- What Is RTI Cover in Car Insurance?

- How Does RTI Cover in Car Insurance Work?

- Benefits of Return to Invoice

- What is Covered/Not Covered in Return to Invoice (RTI)?

- How is RTI Calculated?

- How Much Does Return To Invoice Cost?

- Example of RTI In Car Insurance

- How to opt for RTI Cover?

- Who Can opt for RTI Coverage in Car Insurance?

- How is RTI Different From IDV?

- Which of The Add-on Covers Is Better? (ZERO Depreciation or RTI)

- Conclusion

Owning a car often brings a mix of excitement and unexpected moments—but let’s be honest, not all surprises are the good kind. Picture this: your vehicle gets stolen or ends up completely totaled in an accident. You reach out to your insurer, expecting a fair payout, only to find that the compensation falls well short of what you originally paid for the car. It stings, doesn’t it?

That’s exactly where a Return to Invoice (RTI) Cover becomes a lifesaver. This lesser-known yet highly valuable add-on in car insurance is designed to bridge that frustrating gap. Instead of settling for the depreciated market value of your car, RTI Cover ensures you receive the full invoice amount—yes, the price you initially paid for your car, including registration and road tax in many cases.

Sounds like a win, right? But how does it really work, and why is it considered a smart move by so many car owners?

We’re diving into all of that and more. Stick with us as we break down everything you need to know about Return to Invoice Cover—what it covers, how it benefits you, and why it might just be the smartest insurance decision you make for your vehicle.

What Is RTI Cover in Car Insurance?

Return to Invoice (RTI) cover is like a safety net you didn’t know you needed. It’s a handy little add-on in car insurance that makes sure you get back the full invoice value of your car—not just its worn-out, depreciated price—if it’s ever stolen or completely wrecked. You see, regular insurance usually pays you the current value of your car, which is often a lot less than what you originally shelled out. That can sting.

But here’s where RTI cover steps in and saves the day. It fills in that money gap, giving you back the full price you paid—yes, including those pesky taxes and the on-road costs. This kind of backup is a game-changer, especially if you just got a new set of wheels. Cars lose value fast in the first few years, and RTI keeps you from feeling the burn.

It’s also a smart move if you live somewhere where car thefts are common or natural disasters happen a lot. Basically, it’s like a financial umbrella when the storm hits—protecting your wallet from major hits and helping you get back on the road without a huge dent in your savings.

Sure, it costs a bit extra, but the peace of mind? Totally worth it. Just a heads-up though—most insurers only offer this cover for cars that are up to three to five years old. So, before you say yes, give the fine print a once-over. It could make all the difference when things go sideways.

How Does RTI Cover in Car Insurance Work?

RTI (Return to Invoice) coverage in car insurance is an extra option that makes sure you get the full invoice value of your car if it’s lost or stolen. Here’s how it works:

- Full Invoice Value Compensation: When thieves steal your car or it suffers damage beyond repair (total loss), the insurance company will give you the original invoice value of the car, including registration and road tax costs. This differs from standard car insurance, which pays the current market value (IDV – Insured Declared Value) of the car, which loses value over time.

- Covers Depreciation: RTI cover fills the gap between the car’s reduced value and its original purchase price making sure you don’t lose money.

- Eligibility: You can get RTI cover for new cars and it remains valid for vehicles up to 3-5 years old, depending on the insurance company.

- Additional Premium: RTI is an extra feature so you need to pay more to add it to your car insurance policy.

- When It’s Useful: RTI cover helps most with new or expensive cars, because they lose a lot of value in the first few years, which can bring down the car’s market price.

Benefits of Return to Invoice

| Feature | Benefit |

| Financial Protection | Covers the gap between invoice value and insured declared value (IDV). |

| Depreciation Coverage | Protects against financial loss due to vehicle depreciation. |

| Peace of Mind | Eliminates stress over financial uncertainty after total loss or theft. |

| Full Reimbursement | Ensures you receive the original purchase price of your vehicle. |

| Enhanced Security | Shields you from unexpected out-of-pocket expenses. |

What is Covered/Not Covered in Return to Invoice (RTI)?

Usually included with auto insurance policies, Return to Invoice (RTI) is optional insurance coverage. It guarantees that, rather than only the Insured Declared Value (IDV), which decreases over time, the policyholder would get the entire invoice value of the vehicle, including registration fees and road tax, in the event of a total loss (such as theft or irreparable damage).

Here’s a breakdown of what is covered and not covered under RTI:

What is Covered:

- Vehicle Invoice Value: The entire purchase price of the car as shown on the original invoice.

- Registration Fees: The price paid to the Regional Transport Office (RTO) for the vehicle’s registration.

- Road Tax: The one-time fee paid at the time of acquisition.

- Theft or Total Loss: RTI only applies where there has been theft or total loss (the car is beyond repair).

- Depreciation: It ensures that you receive the entire invoice value by eliminating the depreciation factor.

What is Not Covered:

- Minor Damage: RTI only applies in cases of complete loss or theft; it does not cover repairs or minor losses.

- Add-ons or Accessories: Any additional accessories not included in the original invoice may not be covered unless specified.

- Vehicles Over the Age Limit: Depending on the insurer, RTI is typically offered for vehicles up to three to five years old.

- Non-Comprehensive Policies: RTI is an add-on and cannot be availed with third-party liability-only insurance policies.

- Policy Lapses: RTI coverage will not be applicable if the base insurance policy has expired or is not renewed.

- Base insurance Exclusions: RTI is subject to all exclusions included in the base comprehensive insurance, such as driving while intoxicated or engaging in unlawful activity.

How is RTI Calculated?

RTI, or Return to Investment, is a metric commonly used to assess an investment’s efficiency or profitability. RTI is calculated using the following formula: RTI = (Net Profit / Investment Cost) × 100.

Here’s a breakdown of the components:

- Net Profit: This is the total revenue generated from the investment minus all associated costs (e.g., operational costs, taxes, etc.).

- Investment Cost: The total amount of money invested in the project, asset, or venture.

- × 100: This converts the result into a percentage, making it easier to interpret.

Example: If you invested $10,000 in a project and earned a net profit of $2,000, the RTI would be: RTI = (2,000 / 10,000) × 100 = 20%. This means you earned a 20% return on your investment.

How Much Does Return To Invoice Cost?

A number of variables can affect the price of “Return to Invoice” (RTI) insurance, including:

- Type of Vehicle: The price, make, and model of your car have a big influence on how much RTI insurance costs.

- Insurance Provider: The costs associated with RTI add-ons differ throughout insurers.

- Base Premium: The cost of RTI is determined as a percentage of your base premium because it is an add-on to your comprehensive auto insurance policy.

- Vehicle Age: New or nearly new cars (generally up to 3-5 years old) are normally eligible for RTI. Older cars might not be eligible.

- Location: Because of different risk variables, your geographic location may also affect the pricing.

- Policy Tenure: The total cost may vary depending on how long the policy is in effect.

RTI insurance typically costs between 10% and 20% of the standard price for your full-coverage auto insurance policy. For instance, the RTI add-on could cost an extra $50 to $100 if your base premium is $500.

Example of RTI In Car Insurance

RTI (Return to Invoice) in car insurance is an add-on cover that ensures you get the full invoice value of your car in case of total loss or theft. Here’s an example to illustrate how it works:

Scenario:

- Car Details: You purchased a car for $20,000.

- Standard Insurance Coverage: Without RTI, the insurance company would pay the car’s Insured Declared Value (IDV), which accounts for depreciation. For example, after 2 years, the IDV might drop to $15,000.

- Incident: Your car is stolen or completely damaged beyond repair.

Without RTI: The insurance company would pay you the IDV of $15,000, leaving you to bear the $5,000 difference between the IDV and the original invoice value.

With RTI: If you have the RTI add-on, the insurance company will pay you the full invoice value of $20,000, including the car’s registration cost and road tax. This ensures you don’t face any financial loss in replacing your car.

RTI is particularly beneficial for new or expensive cars, as it protects you from the impact of depreciation during the initial years.

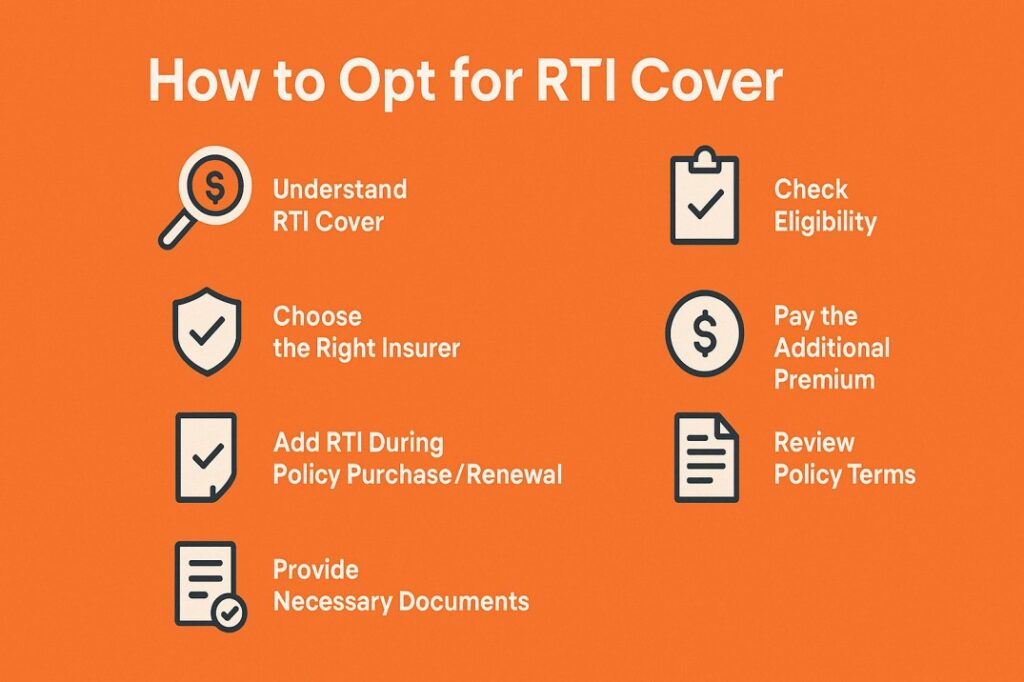

How to opt for RTI Cover?

To opt for a “Return to Invoice” (RTI) cover in car insurance, follow these steps:

- Understand RTI Cover: RTI is an add-on cover that ensures you get the full invoice value of your car (including registration and taxes) in case of total loss or theft. It bridges the gap between the Insured Declared Value (IDV) and the car’s invoice price.

- Check Eligibility: RTI is usually available for new cars or cars that are not older than 3-5 years. Confirm your car’s eligibility with your insurer.

- Choose the Right Insurer: Not all insurance companies offer RTI cover. Research and compare insurers to find one that provides this add-on.

- Add RTI During Policy Purchase/Renewal: You can opt for RTI when buying a new car insurance policy or during renewal. Look for the add-on section and select “Return to Invoice.”

- Pay the Additional Premium: RTI is an add-on, so you’ll need to pay an extra premium. The cost varies depending on your car’s make, model, and age.

- Provide Necessary Documents: Insurers may ask for your car’s invoice, registration certificate, and other documents to process the RTI add-on.

- Review Policy Terms: Carefully read the terms and conditions of the RTI cover, including exclusions (e.g., depreciation, wear and tear, etc.).

- Confirm Coverage: Once added, ensure that the RTI cover is mentioned in your policy document.

Who Can opt for RTI Coverage in Car Insurance?

- New Car Owners: RTI is typically available for cars that are relatively new, usually up to 3-5 years old, depending on the insurer.

- Owners of High-Value Cars: If you own a high-value or luxury car, RTI coverage can be beneficial to recover the full invoice value.

- People in High-Theft Areas: If you live in an area with a high risk of car theft, RTI coverage provides added financial security.

- Loan Borrowers: If you’ve financed your car through a loan, RTI ensures you can repay the loan without financial strain in case of a total loss.

- Cautious Buyers: Anyone who wants complete financial protection for their car investment can opt for RTI coverage.

How is RTI Different From IDV?

| Aspect | RTI (Return to Invoice) | IDV (Insured Declared Value) |

| Definition | It is an add-on cover that reimburses the car’s invoice value in case of total loss or theft. | The maximum amount the insurer will pay if the vehicle is declared a total loss or stolen. |

| Purpose | To ensure the car owner gets the full invoice value, including registration and taxes, back. | Represents the current market value of the vehicle, accounting for depreciation. |

| Coverage | Covers the gap between the insured value and the original invoice value. | Covers the depreciated value of the vehicle only. |

| Calculation | Based on the car’s invoice value, including taxes and registration fees. | Calculated by deducting depreciation from the ex-showroom price of the car. |

| Applicability | Available only during the initial years of car ownership, typically 2-3 years. | Applies throughout the policy term as long as the vehicle is insured. |

| Benefits | Offers complete financial reimbursement to buy a new car of the same value. | Provides a reasonable monetary amount based on the vehicle’s age and condition. |

| Premium Cost | Higher due to extensive coverage. | Lower because it factors in depreciation. |

| When Useful | Ideal for new or expensive cars prone to significant financial loss after theft or total damage. | Suitable for determining the current value of an older vehicle. |

Which of The Add-on Covers Is Better? (ZERO Depreciation or RTI)

To help you compare Zero Depreciation and Return to Invoice (RTI) add-on covers for insurance, check out this comparison:

| Feature | Zero Depreciation Cover | Return to Invoice (RTI) Cover |

| Definition | Covers the full cost of replacing damaged car parts without factoring in depreciation. | Covers the gap between the insured declared value (IDV) and the invoice value of the car. |

| Purpose | Reduces out-of-pocket expenses for part replacements during claims. | Ensures you get the full invoice value of the car in case of total loss or theft. |

| Applicability | Useful for minor to major repairs due to accidents. | Useful in cases of total loss (e.g., theft or irreparable damage). |

| Claim Settlement | Covers the cost of new parts without depreciation deduction. | Pays the full invoice value, including registration and road tax, in case of total loss. |

| Eligibility | Typically available for cars up to 5 years old. | Usually available for cars up to 3 years old. |

| Premium Cost | Slightly higher than a standard policy but lower than RTI. | Higher premium compared to Zero Depreciation. |

| Best For | People looking to minimize repair costs for accidental damages. | People concerned about recovering the full value of their car in case of theft or total loss. |

| Limitations | Does not cover total loss or theft. | Does not cover regular repairs or partial damages. |

Which is better?

- Choose Zero Depreciation: If you want to save on repair costs for accidental damages.

- Choose RTI: If you are worried about recovering the full value of your car in case of theft or total loss.

Conclusion

Return to Invoice (RTI) Cover in car insurance is more than just an add-on; it’s a financial safeguard that ensures you’re not left bearing significant losses in the unfortunate vehicle theft or total damage. By bridging the gap between your car’s depreciation market value and its original invoice price, this cover provides financial protection, particularly for new or high-value vehicles. It eliminates the burden of unexpected expenses, offering peace of mind and allowing you to recover the full value of your investment. Whether you own a luxury car, live in a high-risk area, or simply want to safeguard your finances, RTI Cover proves to be a smart and practical choice. Ultimately, it’s an essential consideration for car owners looking to secure comprehensive coverage and financial peace of mind.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply