- What is Invoice Financing?

- How Does Invoice Financing Work?

- Why Choose Invoice Financing Over a Traditional Loan?

- Types of Invoice Financing

- Advantages and Disadvantages of Invoice Financing

- Real-World Invoice Financing Examples and Case Studies

- Difference between Invoice Financing and Invoice Factoring

- Is Invoice Financing Right for Your Business?

- Conclusion

Running a business comes with several financial challenges, including maintaining a stable cash flow. Often, customers may have to tie the required amount to manage daily operations in waiting for the invoice to be paid. This is the place where the invoice is in the financing game. If you are looking for ways to improve your cash flow and reach working capital, invoice financing can be the solution you are looking for.

What is Invoice Financing?

Invoice financing is a smart financial move that changes your unpaid invoices into readily available working capital. Instead of waiting for weeks, or even months, for the clients to pay; businesses can instantly get up to 90% of their invoice’s worth with the help of a financing partner. This ready availability of funds allows you to maintain normal business operations, deal with immediate expenses and helps you steer clear of the cash flow drought which often stifles even the most successful enterprises. Also known as accounts receivable financing, it provides you with a debt-free alternative to conventional loans by using your own earnings that aren’t due as yet. As soon as your customer pays the invoice, you receive the remaining balance – deducting off a small service fee – in order to keep your cash cycle going strong as well as your company growing.

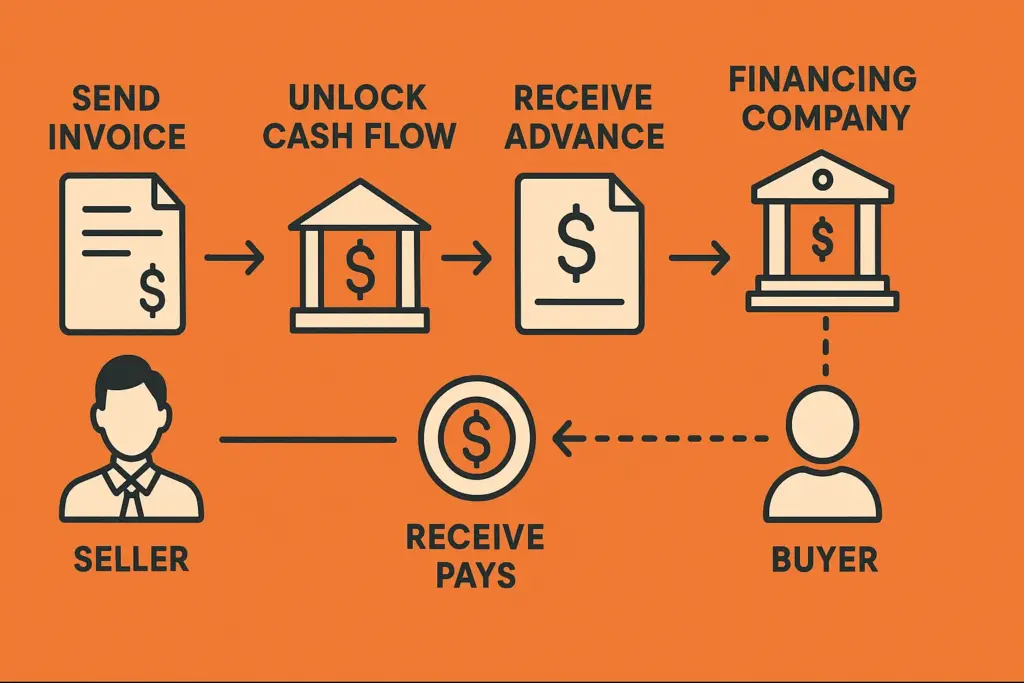

How Does Invoice Financing Work?

Tired of waiting 30, 60, or even 90 days to get paid? Invoice financing can free up your cash flow without the wait. Here’s how the process unfolds, step by step:

- Send the Invoice: After fulfilling your order or service, you issue an invoice to your customer.

- Unlock Cash Flow: Instead of waiting for payment, you forward the invoice to a financing company.

- Receive an Advance: The financer reviews your invoice and sends you up to 90% of its value—often within 24 to 48 hours.

- Your Customer Pays Up: The client pays the invoice as usual, but directly to the financing provider.

- Get the Rest: Once payment is confirmed, the financer sends you the remaining funds minus a small service fee.

The Key Players

- The Seller (You) – The business offering products or services.

- The Buyer (Your Client) – The party responsible for paying the invoice.

- The Financier – The funding company that advances cash against your invoices.

Why Choose Invoice Financing Over a Traditional Loan?

Unlike traditional loans, invoice financing options don’t rely on perfect credit scores or heavy collateral. It leverages your outstanding invoices—meaning your own sales generate the funding. No long-term debt. No waiting. Just smarter, faster cash flow.

Types of Invoice Financing

Invoice financing is a smart cash flow solution that helps businesses unlock working capital from unpaid invoices. Instead of waiting weeks or months for customers to pay, you can access funds quickly to keep your operations running smoothly. Here’s a breakdown of the different options available, each tailored to suit specific business needs:

1. Invoice Factoring – Let the Experts Collect

With invoice factoring, you sell your outstanding invoices to a third-party (known as a factor) at a discount. The factoring company takes full responsibility for chasing payments from your clients.

Why it works: It’s a hands-off solution that saves time, especially for businesses looking to streamline receivables management.

Heads-up: Since your customers deal directly with the factor, it might affect the personal touch in your client relationships.

2. Invoice Discounting – Behind-the-Scenes Boost

This discreet option allows you to borrow against your unpaid invoices while retaining full control of your customer interactions. You remain in charge of collecting the payments.

Why it works: Perfect for businesses that value privacy and want to keep their financing arrangements confidential.

3. Spot Factoring – One Invoice at a Time

Spot factoring is great for flexibility. Discover different types of invoice financing methods for business growth. It allows you to sell a single invoice for immediate funds without locking into a contract.

Why it works: Flexible and commitment-free. A go-to for occasional funding needs or one-off projects.

4. Recourse vs. Non-Recourse – Know the Risk

- Recourse Financing: You’re still on the hook if your customer doesn’t pay—lower cost but higher risk.

- Non-Recourse Financing: The lender absorbs the loss if your client defaults. It’s safer for you, but typically comes at a higher fee.

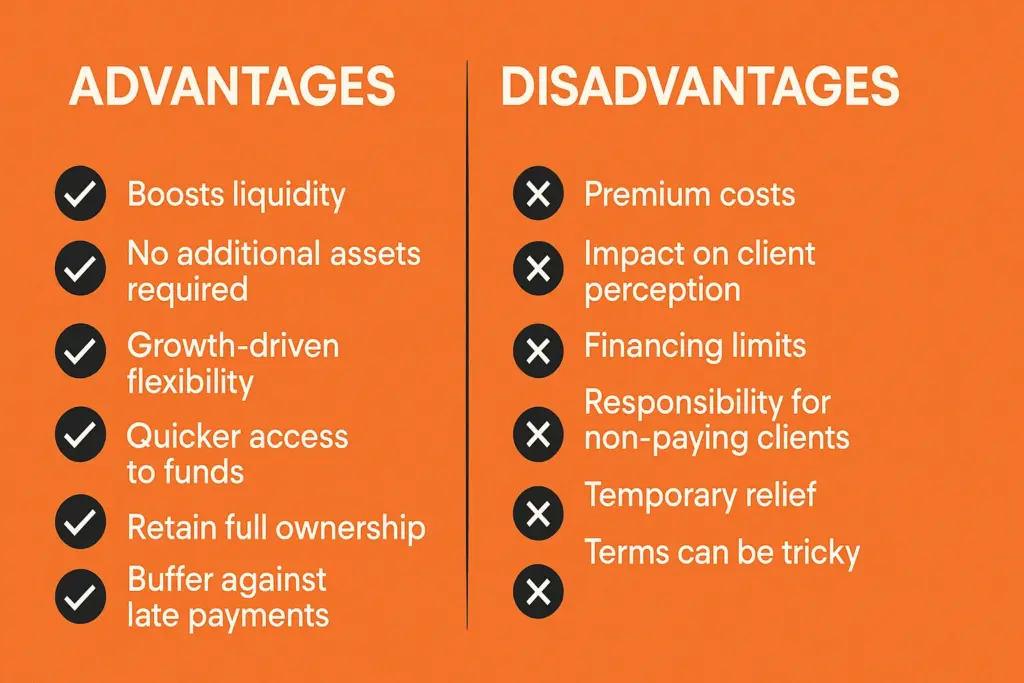

Advantages and Disadvantages of Invoice Financing

Invoice financing, also known as accounts receivable funding, gives businesses a way to turn their unpaid bills into quick cash by selling them to a finance company. This approach can help firms that need money right away but are waiting on customers to pay up.

Advantages of Invoice Financing

- Boosts Liquidity: Boosts Liquidity: Unlock working capital trapped in unpaid invoices with invoice factoring benefits, restock inventory, or handle urgent expenses without delay.

- No Additional Assets Required: Since the invoices themselves serve as the guarantee, businesses typically don’t need to pledge other assets to secure financing.

- Growth-Driven Flexibility: The more you sell, the more you can finance. It’s a solution that scales alongside your revenue, making it ideal for expanding businesses.

- Quicker Access to Funds: Unlike conventional loans that may involve lengthy approval procedures, invoice financing can be processed rapidly and sometimes within 24 to 48 hours.

- Retain Full Ownership: There is no dilution of equity involved which means your company stays fully under your control.

- Buffer Against Late Payments: It softens the impact of clients who take their time to pay and keeps your cash flow steady.

Disadvantages of Invoice Financing

- Premium Costs: The convenience comes at a price where fees and rates are often higher compared to standard financing options.

- Impact on Client Perception: Depending on the type of arrangement, your customers might become aware of the involvement of a third party, which could affect how they view your financial position.

- Financing Limits: Your borrowing power is tied directly to the value of your invoices, which may not always meet your full funding requirements.

- Responsibility for Non-Paying Clients: In some financing models, if a client fails to pay, you could be held accountable for reimbursing the lender.

- Temporary Relief: This is generally a short-term cash management strategy and may not resolve deeper financial challenges within the business.

- Terms Can Be Tricky: Contracts can sometimes contain unclear or hidden clauses thats why businesses need to read the fine print carefully to avoid unexpected obligations

Real-World Invoice Financing Examples and Case Studies

Invoice financing and factoring are powerful tools. See how real businesses leveraged invoice factoring success stories, seize opportunities, and fuel growth. Here are a few real-world stories that show how these tools have made a difference:

1. Kay’s Catering – Turning Invoices into Opportunity

The Challenge: After organizing a $20,000 corporate event, Kay’s Catering issued an invoice with a 30-day payment term. But just a few days later, they landed another gig — a high-end birthday party — and needed cash quickly for supplies and staffing.

The Solution: They turned to invoice financing, unlocking 80% of the pending invoice upfront — that’s $16,000 in their pocket, fast. The service charged a 4% fee for every 30 days the invoice remained unpaid.

The Outcome: With the funds, they delivered a stellar birthday event. Once the corporate client paid their invoice, Kay’s Catering paid back the lender and kept 96% of the original amount. No loans, no credit checks — just smart cash flow management.

2. Aerospace Startup – Big Contract, No Bank Loan

The Challenge: A newly launched logistics company scored a major aerospace contract but lacked the credit history to qualify for a traditional business loan.

The Solution: Instead of waiting or risking the opportunity, they used invoice factoring. Since their client had strong credit, the factoring company advanced them funds against the invoice.

The Outcome: The startup delivered on the contract without missing a beat and used the momentum to grow its operations. Factoring helped them look like a much bigger player than they were — without taking on debt.

3. Steel Fabricator – Bouncing Back After Bankruptcy

The Challenge: After navigating a Chapter 11 bankruptcy, a steel fabrication company needed cash urgently to pay vendors and staff — but banks weren’t interested.

The Solution: They turned to invoice factoring, which gave them immediate access to working capital based on their outstanding invoices.

The Outcome: This injection of cash helped stabilize their operations, keep employees paid, and rebuild supplier relationships. Best of all, it didn’t add new liabilities to their balance sheet.

4. James’ Roofing Equipment Business – From Prototype to $20M

The Challenge: James created a clever rooftop support product, but bringing it to market meant manufacturing at scale — and he didn’t have the capital.

The Solution: He used factoring to get cash upfront for invoices issued to major clients like AT&T and Sprint.

The Outcome: With a steady cash flow, James scaled up production and grew his business to over $20 million in revenue. Factoring became a key part of his strategy for sustainable growth.

5. Gulf Coast Machine Shop – Recovering After Disaster

The Challenge: A Gulf Coast precision machine shop took a hit after multiple hurricanes wiped out their reserves. They needed to restart operations but were short on funds.

The Solution: They used factoring to tap into funds tied up in receivables from large clients like Lockheed Martin.

The Outcome: That move allowed them to get back on their feet quickly. Today, they continue using factoring for large-scale projects while managing day-to-day expenses internally.

Difference between Invoice Financing and Invoice Factoring

| Aspect | Invoice Financing | Invoice Factoring |

| Definition | A loan or credit line where businesses use unpaid invoices as collateral to borrow funds. | Understand clearly the difference between invoice financing and factoring. |

| Ownership of Invoices | The business retains ownership of the invoices and is responsible for collecting payments. | The factoring company takes ownership of the invoices and handles payment collection. |

| Control Over Customer Relationship | The business maintains direct contact with customers and manages relationships. | The factoring company interacts with customers for payment collection, which may affect relationships. |

| Fees and Costs | Interest and fees are charged on the borrowed amount, similar to a loan. | A discount is applied to the invoice value, which is the factoring company’s fee. |

| Risk of Non-Payment | The business bears the risk if customers fail to pay their invoices. | The factoring company may assume the risk of non-payment, depending on the agreement (recourse vs. non-recourse). |

| Visibility to Customers | Customers may not be aware of the financing arrangement. | Customers are usually aware, as they pay directly to the factoring company. |

| Speed of Access to Funds | Funds are quickly accessed, but the process may involve more credit checks and approvals. | Funds are accessed almost immediately after selling the invoices. |

| Best For | Businesses that want to retain control over customer relationships and collections. | Businesses that need immediate cash flow and are willing to outsource collections. |

Is Invoice Financing Right for Your Business?

Unpaid invoices can cause cash flow problems for small and medium-sized businesses. Invoice financing gives a practical way to access money tied up in outstanding bills. This helps companies manage daily costs, grow their business, or survive long payment periods.

This short-term borrowing option eases money stress. It turns unpaid bills into quick working capital. Instead of waiting one, two, or even three months for clients to pay, you can get the cash you need right away.

But like any money product, you should think about the good and bad points. Look at the fees, how it might affect your client relationships, and if it fits with your company’s current money plan.

By understanding your needs and exploring different invoice financing options available today, you can figure out if invoice financing is a good fit for you. When you use it , it can help your business run , grow bigger, and keep money flowing in—even when times are tough.

Conclusion

Invoice financing does more than just patch up cash flow issues—it gives businesses a tool to stay flexible, grab new chances, and handle money troubles. This approach can free up the cash you need without taking on regular debt, whether you run a growing startup, a business with seasonal ups and downs, or an established firm dealing with long wait times for payments.

You can shape the answer to fit your exact business needs and customer relationships by picking the right kind of invoice financing—such as factoring, discounting, or spot funding. Just keep this in mind: your success depends on grasping the terms, looking at the good and bad points, and teaming up with a trusted finance provider.

In today’s quick-changing market, having cash on hand can give your business the edge it needs to do well. Invoice financing isn’t just about getting your money faster—it helps keep your business moving ahead.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply