It is necessary for anyone to understand the proforma invoices, which are needed to navigate the world of business transactions, especially in the context of international trade. These documents play an important role in ensuring clarity and transparency by providing a detailed outline of the proposed sales before any official commitment. Think of an invoice in the form of a roadmap for your transaction, helping both buyers and vendors align on major details such as cost, quantity and conditions. By acting as a bridge between initial negotiations and final agreements, the proforma helps to streamline the invoice processes, reduce misunderstandings and build trust. Whether you are acquiring import permits, draft customs documentation, or simply looking to install clear expectations, In this blog you will get to know how Proforma Invoice is a valuable tool to promote smooth and professional business operations.

What is a Proforma Invoice?

A proforma invoice is an initial bill or an approximate invoice that a seller provides a buyer before the actual sales. This outlines the details, quantity, prices and details of goods or services including any applied terms and conditions. However, unlike a regular invoice, a proforma invoice does not demand payment or legally binding documents. Instead, it acts as an agreement in a formal quotation or principle, which involves a clear understanding of the buyer’s cost and conditions.

They are often used in international trade to help buyers secure permits, arrange financing, or prepare required customs documentation. They act as a reference point for both sides, ensure transparency and reduce the possibility of misconception before the final transaction is completed.

When Should You Issue a Proforma Invoice?

A proforma invoice is not a specific invoice, but an initial bill sent to the buyer before supply of goods or services. This underlines the goods, quantities, prices and conditions of the agreement. This type of document is used in specific conditions where clarification, transparency, or pre-disciplines are necessary. Below are some landscapes where using a proforma invoice is particularly helpful, as well as practical examples for each case:

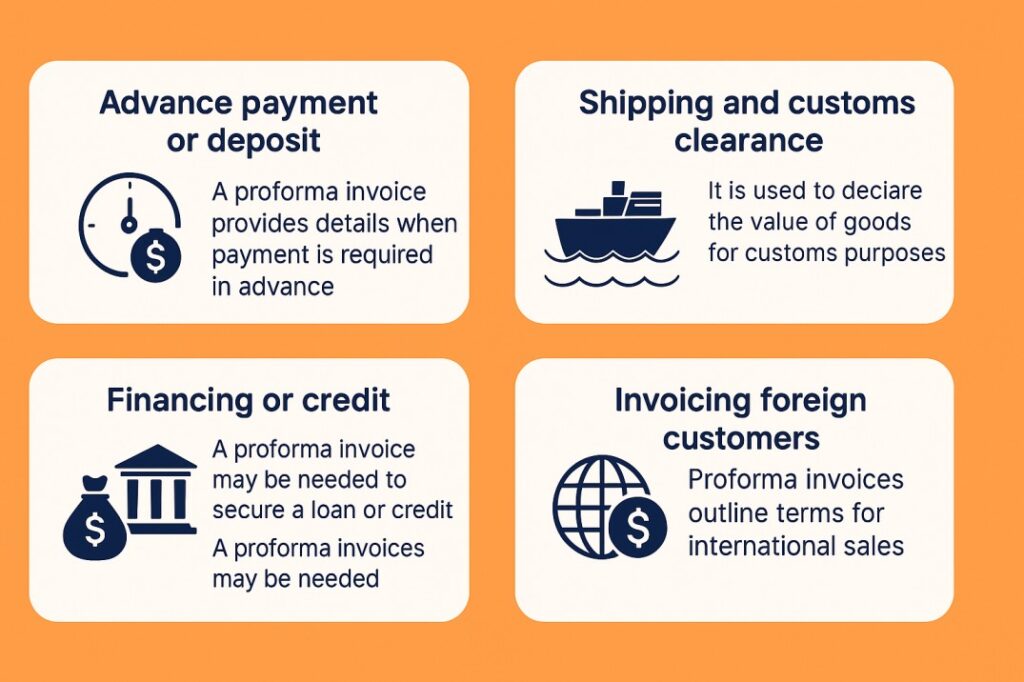

1. Advance payment or deposit

When a seller requires partial or full payment before offering goods or services, a proforma invoice provides clear details to the buyer as to what they are paying. It acts as a formal confirmation of the order and its terms.

Example: A manufacturer producing customized machinery can issue a proforma invoice to a customer who requests 50% of the payment. This helps both sides to make an agreement of machine specifications, costs and deadlines before any money changes.

2. Shipping and customs withdrawal

Proforma invoices are important for international transactions, especially for shipping goods across borders. Customs officers often use these documents to determine duties, taxes or eligibility for imports.

Example: A company shipping handmade products abroad includes a proforma invoice that gives item details, values and details of the original country. Customs officers use this information to calculate duties or verify compliance based on electronic billing systems.

3. Financialization or credit

When buyers require financing or business credit to complete the transaction, lenders and financial institutions often require proforma invoice to assess the financial statements of purchase.

Example: A retailer demanding a bank financing to buy a seasonal inventory from a supplier presents a proforma invoice to the bank, which helps the lender to evaluate the required loan amount and confirm the validity of the deal.

4. Invoices foreign customers:

The practice of international customers often involves additional layers of complications such as various currencies and tax rules. Proforma invoices help both sides understand the conditions before making sales formal.

Example: A software company providing digital services to a foreign customer uses a proforma invoice to underline license fees, currency exchange rates and tax ideas. This ensures that customers agree with the conditions before the official invoice is issued.

Why Do Businesses Rely on Proforma Invoices?

Business Proforma invoice is used as an initial or estimated bill provided to a buyer before finalizing the actual sales. Think of it as the “preview” of the transaction. These invoices are usually used in international trade or large transactions where clarity and transparency are important.

Why are they so useful here:

- Clarity for buyers: Profarma makes outline of goods or services details, including invoice prices, quantities and conditions. This helps buyers to understand what they are getting and at what cost before committing.

- Approval facility: In many organizations, buyers require internal approval before shopping. A proforma invoice provides the documents required to obtain that green light.

- Customs and shipping: In global transactions, documents like proforma invoices and purchase orders are critical for smooth customs clearance. They help to estimate duties, taxes and shipping costs, which ensure smooth logistics.

- Misconception is avoided: By providing a clear, advanced document, businesses can prevent disputes or confusion about the terms of sales.

- Compassionate: It shows the buyer that the seller is organized and transparent, which creates trust and reliability.

In short, Proforma invoice is a tool for communication, planning and ensuring smooth transactions, especially in complex or high-value deals.

Benefits of Using A Proforma Invoice

A proforma invoice is a widely used document in business transactions, providing clarity and structure to the purchase and sales process. But does it really make it so beneficial? Let’s find out its major benefits:

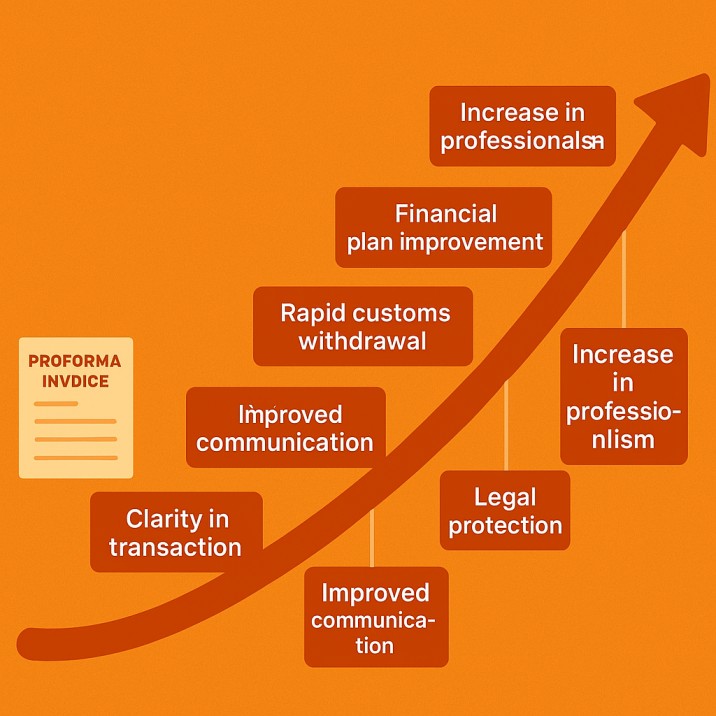

1. Clarity in transaction

One of the biggest benefits of a proforma invoice is that it brings into transactions. This document provides detailed information about the proposed sales products, quantity, prices, taxes and conditions. Both the buyer and the seller have a clear understanding of what is being offered and at what cost. It reduces misunderstanding and risk of disputes.

2. Improved communication

They serve as an excellent tool for communication between parties. Whether you are working with a domestic customer or working internationally, this document underlines all the major details of the proposed deal. It sets hopes quickly, ensuring that both sides are on the same page. For example, if a buyer requires amendment or specific changes, the proforma provides those adjustments before finalizing the invoice transaction.

3. Legal protection

While a proforma invoice isn’t legally binding documents like a sales invoice, it still provides an additional layer of security. The sale proposal in writing formally serves as a proof of the intention and agreement between parties. This can be extremely useful if disagreement arises during the interaction process. This shows which conditions were initially outlined and agreed to.

4. Financial plan improvement

From the point of view of a buyer, a proforma invoice helps conduct finance. Since it contains all the costs involved, such as shipping, tax and additional fees, it gives buyers a chance to calculate the total expenses before making a purchase decision. The sellers also benefit from knowing what to pay and when, allowing them to plan their cash flow.

5. Rapid customs withdrawal for international trade

For businesses involved in international trade, a proforma invoice becomes even more important. Customs authorities often require such documentation to assess product values, taxes and duties. Premature invoices providing a proforma invoice can speed up the customs withdrawal process, to avoid delay in shipment.

6. Increase in professionalism

Using a proforma invoice shows your customers that you give importance to professionalism and organization. This indicates that your business takes the transaction seriously and pays attention to the expansion. This can strengthen confidence with your customers and promote long -term business relationships.

What Details Are Included in a Proforma Invoice?

A proforma invoice is an initial document provided to a buyer before a real sale by a seller. This outlines the details of a proposed transaction, making the buyer clearly understand what to expect. Although it is not legally binding documents like the final invoice, it acts as a formal quotation or estimate. What usually it contains:

- The Seller and Buyer Information: The names, addresses and contact details of both the seller and the buyer are included.

- Invoice Number and Date: A unique identifier for the proforma invoice and the date released.

- Description of Goods & Services: A detailed list of products or services including specialties, volume and any relevant details.

- Pricing Details: Unit value, total value and any applied tax or fee of each item. This may also include discounts, if any.

- Conditions of Payment: Information about payment methods, fixed dates and any condition related to payment.

- Conditions of Delivery: Details about shipping, such as delivery method, estimated delivery date, and which tolerate shipping costs.

- Validity Period: The time frame during which the proforma invoice is valid, allows the buyer to make decisions within that period.

- Additional Notes or Conditions: No other relevant information, such as warranty details, withdrawal policies, or special conditions.

It is a useful tool for both sides to ensure clarity and compromise before proceeding with transactions. This helps to avoid misunderstandings and determines the platform for a smooth business process.

Difference Between an Invoice and a Proforma Invoice

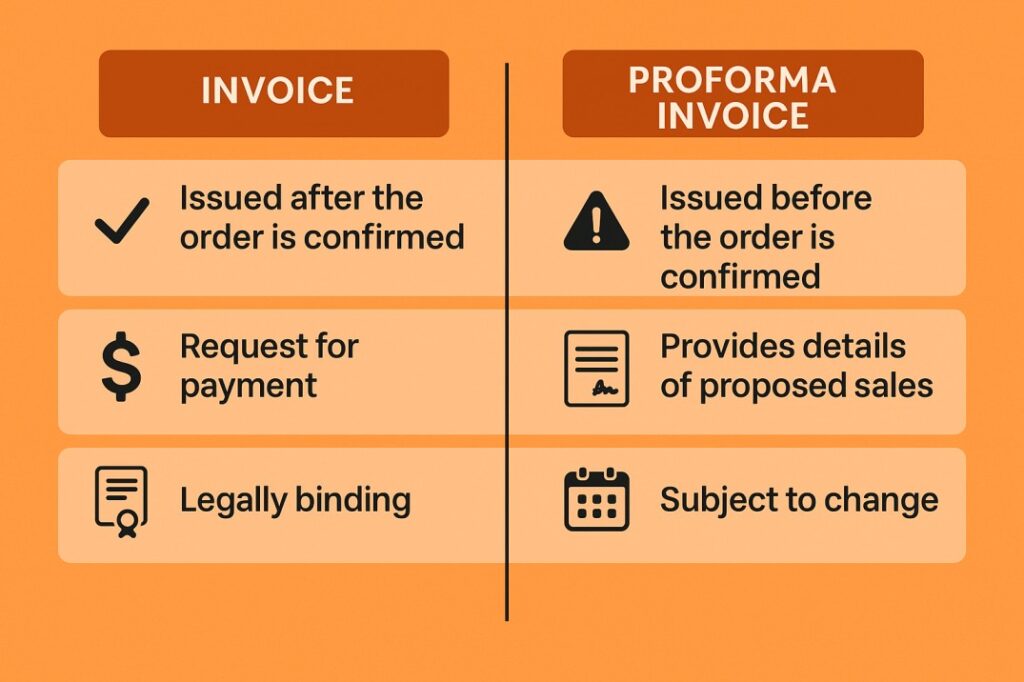

Both are important documents, a proforma invoice and an invoice business transaction, but they serve various objectives and are used in different stages of the sale process. Here is a clear explanation of how they vary:

Objective:

- A proforma invoice is an initial document released before finalizing a sale. It acts as a quote or an estimate, outlines the details of goods or services, their prices and the terms of the transaction. This is not a demand for payment, but a way to inform the buyer what to expect.

- On the other hand, there is a formal request for the payment issued after an invoice, goods or services are distributed. It is a legally binding document that confirms the sale and specifies the outstanding amount by the buyer.

Legal Status:

- A proforma invoice is not legally binding. It does not serve as a proof of a complete transaction and cannot be used for accounting or tax purposes.

- An invoice is legally binding and is used for accounting, tax reporting and payment collection. It acts as an official record of sales.

Time:

- A proforma invoice is issued before the transaction is finalized, often during the interaction or quotation phase.

- Once an invoice is issued after the completion of the transaction, once the goods or services are distributed.

Payment expectation:

- A proforma does not demand invoice payment. This is a proposal to the buyer.

- An invoice clearly requests payment and includes payment conditions, such as fixed dates and methods of payment.

Material:

- Both documents look similar in terms of layouts and information, but a proforma invoice usually involves a disclaimer that states that it is not a demand for tax invoice or payment.

- An invoice includes specific details such as invoices, tax information and payment instructions, making it an official document for financial transactions.

Proforma Invoice vs. Commercial Invoice

- Proforma Invoice: Preliminary documents issued by a seller to a buyer before an actual sale. It outlines the details of goods or services, including value, volume and conditions, but it is not a demand for payment. It is often used for customs purposes or to provide cost estimates.

- Commercial Invoice: A legally binding document issued after finalizing the sales. It acts as a request for payment and includes all details of transactions, such as final value, payment terms and shipping details. It is used for customs withdrawal and accounting purposes.

Main Difference: A proforma invoice is a quotation or estimate, while a commercial invoice is the final bill.

Proforma Invoice vs. Sales Invoice

- Proforma Invoice: A non-negotiable document sent before sale is confirmed. It is used to provide the buyer with details of the transaction, such as pricing and observation of conditions, but does not indicate that goods or services are distributed.

- Sales Invoice: A binding document issued after goods or services have been distributed. It acts as a formal request for payment and is used for accounting and tax purposes.

Main Difference: A proforma invoice is issued before the sale is finalized, while the sale invoice is released after the sale is released.

Proforma Invoice vs. Tax Invoice

- Proforma Invoice: An initial document in which there is no tax implication. It is not recorded in the seller or buyer’s accounts and is not used for filing using it.

- Tax Invoice: A legally binding document that contains details of sales with applied taxes (e.g., VAT, GST). It is used for reporting and compliance using it.

Main Difference: A proforma invoice is not used for tax purposes, while tax Invoices are an official document required for compliance.

Proforma Invoice vs. Purchase Order

- Proforma Invoice: To provide a document issued by the seller with the details of the proposed transaction to the buyer, the pricing, conditions and distribution details are included. This is not confirmation of order.

- Purchase Order: A document issued by the buyer to formally give an order to the seller. It specifies essential commodities or services, volume and agreed conditions.

Main Difference: A proforma invoice is issued by the seller as a quotation, while the purchase order is issued by the buyer to confirm the order.

Proforma Invoice Examples

- Export/Import Transactions: When a seller is shipping goods internationally, they can issue a proforma invoice to the buyer to confirm the details of the order including shipping costs, customs, and taxes.

- Service-based business: Before starting a web design agency project, a proforma invoice can be sent to the customer who outlines the cost of designing a website, including the terms of work and payment.

- Bulk Order: A manufacturer can issue proforma invoice to a retailer for wholesale order of products, specifying the total cost, distribution timeline and payment terms.

Final Thoughts

Profarma Invoices play an important role in business transactions by providing a clear and detailed framework of proposed agreements before the actual sale. These initial documents promote transparency, ensure mutual understanding, and both buyers and vendors help avoid potential misconceptions or disputes. Whether they are assisting organizations in obtaining internal approval, facilitating international trade through customs documentation, or clarifying the terms of payment, Profarma Invoices display their value in many scenarios.

Although not legally binding, they act as a bridge between the phase of interaction and the final transaction, providing clarity on pricing, conditions and expectations. For vendors, they create confidence and professionalism, while buyers get an opportunity to make informed financial decisions. In particularly complex or high-value transactions, the Proforma streamlines Invoice operations and serves as an essential scheme tool.

Finally, involving the professor Invoice into its commercial processes ensures smooth transactions, more efficiency and strong professional relationships, making them an invaluable resource in today’s commercial scenario.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply