

- Crypto wallets account for around 25% of Bitcoin transactions.

- Mobile-based DeFi wallets like MetaMask and Trust Wallet have gained traction, especially among tech-savvy users.

Mobile Payment User Demographics (2026)

As of 2026, mobile payment usage is most common among:

| 18–34 years | 78% |

| 35–44 years | 69% |

| 45–64 years | 48% |

| 65+ years | 31% |

- Men are more likely to use mobile payments than women globally due to 15% less mobile internet access among women, especially in developing regions. (FinDev Gateway)

- Urban consumers are 2x more likely to use mobile payments than rural counterparts, highlighting a digital divide in access.

Why Businesses Must Accept Mobile Payments

With mobile payments becoming the preferred payment method for millions:

- Businesses not offering mobile payments risk losing revenue and customer trust.

- Accepting mobile payments improves customer convenience, transaction speed, and data tracking.

- Most modern POS systems support digital wallets like Apple Pay, Samsung Pay, and Google Pay, along with QR code support.

- Mobile payments enable omnichannel commerce, making it easier to track customer preferences across platforms.

The Future of Mobile Payments

Mobile payments are set to dominate the financial ecosystem. However, addressing security vulnerabilities, especially around Wi-Fi safety and device theft, remains crucial.

Businesses should:

- Use secure POS systems

- Keep systems updated regularly

- Avoid public Wi-Fi connections

- Train staff on cyber hygiene and compliance

- Emerging technologies like NFC, biometric ID, tokenization, and blockchain are expected to enhance the security and efficiency of mobile payments further.

Key Takeaways

- Mobile payment usage is soaring globally, especially in Asia-Pacific and North America.

- By 2026, mobile wallets will drive most e-commerce and POS transactions.

- Security concerns remain, but with proper safeguards, the benefits far outweigh the risks.

- Mobile payments are not just a trend—they are the future of commerce and will continue to evolve with advancing tech and user expectations.

Conclusion

The mobile payment revolution is here, and it is changing how we live, shop, and do business. By 2026, mobile wallets are on track to dominate 79% of all digital transactions worldwide, making them an essential part of our lives. However, while development is undisputed, significant challenges remain important to remove concerns about safety and access.

For businesses, staying ahead means to adopt mobile payment solutions now. Integrating technology such as QR code or mobile point-off-cell system is not just one upgrade; There is a need to remain relevant in the competitive market. For consumers, mobile payments bring unmatched convenience, speed and flexibility.

Data speaks for itself. Mobile payment is no longer an option; They are the future of transactions. Are you ready to embrace change?

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply