- What is Net Income?

- Components of Net Income

- Net Income Formulas and Calculations

- How to Calculate Net Income | Step by Step Process with Real Life Examples

- Net Income vs Other Financial Terms

- Why Net Income Matters: The True Power Behind the Numbers

- How to Improve Net Income – Real Ways That Actually Work

- Limitations of Net Income

- Simplify Your Finances with InvoPilot

- Conclusion

In the business, Net income is left from total revenues after deducting all costs – run expenses, taxes, interest rates and depreciation. This “bottom line” shows how economically healthy and efficient a company really is. For individuals, it means your home salary after tax, PF and other deductions. It is the amount you can actually use, save or invest – which makes it a central part of personal budgeting and financial planning. Whether you run a company, invest in one or manage the household budget, understand it is very important to make smart financial decisions.

In this blog we will cover everything about net income – definition, formula, components, examples, comparisons with gross income, EBIT and cash flow. You also learn why it matters, where it comes to short, and how to improve it – whether you are a business or an individual.

What is Net Income?

Net income is the actual profit a business gets after covering all expenses. This includes costs such as operating expenses, taxes, interest payments and depreciation. This is calculated by deducting total expenses from total revenues, and shows how much money the business really earned during a specific period – whether it is a month, quarter or year. You usually find it at the bottom of the income statement, which is why it is often called the bottom line.

Formula of Net Income: Net Income = Total Revenue – Total Expenses

It can also be referred to as net profits, net earnings, final profit, profits after tax (PAT), or simply the bottom line – all of which represent the same concept.

This figure is important for evaluating a company’s financial health. It helps business owners, investors and other stakeholders to understand profitability, guide strategic decisions, calculate tax liabilities and determine whether the profits should be reinvested or distributed as dividends.

Components of Net Income

Understanding net income starts by knowing what goes into it. Think about it as the “end result” for your business performance, but many goods affect that score. Let’s break down every key piece that plays a role in reaching this final number:

1️) Revenue – The Starting Point of Profit

Revenue refers to the complete amount of money a business generates from the sale of its goods or services. It is often called the “top line” because it first appears on the income statement.

For example: If a clothing store sells 500 jackets at ₹2,000 each, its revenue would be ₹1,000,000.

This is the raw income before you withdraw costs – such as rent, salary or ingredients. It shows how much business you do but not how much you actually hold.

2️) Cost of Goods Sold (COGS) – The Direct Expense

COGS includes all direct costs associated with producing goods or services – such as raw materials, packaging and work that are directly involved in creating the product.

For example: If you make each cupcake cost ₹ 40 (ingredients + labor), COGS for 1000 cupcakes is ₹ 40,000.

Taking COGS from revenue gives you gross profits, which shows how effective you produce and sell.

3️) Operating Expenses – The Day-to-Day Spending

These are the usual business costs that keep the company going – exclude direct production costs. Common examples include:

- Salary to office workers

- Rent and tools

- Advertising and marketing

- Software subscription

- Travel expenses

These are known as overheads. They reflect how much it is needed to run your business beyond just creating your product.

4️) Interest – The Cost of Borrowing Money

If your business has loans or uses credit, you pay interest on the borrowed money. This expense reduces your revenues, but is a necessary part of financial management.

For example: If you took a business loan of ₹ 5 Lakhs and paid ₹ 50,000 as interest rates in a year, this amount will be deducted when it calculates net income.

On the other hand, if the company earns interest from investment or savings, it increases your income.

5️) Taxes – Your Contribution to the Government

All businesses are required to pay tax on revenues. This includes income tax, corporate tax or local/state taxes. These are calculated based on pre -tax revenue (earnings before tax, but after all other expenses).

Taxes reduce the final net income – but they are also a sign that your business is profitable.

Also Check: Tax Invoice Guide | Definition, Benefits & Key Differences

6️) Depreciation and Amortization – The Wear and Tear

These are non-responsible expenses responsible for aging or the use of long-term assets:

- Depreciation: Used for physical assets such as machines, vehicles or buildings.

- Amortization: Used for intangible assets such as patents, copyright or software.

Although no money goes out of your pocket at that time, these expenses are included to reflect the real value of assets over time.

Example: If a van worth ₹ 5.00,000 is written off over 5 years, you will register ₹ 1,000,000 depreciation costs each year.

7️) Other Income and Expenses – The Unexpected Items

This section includes non-operating income and costs that are not related to your most important business activities. For example:

- Gain by selling old equipment

- Loss from legal claims

- Dividend

- Currency gains or losses

These items are not part of daily operations, but still affect net income. They can fluctuate profits up or down unexpectedly.

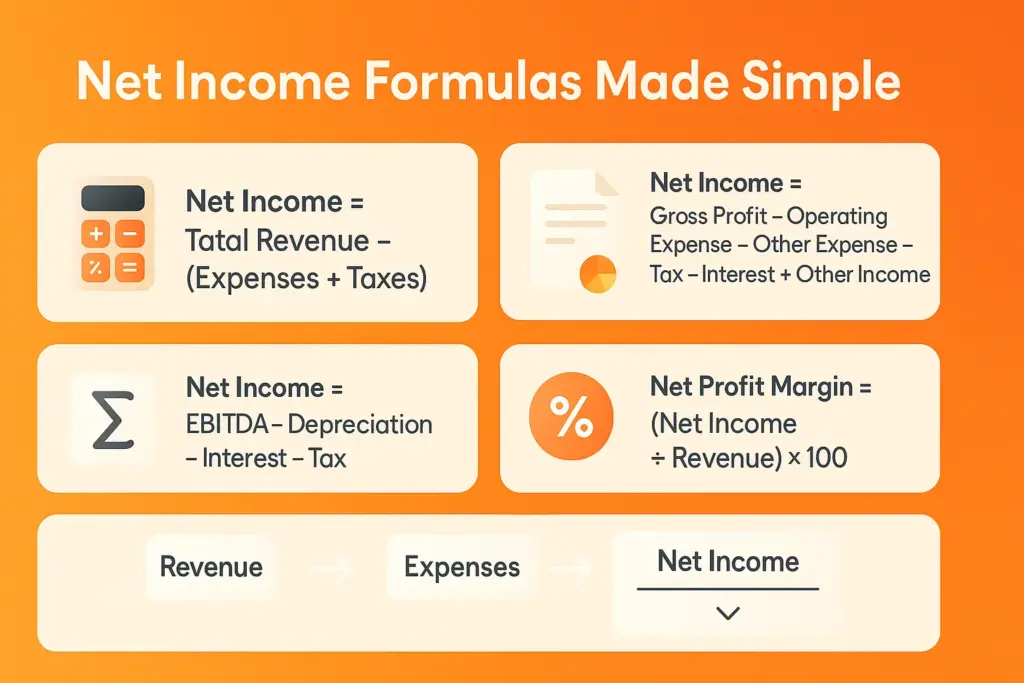

Net Income Formulas and Calculations

Understanding how net income is not just calculated for accountants – it is important for anyone who makes business decisions. Whether you are a startup founder, freelancer or investor, these formulas reveal the real profitability of a company. Let’s look them in a simple way:

1. The Basic Formula

This is the easiest way to figure out how much actual profit a business makes:

Net Income = Total Revenue – (Expense + Taxes)

You deduct all operating expenses and tax obligations from the total revenue. The result? The amount your business truly keeps.

2. The Detailed Equation

Want a deeper dive? This expanded version gives a full breakdown of how net income is derived:

Net Income = Gross Profit – Operating Expense – Other Expense – Tax – Interest + Other Income

This shows how income moves from your product sales to your pocket, factoring in every major business cost and gain.

3. Net Income via EBITDA

Many professionals use EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to understand a company’s operational performance. To get net income from EBITDA, use this:

Net Income = EBITDA – Depreciation and Amortization – Interest – Tax

This method is especially useful for comparing profitability between companies, regardless of capital structure.

4. Profit & Loss (P&L) Flow

From your sales revenue at the top to retained earnings at the bottom, net income plays a starring role in your profit & loss statement. It’s the final destination after deducting every cost, and it tells you exactly what the business earned during a period.

5. Net Profit Margin Formula

Want to know how efficiently a business turns revenue into profit? Use this:

Net Profit Margin = (Net Profit ÷ Revenue) × 100

This percentage reveals how much of every dollar earned is actual profit. Higher margin = better efficiency.

Pro Tip: Mastering these formulas helps you understand your financial health, make smarter decisions and see red flags before damaging the bottom line.

How to Calculate Net Income | Step by Step Process with Real Life Examples

Net income is calculated by subtracting all expenses from a company’s total revenue. These expenses typically include the cost of goods sold (COGS), operating costs, interest payments, and taxes. The final amount shows whether the business made a profit or a loss during that specific time period.

Let’s walk through a real-world example that brings the numbers to life! Imagine a small business, Kadam Haat, selling Handmade Home Decor Items online. Here’s a quick look at their finances for the year and how to calculate Net Income:

- Total Revenue: ₹10,00,000

- Cost of Goods Sold (COGS): ₹4,00,000

- Operating Expenses: ₹3,00,000

- Interest & Taxes: ₹50,000

Step 1: Calculate Gross Profit

Gross Profit = Total Revenue – COGS

₹10,00,000 – ₹4,00,000 = ₹6,00,000

Step 2: Subtract Operating Expenses

Operating Profit = Gross Profit – Operating Expense

₹6,00,000 – ₹3,00,000 = ₹3,00,000

Step 3: Subtract Interest and Tax

Net Income = Operating Profit – Interest and Tax

₹3,00,000 – ₹50,000 = ₹2,50,000Final Net Income: ₹2,50,000

This is the company’s true profit—what it actually keeps after all costs are paid.

Profit & Loss Statement Snapshot (P&L)

| Income Statement for Kadam Haat | Amount (₹) |

| Revenue | 10,00,000 |

| Cost of Goods Sold | 4,00,000 |

| Gross Profit | 6,00,000 |

| Operating Expenses | 3,00,000 |

| Operating Profit | 3,00,000 |

| Interest & Taxes | 50,000 |

| Net Income | 2,50,000 |

This simple P&L (Profit and Loss Statement) visually highlights how each cost eats into revenue until you reach the net income.

Can You Find Net Income in the Balance Sheet?

Technically, no— it does not appear directly in a balance. But it affects it.

How to do it:

- Net income flows into the retained earnings section under shareholder’s equity.

- So even if you do not want to see the “net income” marked in the balance sheet, it increases equity every year the business is profitable.

Net Income vs Other Financial Terms

Here is a complete comparison table for Net Income vs Other Financial Terms, written in a simple and easy-to-understand format:

| Comparison | What It Means | What the Other Term Means | How They’re Different |

| Net Income vs Gross Income | Net income shows how much money a company actually keeps after covering every cost, including taxes and overhead. | Gross income is the amount left after subtracting only the cost of producing goods or services (COGS) from revenue. | Gross income gives a rough profit before running expenses, while net income tells you what’s really earned at the end of the day. |

| Net Income vs Operating Income | This amount covers all company expenses, whether operational or not, including taxes and interest payments. | Operating income focuses solely on the profit earned from core business activities, excluding any impact from taxes and interest expenses. | Operating income reflects how effectively a company manages its core business operations. |

| Net Income vs EBIT | It’s the remaining profit after subtracting interest expenses and taxes. | EBIT stands for Earnings Before Interest and Taxes—it excludes both interest expenses and income taxes from the calculation. | EBIT highlights how the business performs before financing and taxes. Net income shows what’s left for shareholders after all is said and done. |

| Net Income vs EBITDA | This means all expenses, including interest, taxes, depreciation, and amortization, have already been subtracted. | EBITDA skips depreciation and amortization, giving a cleaner view of earnings from operations. | EBITDA gives a cash-style look at profits. Net income, on the other hand, reveals the actual amount of profit remaining after all expenses have been paid. |

| Net Income vs Cash Flow | Net income can include non-cash items like accrued revenue or depreciation. | Cash flow represents the real amount of money entering or leaving a business over a certain time period. | Net income is more of an accounting figure; cash flow reveals how much money the business actually has on hand. |

| Net Income vs Net Operating Income (NOI) | Net income adds up everything—operating results, interest, taxes, and other expenses. | NOI is used in real estate and excludes financing costs, income taxes, and depreciation. | NOI focuses purely on a property’s profitability. Net income covers the full financial performance of the entire business. |

Why Net Income Matters: The True Power Behind the Numbers

Net income is more than just a figure on a financial report — it’s a key measure of a company’s performance, financial health, and long-term potential. Whether you are a business owner, investor or person who manages your finances, understand it can help you make smarter decisions. That’s how it is:

1️) Profitability Assessment – Is the Business Actually Making Money?

Net income helps to determine if a company is really profitable after paying all expenses, taxes, interest and operating costs. Although revenues show how much money a business brings in, it does not reflect the actual profits. Net income does. It tells you how effectively a company converts revenues to profits and gives a clear picture of their financial results.

Example: A company with ₹10 crore in revenue but ₹9.5 crore in expenses will only have ₹50 lakh in net income. That slim margin shows tight profitability.

2️) Financial Health – The Company’s Financial Fitness Test

Net income acts as an economic health score. A consistently positive and growth signals that the business is financially stable and controls its resources carefully. On the back, a negative net income can point to poor cost control, declining sales or operational inefficiency.

A healthy net income helps build reserves, pay down debt and survive tough financial conditions.

3️) Investment Decisions – The Go-To Metric for Investors

Investors carefully monitor net income to evaluate whether a company is worth investing in. It reflects how much profits are available to reinvest in the business or distribute to shareholders. High and growing net income often leads to higher stock prices and increased investor confidence.

Companies with strong net income attract more financing and market attention.

4️) Strategic Planning – Guiding Long-Term Business Goals

When making big decisions such as expanding to a new location, launching a new product or hiring employees, companies must look at it. A solid net income provides the financial pillow to take on calculated risks and invest in growth without jeopardizing the business.

Strategic plans supported by positive net income are more sustainable and less risky.

5️) Individual Financial Planning – Know Your Real Earnings

For freelancers, gig workers or small business owners, the net income shows the real money you take home after deducting all expenses. It is important for budgeting, tax planning, loan applications and personal financial goals.

Knowing your net income helps you live within your funds and plan for the future.

6️) Valuation – Understanding What a Business is Truly Worth

Net income is an important driver in the company’s valuation models such as P/E (price-to-earnings). It has a direct impact on how investors and the market perceive a company’s value. The higher and more consistent net income, the more valuable a business will probably be.

Investors rely on net income to assess a company’s potential future cash flow and overall market value.

7️) Shareholder Value – Driving Dividends and Sustaining Market Expansion

The shareholders care deeply about it because it determines payments and future growth. Companies with a strong net income can reward shareholders through higher dividends or reinvest the profits to increase the share value.

A higher net income usually results in a larger return for shareholders.

8️) Sustainability – Supporting Long-Term Growth

It provides the resources needed to innovate, improve infrastructure, invest in employees and use sustainable practice. A company with steady earnings is more likely to survive downturns for the market and adapt to changing conditions.

A healthy bottom line keeps the business future ready and competitive.

How to Improve Net Income – Real Ways That Actually Work

- Cut operating costs without damaging performance

- Adjust prices strategically to reflect both value and inflation

- Double down on top -performing sales channels

- Think big, not per-order profits-go to general growth

- Enter new markets to increase the customer base

- Track and manage costs better with real -time tools

- Keep the inventory lean and well optimized

- Increase your total revenues by expanding offers or selling

- Encourage larger purchases with bundles or volume agreements

- Focus on developing your product or team to drive long-term growth

- Use strategic discounts to run volume, do not kill margins

- Build a brand people trust – it pays off in loyalty

- Negotiate smarter when buying stock or supplies

- Keep a pulse on your customers through continuous market research

- Continuously monitor and control the expenses

- Seen clear realistic budgets and stick to them

- Remove unnecessary costs that lose excess

- Reduce waste in each part of the process

- Craft Winning Sales Strategies based on data

- Strengthen vendor relationship to unlock better terms

- Invest in innovation that solves real customer pain points

- Keep an eye on your profit margins not just revenue

- Test and improve your pricing model regularly

- Make sure you are covered – long -term insurance savings

Limitations of Net Income

Net income is very important profitability but has several limitations. It does not always reflect a company’s cash flow exactly due to non-accounting expenses such as depreciation. Furthermore, it can be manipulated through accounting choices and does not constitute even even, which makes it difficult to assess real operating efficiency or long -term economic health.

1. Ignores Cash Flow

Net income does not reflect the actual cash movement. A company may show high profits, but still faces liquidity problems due to poor cash flow. This can mislead stakeholders on financial health if they are solely dependent on it without reviewing the cash flow statement next to it.

2. Affected by Accounting Methods

Different accounting methods (cash vs. periodization, FIFO vs. LIFO) can have a significant impact on it. As a result, two companies with identical activities can report different net income simply due to accounting choices, making it more difficult to compare their true financial results accurately.

3. Subject to Non-Operating Items

Net income also accounts for one-time or non-operating items, such as gains from asset sales or expenses from lawsuits. These irregular gains or losses can distort profitability, which makes the number work better or worse than the company’s actual core business performance for that period.

4. Vulnerable to Manipulation

Through creative accounting or aggressive income recognition, net income can be manipulated. Managers can change the time of expense or blow the revenues to meet income goals, misleading investors and distort the company’s real financial condition.

5. Lacks Insight into Operational Efficiency

Net income does not isolate how effective a business operates day to day. A company can be profitable due to investments or financing activities, but still struggling with high operating costs or low productivity, it is not clearly emphasized.

6. Excludes Market Conditions

Net income does not constitute external financial factors such as inflation, the market’s demand or interest rate changes. Although the figure shows internal profitability, it may not reflect the company’s resistance or adaptability to changing market environments.

7. Can Be Impacted by Tax Strategy

A company’s tax planning – for example, vulnerable credits or incentives – may artificially increase or lower net income. This means that the final figure may not completely reflect the actual operating force of the business, but rather its ability to manage tax obligations.

8. Doesn’t Reflect Asset Health

Net income does not reveal whether a company has been handed over or has aggravated assets. A business can show strong profits while the equipment, inventory or property lose value or become obsolete, and constitute long -term risk that is not trapped in the income number.

Simplify Your Finances with InvoPilot

Looking for an easier way to track your income, manage invoices, and improve profitability?

InvoPilot is the all-in-one invoice and accounting solution built for freelancers, startups, and small businesses.

✔ Create tax-compliant invoices in seconds

✔ Track income, expenses, and profits without any problems

✔ Stay organized and aligned with best practice for accounting principles

Want a quick start? Generate invoices instantly with our Free Invoice Generator — no sign-up required.

Start managing your business finances effortlessly with InvoPilot.

Conclusion

Net income is more than just a number – that is the final goal of a business success and sustainability. From start -up to companies, understanding gives you clarity on profits, control over expenses and trust in your next move. It strengthens smarter decisions, stronger growth strategies and better financial results. Whether you manage a company, invest in one or plan your personal finances, the net income is the bottom line that really matters.

By mastering how it is calculated, what affects it, and how to improve it, you do not just crush numbers – you build a healthier financial future.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Invoice Generator