Knowing the basic financial terms is important to run a business smoothly. An important word to understand is “open invoice”. It is commonly used in accounts received and affects how business payments track. Whether you are the owner, accountant, or freelancer of a business, understanding the open invoice can help you manage your finance better and keep your cash flow on track.

What is an Open Invoice?

An open invoice (also known as unpaid invoice) is only one bill that a customer has received, but has not yet been paid. This means that the business is still waiting for payment, and the amount is recorded as money to the company until the money is received.

Saying this simply, an open invoice is requested by a seller to pay for products or services given to a buyer. This includes details such as the amount, payment time limit, and the terms of payment – acting as a formal agreement between the two sides. The invoice remains “open” (unpaid) until the customer cleanses the payment within the given time, following the basic invoice writing standards.

Open invoices are common in business, especially when companies allow customers to buy on credit. However, if too much invoice remains unpaid for a very long time, it can cause cash flow problems. This is why businesses track these invoices closely and are made on time to ensure payment.

Types of Open Invoices?

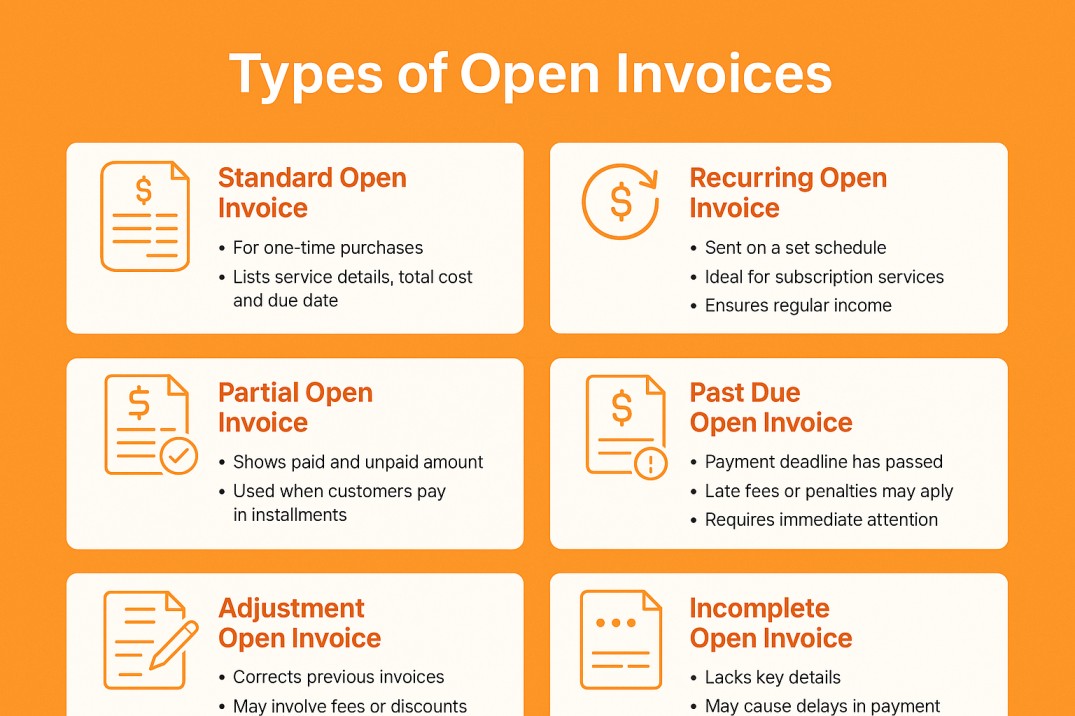

Managing the invoice properly is important to keep your business finance on track and ensure smooth customer transactions. Here are some types of open invoices.

1. Standard Open Invoice

This is the most common type of invoice. This is issued when a business sells a product or service and is waiting for payment from the customer. These invoices include important details such as the invoice date, fixed date, list of products/services, total amount payable and payment options. The major features are:

- Used for a one -time purchase.

- The service lists details such as the details, the total cost and the due date.

- It is usually issued for standard trade transactions.

2. Recurring Open Invoice

Recurring Open Invoice is used for ongoing payments, such as membership. It automatically generates regular intervals – in fact, monthly, or annually – similar to how proforma Invoices forecast transactions, making it easy to maintain stable cash flow for businesses. The major features are:

- Sent on a certain schedule (e.g., monthly, annually).

- Ideal for membership services such as software schemes or gym membership.

- Helps businesses to ensure regular income.

3. Partial Open Invoice

A partial open invoice occurs when a customer has partially paid but still outstanding some amount. This type is useful for businesses that offer payment schemes or allow customers to pay in installments. The major features are:

- Shows how much has been paid and still so much payable.

- In cases where customers pay in installments.

- Businesses help track unpaid balances.

4. Past Due Open Invoice

A past-pay invoice means that the customer has recalled the payment deadline. Businesses often send reminders or charge late to encourage customers to empty their dues. See how this differs from issuing a receipt. The major features are:

- The payment deadline has passed.

- Late fees or punishment may apply.

- Payment collection requires immediate attention.

5. Adjustment Open Invoice

Adjustment Open Invoice is used to fix errors in the previous invoices. This can be issued to add missing fees, apply discounts or correct incorrect quantities. The major features are:

- Fix errors or updates the previous invoices.

- Additional fees, discounts or improvements may be involved.

- This ensures that financial records are accurate.

6. Incomplete Open Invoice

An incomplete Open invoice is the major details missing, such as payment terms or customer information, which can delay processing. Businesses have to update these invoices quickly to avoid payment delays. The major features are:

- Missing important details such as payment terms or item details.

- Payment can cause delays.

- Smooth processing requires quick updates.

By understanding this type of open invoices, businesses can better manage payment, improve cash flow and maintain strong customers.

Importance of Open Invoice

Think of open invoices as a link between businesses and their customers. They are not just paperwork-they help to organize financial transactions and keep them free from trouble. Why are they so important here:

- Cash keeps the flow healthy: Keeping an eye on the open invoices helps the businesses to be at the top of the pending payments, ensuring sufficient funds to cover salary, supplier costs and other expenses.

- Financial clarity brings: To know how much money is payable and when it is expected, it becomes very easy to make a budget and plan.

- Encourages timely payment: Invoices remind customers to pay on time, prevent cash flow issues due to late payment.

- Promotes Trust: A well managed invoice system reflects reliability, strengthens business relations and increases reliability.

- Provides legal protection: Invoices serve as an official evidence of the challan transaction, which may be important in case of disputes or unpaid bills.

By staying at the top of the open challan, businesses can maintain financial stability, avoid unnecessary risks, and ensure smooth operation.

How Does an Open Invoice Work?

Ever found a bill that is still unpaid? This is an open invoice – a payment request from a seller that has not yet been approved. Whether you are running a business or managing just personal payment, understanding the open invoice is important to keep your finances in check. Let’s break it step by step:

1. Buying a product or service

- You give an order for a product or service.

- The seller confirms this and prepares you to send it.

- This step sets the platform for the open invoice process.

2. Invoice is made

- Once the product/service is distributed, the seller releases an invoice.

- This includes details such as total amount, payment fixed date and order details.

- Think of it as an official bill that tells you how much to pay and when.

3. You get invoice

- Invoice comes through email or an invoice system.

- It acts as a reminder that you give money.

- Knowing the exact amount and the due date helps you plan your payment.

4. Payment comes the fixed date

- Sellers often determine words like “NET 30”, which means you have 30 days to pay.

- Some provide initial payment discounts, while others charge late fees.

- This timeline helps both you and the seller manage the cash flow.

5. You process the payment

- As near the Near date, you send payment through bank transfer, credit card or any other method.

- Re -check the invoices details to ensure accuracy.

- A smooth payment process strengthens confidence between you and the seller.

6. Invoice is closed

- Once the seller confirms the payment, the invoice is marked as payment.

- Both you and the seller have a record for the future reference.

- With this, the transaction is officially completed!

Components of an Open Invoice

An open invoice contains various details that help the buyer and the seller. These components ensure smooth transactions, prevent confusion, and make payment processes easier. Let’s break them in a simple way:

1. Invoice Number – Your Unique ID: Each invoice comes with a unique number. Think of it as an identity tag that helps track payments, avoids mix-up, and keeps the records organized. It is particularly useful when handling many invoices.

2. The Invoice date – when it all begins: this is the date when the invoice is issued. This helps both sides to know when the billing cycle begins and determines the time limit for the payment time limit.

3. Fixed date – Pay time limit: The fixed date tells the buyer when the payment needs to be made. A clear time limit prevents delays, keeps the cash flow stable, and ensures smooth financial planning.

4. Details of Goods and Services – What are you paying: What was this section details provided – whether it is a product or a service. A clear breakdown avoids misunderstanding and assures the buyer that they are paid for the right objects.

5. Quantity and Price: Here, you will see how much each item was purchased and their prices. This makes it easy for both sides to verify cost and ensures transparency in billing.

6. Total amount payable – Final Bill: This is a grand total, including any tax (which may vary for a tax invoice) or additional fee. This should be clearly visible so that the buyer knows how much it really has to pay.

7. Payment instructions – How to Pay: This section provides payment details, such as bank account number or online payment option. Clear instructions help avoid delays and make the payment process free from trouble.

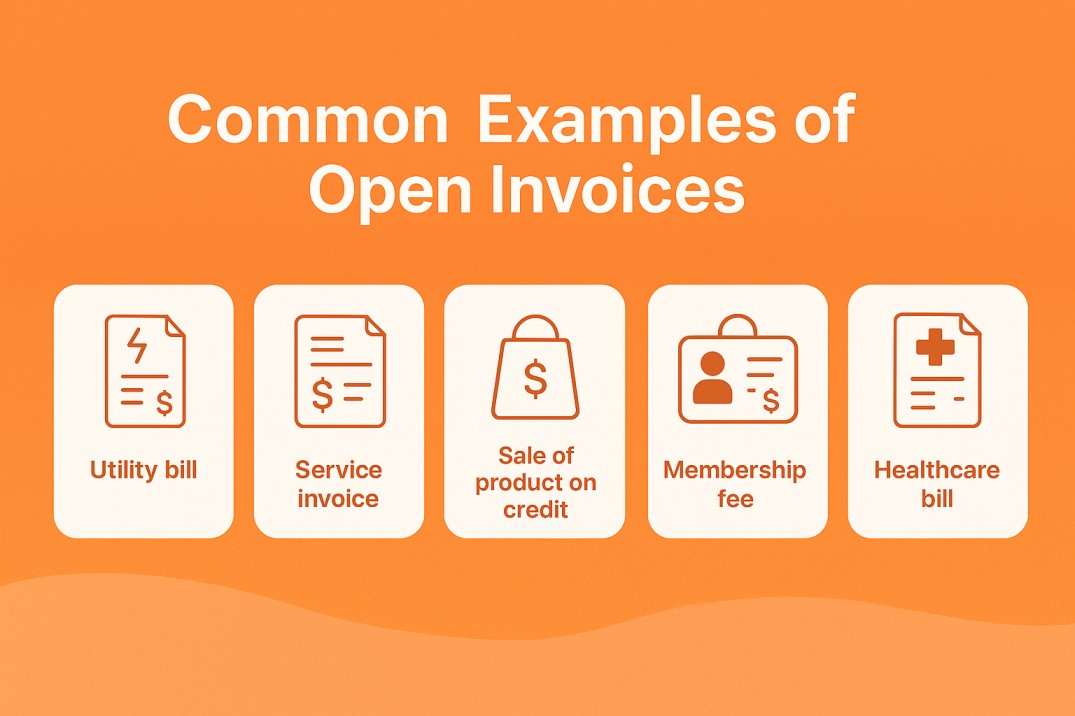

Examples of Open Invoice

- Utility Bill – Payment pending for electricity, internet or water services.

- Service Invoice – Unpaid bill for services such as graphic design, consultation or repair work.

- Sale of Product on Credit – When wholesale traders sell goods to retailers, but have not yet received payment.

- Membership Fee – Excellent fee for services such as cloud storage or streaming platforms.

- Healthcare Bill – Insurance coverage or medical expenditure waiting for personal payment.

- Due to event management fees – event planning or post-event services, payments are still paid.

Challenges in Processing Open Invoices

Processing open invoices can be a complex task, especially when done manually. It often leads to a range of issues such as high costs, slow approvals, data errors, compliance risks, and limited visibility. These challenges can delay payments, disrupt cash flow, and damage supplier relationships.

High Processing Costs: Handling invoices manually takes time and manpower, which increases operational expenses significantly.

Slow Approvals and Delays: Manual workflows usually require multiple steps and approvals, causing bottlenecks and delaying both invoice processing and payments.

Human Errors and Duplicate Invoices: Entering data by hand is error-prone. Mistakes like duplicate entries can result in double payments and accounting issues.

Compliance and Tax Risks: Manual processes make it harder to stay compliant with tax laws and audit requirements, increasing the risk of penalties.

Limited Visibility and Tracking: It can be difficult to track where an invoice is in the approval process, making it hard to identify and fix delays or inefficiencies.

Additional Invoice Processing Challenges

Late Payments: Delayed invoice payments can negatively affect cash flow, damage supplier relationships, and even result in late fees or penalties.

Higher Risk of Fraud: Manual systems are more vulnerable to fraud, including false invoices or unauthorized approvals slipping through unnoticed.

Scalability Issues: As your business grows and invoice volumes increase, manual processes become more time-consuming and harder to manage efficiently.

Integration Difficulties: Connecting a new invoice system to your existing accounting or ERP platforms can be complicated and may require custom solutions.

Data Accuracy Problems: Missing or incorrect information on invoices can lead to payment delays, disputes with vendors, or processing errors.

Vendor Management Complications: Keeping vendor details—like contact information and payment terms—accurate and up to date is more difficult with manual systems.

Difference Between an Open Invoice and an Overdue Invoice

The management of effective payment is important for businesses and customers. You have two common words: “open invoice” and “overdue invoice” in billing – but what do they really mean? Let’s break it into simple words.

| Aspect | Open Invoice | Overdue Invoice |

| Definition | A bill that has been issued but not yet paid. | A bill that has not been paid even after the due date has passed. |

| Payment Status | Waiting for payment within the given timeframe. | Payment is late and past the deadline. |

| Due Date | Still within the allowed payment period. | Due date has passed, but payment hasn’t been received. |

| Impact on Business | Expected cash flow, no issues. | Can cause cash flow problems if not collected on time. |

| Action Required | No immediate action; just wait for the payment. | Follow-ups, reminders, or late fees may be applied. |

| Example | Invoice sent on Oct 1, due on Oct 15, and remains open until paid. | If the invoice isn’t paid by Oct 16, it becomes overdue. |

How to Close an Open Invoice?

To close an open invoice, the payment must first be received and recorded. Once the payment is successfully processed, the invoice is marked as “paid” and officially closed. A closed invoice means that the customer has fulfilled their financial obligation.

- Check the Payment Details: Payment date, amount and method are matched to invoice. Double-checked for any overbearing or underpayment.

- Update the Invoice Position: If using accounting software, mark the invoice as “payment”. If you manually manage records, log in to your laser with notes.

- Send Payment Confirmation: Inform the customer with a receipt or confirmation email.

- Strict with Bank Records: Compare your record to bank statements. Fix any discrepancies immediately.

- File and Review: Store closed invoice for future reference. Regularly review previous invoices to keep your financial records accurate.

Final Thoughts

Open invoices may look like just another piece of paperwork, but their role in the financial health of a business cannot be eliminated. They act as a bridge between companies and their customers, which ensure smooth transactions, clear financial planning and stable cash flow. By understanding the types of recurring or partially open invoice from the standard, and studying the latest invoice statistics, businesses can better predict payment trends and avoid unnecessary delays.

However, challenges such as overdue payments, manual processing errors and credit risk highlight the importance of efficient management. Addressing these obstacles with carefully designed strategies and correct tools not only keeps the cash flow stable, but also strengthens trust and professionalism in business relationships.

Finally, living on top of the open invoice is not only about payment tracking. This is about promoting accountability, maintaining accurate financial records and creating a reliable basis for long -term success. With hard work, clear processes and periodic reviews, businesses can turn open invoice into a property that increases growth and stability.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply