Running a business or working as a freelancer comes with its proper part of challenges, and the management of payment should not be one of them. Enter the PayPal invoice, a tool designed to streamline the payment process and make your life completely easier. Whether you are the owner of a small business, sending recurring invoices or a freelancer managing projects, PayPal gives you a professional and efficient way to handle the transaction.

What is a PayPal Invoice?

With only a few clicks, you can make customized invoices and send which are easy to pay for your clients . Even better, these invoices simplify cash flow management, which helps you keep track of who’s paid and what’s still outstanding. Add the safe payment platform of that PayPal to the platform, and you get peace of mind to know that your money is safely handled.

Gone are the days of emailing spreadsheets or chasing customers for cheques — modern electronic invoices simplify and speed up billing. The user-friendly invoice system of PayPal brings professionalism to your business while protecting you from time and trouble. If you want to increase your cash flow and focus more on the management of payment, then PayPal invoice can just be your new best friend.

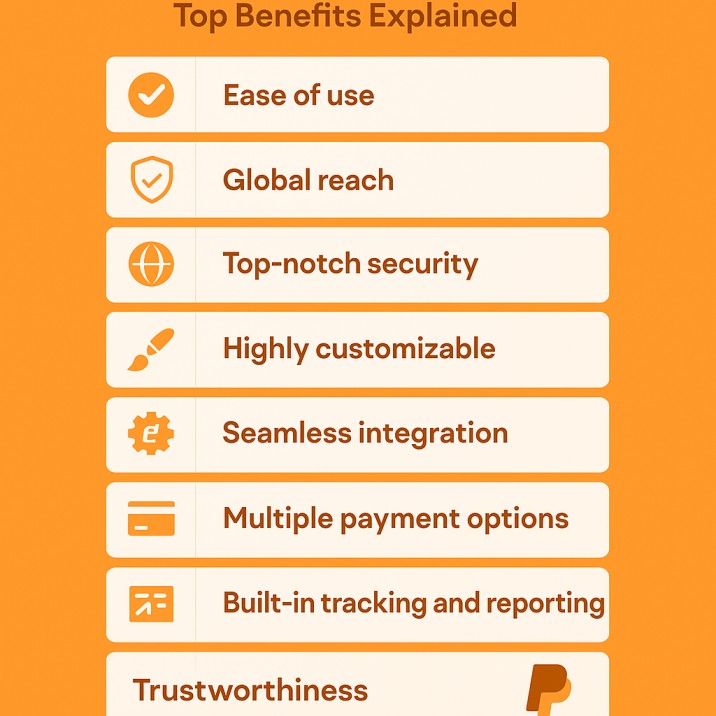

Why Choose PayPal Invoices? Top Benefits Explained

Managing the invoice is an important part of business or freelancing running. It is not just about paying; This is so smoothly, safely and professional. This is where the PayPal Invoices stands out. If you are considering a simple yet powerful invoicing solution, then the top reasons here are why Papail Invoice may be the right choice for you.

Ease of use

PayPal simplifies the entire invoice process. You do not need a degree of finance or training to send polish, professional invoices. It takes only a few minutes to make and send invoices. The platform provides a user -friendly experience, allowing early and experienced business owners to generate invoices with minimal trouble. Save time and focus on what you do best, much like when you streamline invoice creation with professional templates.

Global Reach

One of the standout features of PayPal is its global presence. With PayPal Invoice, you can easily send payment requests to clients worldwide, offering a smoother process than traditional paper vs electronic invoicing. The platform supports more than 25 currencies, making it easier for international clients to pay in their preferred currency. This global capacity is invaluable for freelancers and businesses working with clients across borders.

Top-Notch Security

When it comes to handling payments, security is non-negotiable. PayPal is known for its strong safety measures, keeping its transactions and client information safe. It uses industry-standard encryption and fraud detection, so you can send invoices and accept payment with confidence. For businesses and freelancers, this peace of mind is precious.

Highly Customizable

Your invoices are often the first financial interaction clients have with your business, much like when using a vat invoice to maintain professionalism and compliance., and the first impression matters. PayPal allows you to customize your invoices with your logo, business name, and contact details, creating a polished, branded look. You can also include discounts, taxes, and notes to ensure each invoice fits your needs.

Seamless Integration

PayPal basically integrates with different types of devices and platforms. Many businesses already use it. From e-commerce platforms to shopify and wooCommerce such as quickbooks such as PayPal makes your invoice easier to connect with other essential business apps. This integration helps in streamlining your workflow and reduces manual bookkeeping efforts.

Multiple Payment Options

Your customers appreciate flexibility, and PayPal delivers. With PayPal Invoice, customers can pay using financing options such as credit cards, debit cards, PayPal balance, or even PayPal credit (where are available). This versatility helps speed up cash flow, just like choosing flexible terms when handling invoice financing options.

Built-In Tracking and Reporting

PayPal does not stop sending only invoices. The platform also helps you to stay organized by providing tracking and reporting tools. You can easily see which invoices are paid and which are still pending, making sure you are always at the top of your cash flow. In addition, reporting tools give you insight into your earnings, helping you forecast and optimize your vendor invoice management processes.

Trustworthiness

For many people, the name of PayPal inspires trust. It is one of the most widely recognized payment systems in the world. When customers see a PayPal invoice, they know that they are working with a reputed, safe service. This recognition can make clients more likely to believe and pay on time.

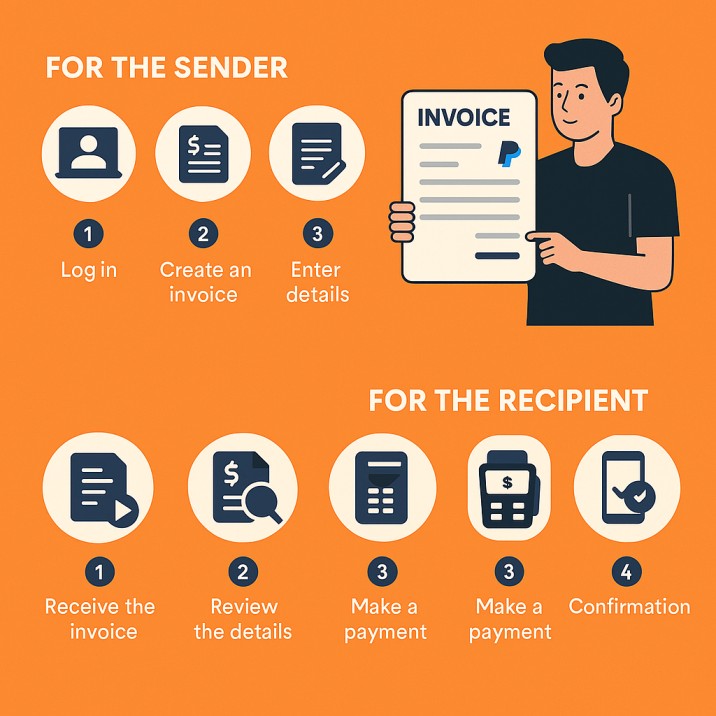

Step-by-Step Guide to Creating and Sending a PayPal Invoice

This guide keeps you how a PayPal Invoice works, step by step, for both sender and recipient.

For the Sender

- Log into Your PayPal Account: First of all, go to PayPal‘s website or open the PayPal app. Use your email and password to log in. If you do not have any account yet, you will need to make one. It is free and takes only a few minutes.

- Access the Invoice Tool: Once you log in, go to the menu and choose “Send and request“. From there, click “Create an Invoice“. This will open an invoice creation tool.

- Fill Out the Invoice Details: Now the time has come to customize your invoice. You will need to fill in the following details:

- Bill: Enter the recipient’s email address. Double-check it to ensure accuracy.

- Invoice Number (optional): Assign a unique invoice number if necessary. This helps to keep the records organized.

- Item Details: Describe the product or service for which you are charging. Use clear, specific wording and include the Price for each item.

- Tax and Discounts (optional): If applicable, add discounts in sales tax or total.

- Due Date (optional): Determine the time limit of payment to encourage timely payment.

- Review and Send: Before sending, check all the information again. Once you are confident that everything is correct, click “send” to email it directly to the recipient. The recipient will inform you when the recipient sees or pays the invoice.

For the Recipient

- Receive the Invoice: When someone sends you a PayPal invoice, you will get email information. Open the email and click on the “View and Pay Invoice” button. It will take you to PayPal.

- Review the Details: Take a moment to go to invoice details. Check the amount, details and due date to ensure everything is correct or not.

- Make the Payment: Click on the “Pay Now” button. You will have the option to pay by using PayPal balance, linked bank account or debit/credit card. Select your favorite payment method and follow the instructions to meet the payment.

- Confirmation: Once your payment is processed, you will receive a confirmation message and email. The sender will also get information that the invoice has been paid, keeping everyone in the loop.

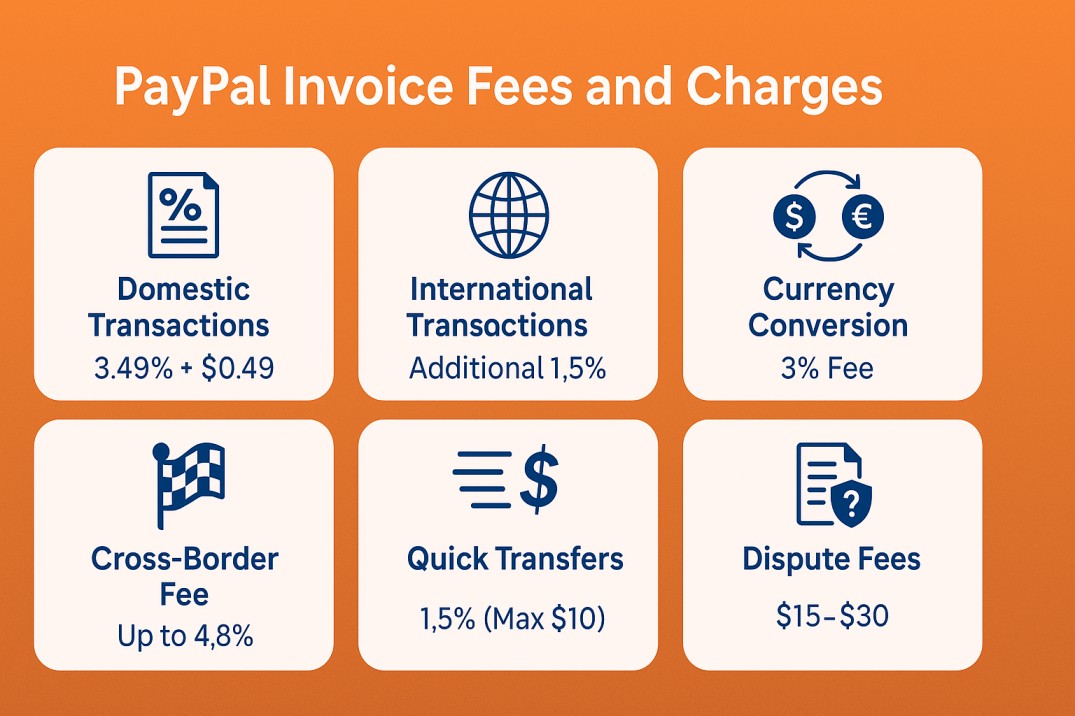

PayPal Invoice Fees and Charges

As of 2026, PayPal’s invoice fees include:

- Domestic transactions: 3.49% + $0.49 or 2.9% + $0.30

- International transactions: Additional 1.5% fee

- Currency conversion fee: 3% (if applicable)

- Cross-border fee: 3-4.8% depending on location

- Quick transfers: 1.5% of the amount (capped at $10)

- Micropayments (under $10): 5% + $0.05 per transaction

- Dispute fees: $15-$30

- PayPal Payments Pro fee: $30/month, with a 2.29% + $0.09 transaction fee

To minimize costs, consider consolidating invoices, using bank transfers, billing in local currency, and processing over $3,000 per month for lower rates

Expert Tips for Managing PayPal Invoices Like a Pro

PayPal is a Go-to Tool for freelancers and small business owners, but effectively managing the invoice is important to stay organized and pay on time. Here are quick suggestions that you mastered the art of PayPal Invoicing.

1. Stay organized: Use a clear, detailed description like “March Social Media Management for ABC Corp”. Export your invoice history to track “Paid,” “” pending, “and” overdue “invoices to track history.

2. Automatic where possible: Schedule recurring invoices for regular clients. Use an automated payment reminder of PayPal to follow the overdue balance.

3. Monitor Payment: Check your PayPal Dashboard Weekly for Payment Status. For better tracking, export transactions in accounting software such as quickbooks.

4. Avoid Common Mistakes: Double-check the client email address before sending the invoices. Always include due dates to keep clients accountable. Factor in PayPal fees when pricing your services to avoid revenue loss.

5. Communicate Clearly: Make advances about payment terms, late fees or policies. Follow professionals on late payment for better response rates.

Final Thoughts

PayPal Invoice is a powerful tool that replaces payment management for freelancers and small business owners. With ease of its use, global access and strong safety, it offers a comfortable, professional way to handle the transaction. From creating adapted invoices to accept payments in many forms and currencies, PayPal simplifies the entire process, saving you time and effort, while ensuring that your cash flow remains on the track. Its ability to integrate and provide detailed tracking and reporting with essential business equipment combines its value only as a comprehensive invoices solution.

Payments are the days of paying payment or chasing tedious administrative tasks. PayPal invoice takes trouble by managing problems, which gives you more time to focus on growing your business. If you are ready to control your payments with a reliable, efficient system, then PayPal Invoice is the time to try. Start from today and experience that difference in streamlining your business operations!

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply