Effective business management and organization requires attention to detail on many levels and any company operates optimally when its finances are in order. There are many documents like purchase orders and invoices which people get mixed up with. Understanding the terms purchase order and invoice is not as simple as knowing several words – it is far deeper than that, as both documents serve very different functions in the spending process. Analyzing ‘Purchase Order vs Invoice,’ you would be able to realize the significance of each of them and why adhering to these basic steps is so crucial. Understanding these documents helps businesses improve their communication, ease of transactions, and overall financial management.

What Is a Purchase Order?

A Purchase Order (PO) is an official document a buyer sends to a seller. It shows the buyer wants to buy specific goods or services. This document acts as a legal agreement between the two sides and spells out the details of the deal. Companies often use purchase orders in business-to-business (B2B) deals to make buying easier, ensure everyone’s on the same page, and keep a record of what they agreed to.

What Does a Purchase Order Contain?

A purchase order contains these essential elements:

- Purchase Order Number: A distinct code to track and refer to the order.

- Buyer and Seller Information: Names addresses, and how to contact both the company that buys and the supplier that sells.

- Order Date: The day the company issues the purchase order.

- Description of Goods/Services: A full list of what the company buys, with details, amounts, and other key facts.

- Quantity: How many of each item the company orders. Price: The cost per item and the total cost for everything the company buys.

- Payment Terms: How and when to pay, plus any rewards for early payment or fees for late payment.

- Delivery Details: When the company expects to get the items, how they’ll ship, and where to send them.

- Terms and Conditions: Other rules, like how to return items, what guarantees apply, or what happens if someone breaks the rules.

- Authorized Signatures: People in charge from both sides sign to show they agree.

Why Are Purchase Orders Important?

- Clarification: They guarantee that both parties are in agreement about the details of the order.

- Legal Protection: They function as a binding contract in the event of a dispute.

- Reporting Function: They provide a complete record of transactions for accounting and auditing purposes.

- Streamlined Function: They assist organizations in managing inventory, budgets, and supplier relations more effectively.

What Is an Invoice?

An invoice is one of the most crucial components of every business transaction. Consider an invoice to be a formal bill that verifies a purchase contract between a purchaser and seller. With small businesses, freelancing, or large corporations, invoices maintain organization, professionalism, and documentation. At its most basic definition, an invoice is simply a document requesting payment for products or services sent to the customer from the seller. And, it does more than asking for payment; it creates a record of the sale. When invoices exist, both entities can avoid confusion in the future.

Why Are Invoices Important?

Invoices do more than just keep track of payments. They aid businesses in being organized, transparent, and cash-flow conscious. They also serve as documentation to file taxes and can be used as proof in case of disputes. Furthermore, when you send flawless invoices, it displays professionalism and builds trust with your clients/customers.

What Does an Invoice Contain?

To ensure that an invoice does its job, there are some specific details that it will require. Here is an overview of the major pieces of information it should contain:

- Sender’s Information (Your Information): This is where you will put the name of the company, its address, as well as a phone number and email address are listed. If you are a freelancer, you will want to include your personal name and contact info as well.

- Recipient’s Information (Customer Information): You will want to print the name and address of the person or business who is going to pay for your goods or services.

- Invoice Number: Each invoice regardless of the transaction should be assigned its own number, which makes it easier to track and refer it back to it if needed.

- Date issued and Due date: Date issued is going to coincide with the day you generate the invoice and the due date will tell them when you expect payment.

- Itemized goods or services: Be as specific as you can and itemize what you are charging for. For example, you can itemize each service you may have provided, products sold and/or hours worked. Be as specific as possible so the person (or entity) who is receiving the invoice knows what the invoice is representing.

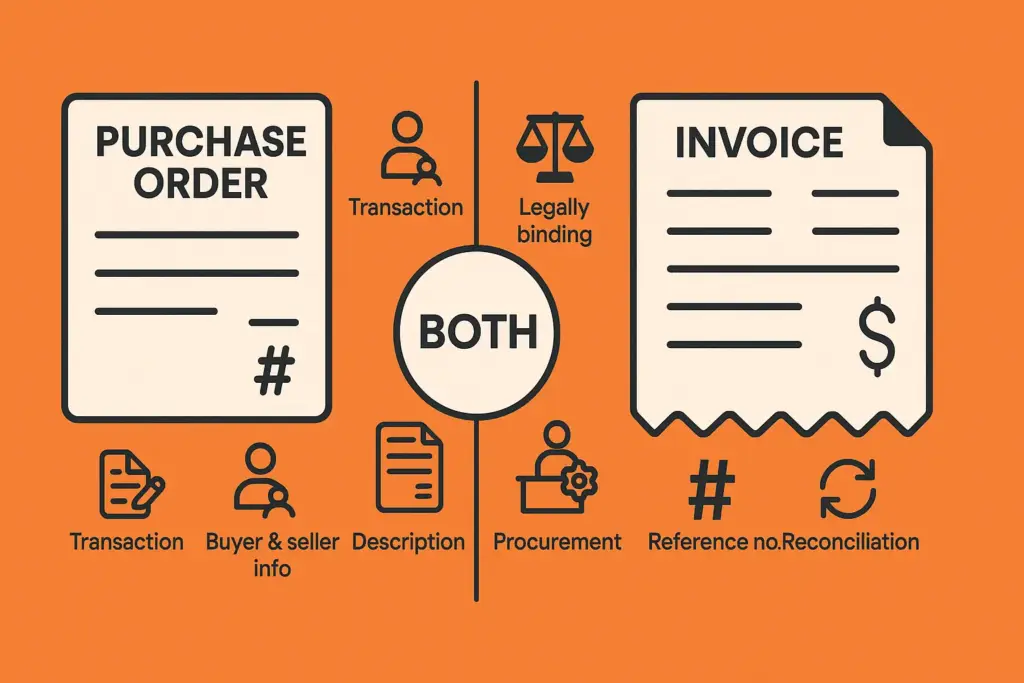

Similarities Between Purchase Orders and Invoices

Here’s a quick overview of the similarities between purchase orders (POs) and invoices:

- Recording the Transaction: Purchase orders and invoices are official paperwork that details the transaction between the buyer and seller.

- Common Information: Both types of documents will generally contain similar types of information. These types of information are the buyer/seller information, items description, quantity, price of goods, and payment terms.

- Legally Binding: Both can be deemed legally binding documents if accepted by both the buyer and seller, as most invoices reference the purchase order to document the transaction.

- Procurement Process: Purchase orders and invoices are all components of the procurement process and the payment processing. Both documents also communicate information and serve as record keeping to both the buyer and seller.

- Reference Numbers: Purchase orders and invoices will typically contain a unique reference number. A PO number will be present on the purchase order, and an invoice number will be present on the invoice. Reference or transactional numbers can assist in tracking the transaction.

- Reconciling Financials: Both purchase orders and invoices will be used to ensure what is being ordered to what was delivered to the buyer was billed and paid for.

Why Do Companies Need Both Purchase Orders and Invoices?

Companies use both purchase orders (POs) and invoices because they serve distinct but complementary purposes in the procurement and payment process. Here’s why both are essential:

Purchase Orders (POs) Helps to control spending by requiring approval before purchases. It Provides a clear record of what was ordered and Simplifies inventory and budget management.

Invoices Ensures the seller gets paid for their goods or services. It Helps the buyer track expenses and manage cash flow and Acts as proof of the transaction for accounting and tax purposes.

POs and invoices work together to ensure accuracy and accountability. The PO outlines what was agreed upon, and the invoice confirms what was delivered and billed.

Matching POs with invoices (a process called “three-way matching” when combined with delivery receipts) helps prevent overbilling, duplicate payments, or unauthorized purchases.

Using both documents creates a clear paper trail, making it easier to resolve disputes, track orders, and maintain compliance with financial regulations.

In short, purchase orders initiate the buying process, while invoices finalize it. Together, they create a robust system for managing procurement and payments efficiently.

Purchase Order vs Invoice: Differences

A purchase order (PO) is a document that a buyer issues to a supplier, detailing the specifics of goods or services that they wish to purchase. This acts as a formal request and serves as the first step of the purchasing process. An invoice, on the other hand, is a document issued by a seller to a buyer, requesting payment for the goods or services that have been provided. This serves as proof of a transaction.

Simply put:

- A purchase order is a request to buy.

- An invoice is a request to get paid.

| Aspect | Purchase Order (PO) | Invoice |

| Definition | A document issued by the buyer to request goods/services. | A document issued by the seller to request payment. |

| Creator | Buyer | Seller |

| Purpose | To initiate and formalize the purchasing process. | To request payment after fulfilling the order. |

| Key Use | Tracks and specifies purchase details. | Tracks and specifies payment details. |

| Approval Process | Approved internally by the buyer before submission. | Verified against POs/delivery receipts by the buyer. |

| Numbering System | Assigned by the buyer, often unique to each PO. | Assigned by the seller to track invoices systematically. |

| Key Elements | Items, quantities, prices, and delivery terms. | Items delivered, totals, taxes, and payment terms. |

| Timing | Issued before the goods/services are delivered. | Issued after the goods/services are delivered. |

What Makes a Purchase Order an Important Legally Binding Document?

A purchase order (PO) is a critical legally binding document in business transactions for several reasons:

- Agreement: The PO is a necessitating agreement between a buyer and seller, that states specific details of a transaction, including product/service, quantities, price, delivery time and payment terms.

- Legal Contract Protection: Once the seller accepts a PO, it becomes a legally binding contract. This means that both the buyer and the seller must meet their obligations – the buyer pays and the seller delivers as stated in the PO.

- Reduces Misunderstanding: A PO lays out the full transaction details minimizing the chance of misunderstandings or disputes. Everything is written so there are no questions.

- Audit and Records: Financial tracking and auditing require a PO. It provides documentation trail to monitor spending, budget management and to meet internal and external compliance.

- Dispute Resolution: If a dispute were to arise, you would use the PO as a point of reference. If needed, a PO can be a legal document used in court.

- Efficiencies: POs increase business efficiencies by standardizing the way orders are placed and tracked.

Final Thoughts

In comparison, purchase order vs invoices both are important elements for business transactions, each having a distinct purpose, but they work well together. A purchase order is essentially the buyer’s simple way to request to “buy,” while an invoice represents a request for payment on behalf of the seller for the goods or services provided. Both documents give a detailed record of the transaction and allow businesses to achieve accuracy and accountability in financial records. With purchase orders, companies can have a handle on spending, assist in budget management, and have a clear agreement up front. For sellers, an invoice is an easy way to track requested payments and maintain a good amount of cash in the business. Together, the use of a purchase order and an invoice creates a streamlined process to create visibility, reduce disputes and antagonism between sellers and buyers. For the business overall, utilization of purchase orders and invoices creates a smoother and efficient process, while developing a reliable financial process.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply