When you do business, each piece of financial documentation plays an important role, but some taxes are just as important as invoices. Whether you are an entrepreneur, owner of a small company or accountant, it is important to understand the tax invoice to ensure compliance, openness and steady financial operation.

This guide you need to know about tax invoices, from their definition and significance to regular invoices you know about their essential components and differences.

What is a Tax Invoice?

A tax invoice is a legal document issued by a seller to a buyer, who outlines the details of the transaction with used taxes. It acts as proof of delivery of goods or services and taxes charged in that transaction. Companies that work with taxable goods or services require tax challengers and help fulfill both compliance and record obligations.

Unlike a simple Invoice, which can only list items and payments, a tax invoice specifically refers to the tax details required by local or national authorities (e.g. sales fees, value -improved taxes or value added tax, service fee). This ensures accurate reporting of taxes and where used helps to claim tax credit.

Purpose and Key Elements of a Tax Invoice

Purpose of a Tax Invoice

The primary function of the tax invoice is to document the transaction for compliance. This ensures that taxes are charged and collected correctly, and thus there is no ambiguity for buyers, sellers or authorities. In addition to taxation, tax invoices also meet other goals, such as:

- Registration: This helps companies maintain accurate financial items.

- Evidence of Sales: It acts as a legal proof of goods or services exchanged in transactions.

- Requirements for incoming tax credit: Buyers often use tax invoices, which require taxes paid on purchases based on rules.

Key Elements of a Tax Invoice

In order to ensure that the tax invoices are valid and the audit can be investigated, some details must be included. These main elements are important to standardize the document and maintain its reliability. Here are the essential components of a tax invoice:

- Seller description: Name, address and tax identity number (eg Gstin or VAT registration).

- Buyer details: If applicable, name, address and relevant tax identification number.

- Invoice number: A unique, sequential number for easy tracking.

- Invoice date: The date when invoices are issued.

- Details of goods/services: List of the objects or services provided clearly.

- Quantity and price: Specify the amount and unit price sold.

- Tax Amounts: Break tax rates and zodiac signs.

- Gross and Net Total: Final taxable value and total value including tax.

The implementation of one to Invoice ensures compliance with laws and avoids delay during auditing or reconciliation.

Why Tax Invoices are Important for Businesses

Tax invoices are a spine of accountable financial practices. For organizations, they’re now not just documents but tools that streamline operations and safeguard financial fitness.

1. Ensures Legal Compliance: Tax government regularly mandates the use of right tax invoices for every taxable transaction. Non-compliance may additionally result in heavy consequences.

2. Facilitates Claiming Input Tax Credit: For organizations registered for GST or VAT, tax invoices are essential for claiming enter tax credits. This reduces the tax burden via deducting taxes already paid on bought goods or offerings.

Example: An advertising enterprise purchases laptops for worker use and pays GST on the purchase. By providing the provider’s tax invoice, the employer can claim an enter tax credit score whilst filing GST returns.

3. Builds Trust with Clients: Transparent billing practices, confirmed via special and accurate tax invoices, enhance acceptance as true between organizations and their clients or partners.

4. Streamlines Financial Management: Well-prepared tax invoices make a contribution to higher bookkeeping and monetary analysis. They provide perception into coins glide, tendencies in revenue, and tax responsibilities, that can manual smarter enterprise decisions.

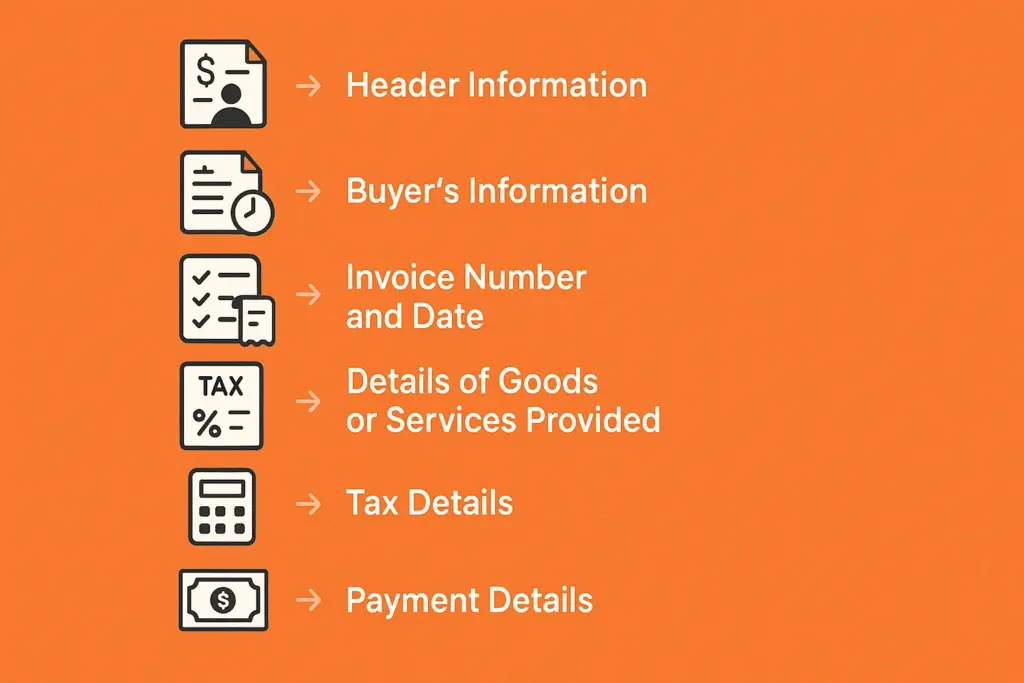

How to Create a Tax Invoice?

Creating a tax invoice doesn’t have to be overwhelming. Here’s a step-by-step guide to crafting one with all the necessary details.

1. Header Information

- Add your company’s name, logo (optional), and contact details.

- Include your tax registration number.

2. Buyer’s Information

- Input the buyer’s name and address.

- If the buyer is also tax registered, include their tax number.

3. Invoice Number and Date

- Assign a unique number to the invoice. Make sure your numbering is sequential to comply with regulations.

- Mention the invoice issue date.

4. Details of the Goods or Services Provided

- Item descriptions, quantities, unit prices, and any discounts offered should be clearly listed.

5. Tax Details

- Specify the applicable tax rates (e.g., 10%) and amounts for each item. Include the total tax amount applied to the invoice.

6. Total Calculation

- Sum up the subtotal (taxable amount) and add the total tax to get the gross amount payable.

7. Payment Details

- List the payment terms, modes of payment, and due date.

Example of Tax Invoice Template

| Header | Example |

| Supplier Name | ABC Solutions Pvt. Ltd. |

| Supplier Tax Number | 12345-GSTIN-67890 |

| Buyer Name and Address | XYZ Retail, 456 Elm St, City A |

| Buyer Tax Number | 98765-VAT-ID |

| Invoice Date | 01-Nov-2023 |

| Invoice Number | INV-20231101 |

| Item Description | Office Desks (10 units) |

| Unit Price | $100 |

| Tax Rate | 10% |

| Total Tax Amount | $100 |

| Gross Amount (Payable) | $1,100 |

Digital tools or invoicing software like QuickBooks or Zoho Invoice can simplify this process, ensuring accuracy while saving time.

Difference Between a Tax Invoice and a Receipt

While both tax invoices and receipts serve as important documents in financial transactions, they serve distinct purposes.

| Aspect | Tax Invoice | Receipt |

| Purpose | Issued before or during payment, showing taxes applied. | Proof of payment made for a transaction. |

| Timing | Sent at the time of purchase or before payment. | Issued after payment is received. |

| Details | Has extensive details like tax breakdown, seller/buyer IDs. | Simple acknowledgment of money received. |

| Use Case | To claim input tax credits, track due payments, or comply with tax laws. | Recordkeeping or confirming payment for goods/services. |

For example, when a customer buys office furniture from a retailer, the retailer issues a tax invoice detailing price and tax. After the customer pays, they get a receipt confirming the payment.

Why You Should Get Your Tax Invoice Right

Neglecting accuracy or missing details on a tax invoice can result in serious consequences for a business, including legal penalties, tax rejections, or disputes with clients. It’s not just about following local laws; a well-maintained tax invoice system streamlines your organization’s finances and keeps your business on solid ground.

You can utilize invoicing software to create tax-compliant invoices effortlessly. Many tools automatically calculate taxes and generate invoices that meet regulatory requirements, saving time and reducing the chances of errors.

Final Thoughts

A tax invoice is far more than just a piece of administrative paperwork. It’s a legal, financial, and operational tool that provides clarity, ensures compliance, and strengthens business relationships. By understanding its importance and ensuring every tax invoice you issue is complete and accurate, you’re not just following the rules; you’re setting your business up for long-term success.

Take the time to audit your current invoicing practices and ensure they align with tax regulations. A little attention to detail now can save much larger headaches down the road.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply