- What Is a VAT Invoice?

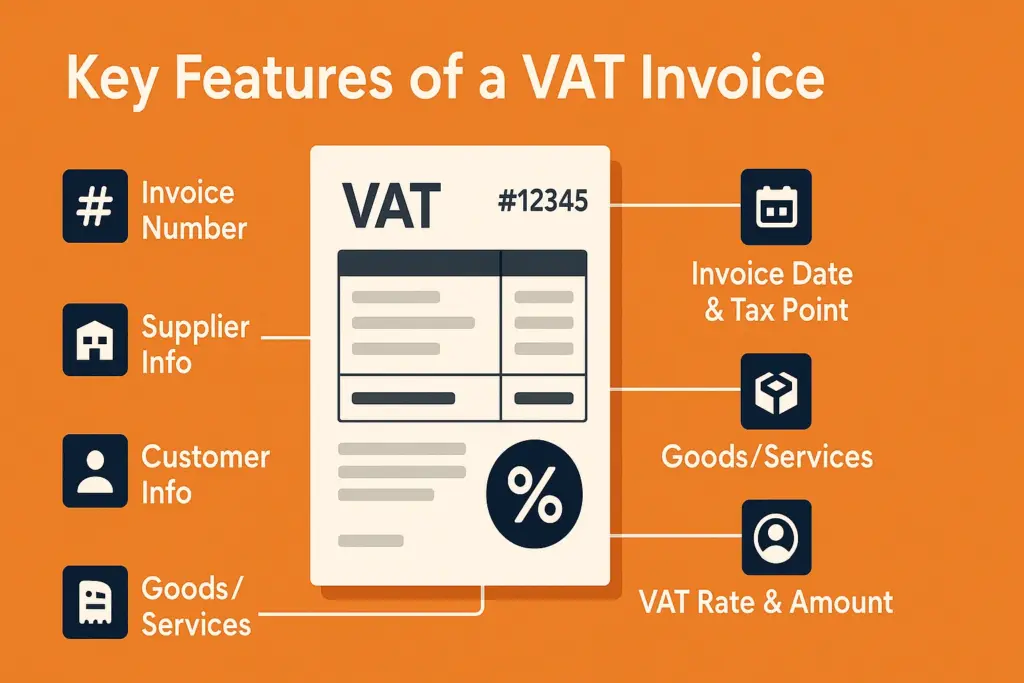

- Key Features of a VAT Invoice

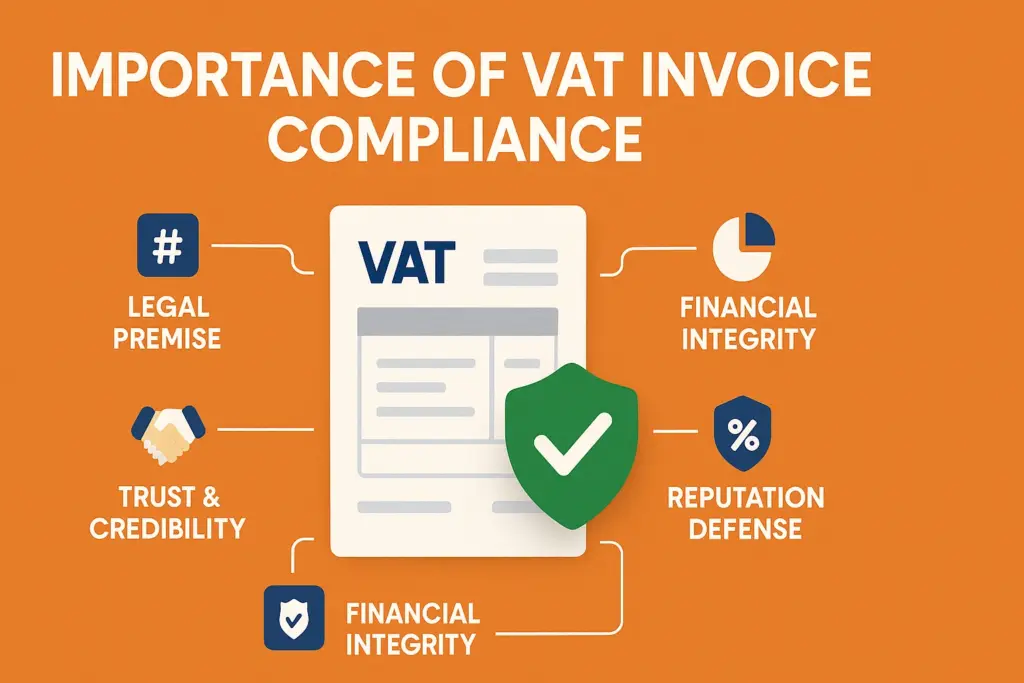

- Importance of VAT Invoice Compliance

- Components of a VAT Invoice (with Illustration)

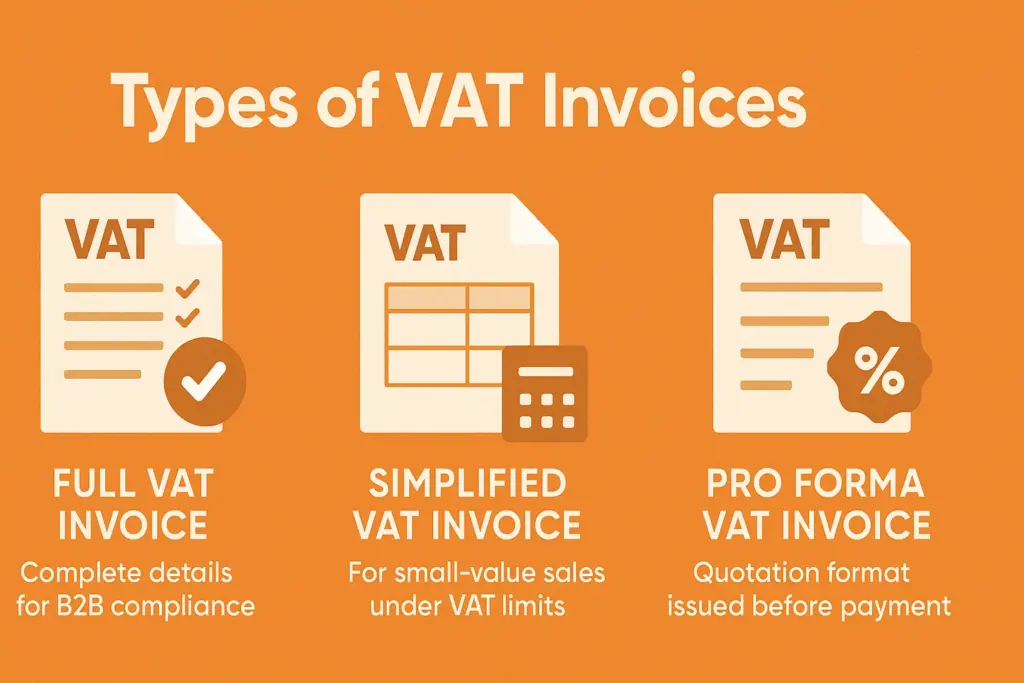

- Types of VAT Invoices

- Who Is Required to Issue a VAT Invoice?

- VAT Invoice vs. Standard Invoice: What’s the Difference?

- Issuing VAT Invoices for International Transactions

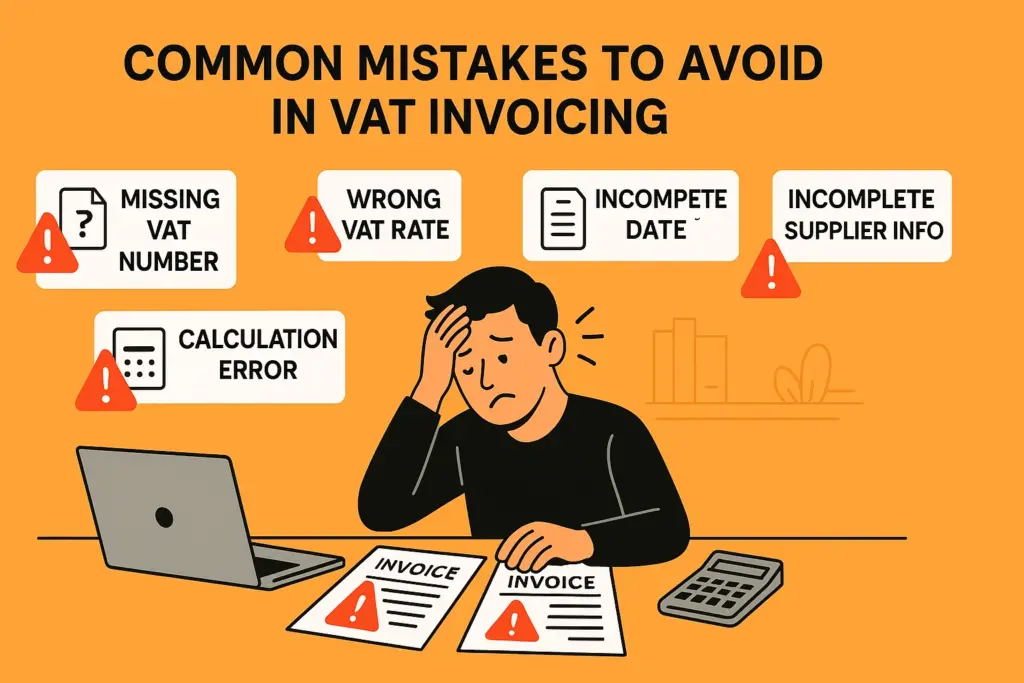

- Common Mistakes to Avoid in VAT Invoicing

- Best Practices and Tips for VAT Compliance

- Conclusion

If you are a newcomer into the world of business or taxes, learning how to read a VAT invoice might look like a challenge. Well, what if I told you that you don’t have to master VAT Invoices like they are rocket science? A VAT invoice is far more than just a piece of paper, it ensures tax compliance, aids you to keep accurate bookkeeping and keeps your transaction for both parties clear and transparent.

As a business owner, freelancer or even an accountant: Not mastering the effective creation of a VAT invoice is like riding off with the show!. Why? Given the importance of getting error-free invoices across your business, law practice and avoiding penalties for lack of compliance with tax authorities.

Let this blog walk you through a layman’s definition of what a VAT invoice means. You will get to know The elements it must have, when to issue and few tips for writing it correctly. Afterward, you will be able to do VAT Invoicing like a pro and all the freaking chaos and stress that comes with it. So you want to learn more about how you can take control of one of the most crucial elements of your business finance? It’s easier than you think.

What Is a VAT Invoice?

The VAT invoice is one of the most important documents for companies; it is a receipt and a valid legal document when value added tax (VAT) on a transaction. This includes information about the seller, buyer, items or service supplied, the applicable VAT rate and the net amount due standing to it the tax on the invoice.

The role of VAT invoice is what distinguishes it from others. Businesses see, it is more than a bill — similar to how commercial invoices validate international trade transactions and VAT claims. Its absence makes bookkeeping a hurdle for following tax rules. You might have to argue your tax deductions if you do not have the proper paperwork together!

Whether you run a home-based business or decades into your entrepreneurship career, producing and keeping a record of VAT invoice for issue ends up being one way to enhance transparency, making sure legal compliance and clean books. Knowing the relevance to it, you may have a massive difference in making your business smooth and tax complaint.

Key Features of a VAT Invoice

It is a comprehensive log of sales transactions, maintaining transparency against tax laws and much like proforma invoices for preliminary transactions. Listed below are few essentialities of a VAT invoice and their importance-

- Unique Invoice Number: Every tax invoice requires a unique serial number. For both businesses and tax authorities, this assists in identifying transactions that are recorded.

- Supplier Details: Include the name, address and VAT no of the supplier This makes the seller legitimate and imposing a sense of consequence

- Customer Details: It is especially necessary for transactions worth more than a certain amount, as the name and address of the buyer This is so that there are reasonable records on both sides.

- Invoice Date and Tax Point: These are the time that the invoice was created, and the tax point of the sale so that Businesses can invoice the tax period correctly.

- Details of the goods/services: This leaves nothing to dispute, as clear facts about what was sold (quantities and unit prices) are thoroughly disclosed.

- VAT Rate and Amount: VAT Rate and corresponding amount must be given for each item. It is to avoid it and for the simplest taxation, this should be characterized by a seller.

A VAT invoice not only builds trust but also makes sure that businesses remain compliant and get things done correctly due to the inclusion of information such as these.

Importance of VAT Invoice Compliance

Complying to tax acts is crucial — especially when considering document accuracy like invoice vs receipt differences. Why it so important to get it right

- Legal Premise: You are practicing your right of VAT invoice and making sure that your business is legal and in compliance with tax authorities that save you from hefty fines or even legal issues. Non-compliance may cause audits, investigations and penalties eroding your business stability.

- Financial Integrity: Correct VAT invoices give you the clarity needed for transparent finance tracking They improve your cash flow management and help you get the VAT back or credit correctly — or handle expenses like a pro for this quick money back.

- Trust of Customer and Partners: Compliance demonstrates to your own clients, suppliers, and other partners that you work as a professional and responsible business. It builds credibility in your operation, and is required to be a role model.

- Reputational defense: Tax mistakes and the branding of harm to your never-too-vital brand is only retribution when financial authorities (or the like are involved). Exact precision saves your character.

You are not only avoiding legal landmines by focusing on embracing little excursions of VAT invoice compliance, you are also priming your company for long term success. Always be on the look for your invoicing procedures, tracking the tax law and have all invoices comply with relevant demand-regulation. This is an unbreakable foundation that every business just cannot ignore.

Components of a VAT Invoice (with Illustration)

It serves as a legal record of a taxable transaction and is required for the buyer to reclaim VAT. To ensure compliance, the VAT invoice must include specific mandatory components.

- Invoice Title: Must clearly state “VAT Invoice” or “Tax Invoice”.

- Unique Invoice Number: A sequential number unique to each invoice for record-keeping and audit purposes.

- Date of Issue: The date the invoice is issued.

- Supplier’s Details: Name, address, and VAT registration number of the seller.

- Customer’s Details: Name and address of the buyer (VAT number if applicable).

- Description of Goods or Services: Clear details of what is being sold, including quantity and unit of measure.

- Date of Supply (Tax Point): The date goods or services were provided (if different from the invoice date).

- Unit Price: Price per item/unit, excluding VAT.

- Net Amount: Total value of goods or services before VAT.

- VAT Rate Applied: The percentage rate applied (e.g., 5%, 12%, 18%, etc.).

- VAT Amount: The calculated VAT amount for each line item or the total.

- Total Amount Including VAT: The grand total payable by the customer, including VAT.

Types of VAT Invoices

You cannot properly manage your business without the VAT invoices it keeps record of taxable business. Once you know their types it becomes very easy to comply and to keep accurate accounting of your finances. So here are the quick breakdowns of major categories you must know:

Full VAT Invoice

This is the most detailed type of invoice. This gets all the basics (seller / buyer details & numbers, Vat reg. numbers, invoice number, total including VAT, rate & amount of VAT charged. These are generally sent on a B2B scenario.

Simplified VAT Invoice

For smaller transactions or if the VAT amount is under a certain specified amount, this type includes less detail. It simply lists the least prerequisite fields such as supplier info, invoice date and VAT-inclusive total.

Pro Forma VAT Invoice

In an estimate form of invoice-issued before actual transaction happens It is nothing but a bill of arrival being passed off lawfully But it gives customers an idea about how much VAT they would pay.

All are created for particular purposes to ensure precision standards compliance. Knowing which of the two to send or ask for help with transparency and tax compliance Lastly, keep them in order because they are the “backbone” of your VAT filing!

Who Is Required to Issue a VAT Invoice?

The obligation to issue a VAT invoice typically falls on businesses registered for VAT in their country. This includes sole traders, partnerships, and companies whose turnover exceeds the VAT registration threshold. However, there are exceptions. For instance, you don’t need to issue a VAT invoice for goods or services sold to non-VAT-registered customers, such as end consumers, unless specifically requested.

The VAT invoice requires things like your business name, VAT reg number, the date of supply and also must have the write off of VAT charged at a granular level.

If you leave out this information or do not issue an invoice, as you are legally obliged to do when you have been requested, then you are OPENING YOUR OWN DOOR FOR COMPLIANCE ISSUES and PENALTIES.

Being VAT compliant will protect your business reputation and allow business to run smoothly. If you are uncertain about your VAT liabilities, ask for expert advice or read your local tax authorities guidance on this. Schedule accurate VAT invoicing as one of the things for your business starting immediately.

VAT Invoice vs. Standard Invoice: What’s the Difference?

| Aspect | VAT Invoice | Standard Invoice |

| Purpose | Used for transactions where VAT (Value Added Tax) is applicable. | Used for general transactions without VAT details. |

| Tax Information | Includes details of VAT charged (e.g., tax rate, VAT amount). | Does not specify VAT or tax information. |

| Legal Compliance | Mandatory for VAT-registered businesses and required for tax reporting. | Not legally required for tax reporting unless taxes are applied separately. |

| Content Details | Must list seller and buyer VAT numbers, itemized VAT amount, and tax rate. | Includes basic details like bill amount, products, or services but no VAT numbers. |

| Usage Scenarios | Common in B2B transactions and when the buyer intends to claim VAT refunds. | Suitable for B2C transactions or informal sales where taxes aren’t claimed or charged. |

| Recipient Type | Issued to VAT-registered businesses or entities. | Issued to individuals or businesses without a need for VAT data. |

| Complexity | More detailed due to the inclusion of VAT-specific fields. | Simpler in format and content. |

| Regulatory Need | Subject to country-specific VAT rules and regulations. | Not tied to specific VAT rules but may still follow general invoice standards. |

| Examples | Sale of wholesale goods, import/export transactions. | Freelance services, retail sales. |

Issuing VAT Invoices for International Transactions

Issuing VAT invoices for international transactions is a vital step in maintaining VAT compliance across borders. International trading needs to comply with the tax rules of every country involved which will be the further layers of complexity to this process. This is not just the invoice for the transaction, but also it provides necessary deduction of right vat and consequently stops any fine or penalty to your company.

International trade is complex — just like using electronic invoices to simplify cross-border compliance. Invoice management needs to be accurate because any small mistakes make things delayed or in dispute. This is why a process for VAT invoice issuance, that is as streamlined, can help save time and effort on the business end while staying compliant.

Invoice management tools tailored for international trade just makes the process in order to keep it simpler for businesses.

Easy to use, these help tools will automatically add all the tax information needed as a human would not possibly know it all. When the responsible tax, their rules are alive and well — companies can grow global without slacking on compliance.

Common Mistakes to Avoid in VAT Invoicing

Here are some common mistakes to watch out for –

One frequent issue is using incorrect or missing VAT numbers. A valid VAT number is essential for both claiming VAT refunds and maintaining compliance. Another common oversight is omitting key details such as the supplier’s information, a clear invoice date, or the correct line descriptions for goods or services. These details are mandatory and their absence can render your invoice invalid.

Calculation mistakes are also surprisingly common. Errors in applying the correct VAT rate or miscalculating the totals can lead to discrepancies that risk penalties or delayed payments. Even small mistakes can snowball into bigger financial and operational problems.

Failing to avoid these errors not only disrupts cash flow but may result in audits, fines, and the need for vendor invoice management solutions. To safeguard your business, always double-check your invoices before sending them. Better yet, consider leveraging automated invoicing tools to ensure accuracy and compliance.

Best Practices and Tips for VAT Compliance

Navigating VAT compliance can feel overwhelming, but getting it right is vital for your business. Beyond avoiding hefty fines, staying compliant safeguards your reputation and builds trust with both clients and authorities.

To tackle VAT effectively, start with accurate record-keeping. Maintain detailed invoices, receipts, and financial statements to ensure no figures are overlooked. Next, understand the specific VAT regulations in your jurisdiction. This knowledge is key to determining which goods and services are taxable and which exemptions may apply. Don’t forget about deadlines! Timely filing and payment are non-negotiable to avoid penalties.

Additionally, consider implementing robust accounting software. These tools streamline VAT management and reduce the risk of human error. For businesses operating across multiple regions, stay on top of varying VAT rates and rules to ensure compliance everywhere you operate.

VAT laws evolve, so staying updated is just as critical. Subscribe to regulatory newsletters or consult a tax expert periodically to avoid unpleasant surprises.

Conclusion

VAT Invoices are not hard to get if you know your way around a maze Mastering this effectively from the very beginning doesn’t have to be complex. Once you know the basics, some things are just required by regulation; tax considerations and client retention laws to ensure your business comes across as transparent, disciplined and of course, financially clear.

No matter what, whether it is full or simplified, pro forma VAT invoices are important to keep the system running in your operations and don´t let your tax obligations make a mess out of you.

It is not just to make sure you comply with the VAT; accurate invoicing builds trust, increases your professional credibility and helps the growth of your business over the long run. With this mini-tutorial and best practices in mind, you now have everything you need to get your invoicing act together like a vet.

You are ready to go right? Step in the right direction → start by looking at your existing invoicing methods and begin updating them today. Do you have any queries or more on VAT Invoices? Comment your thoughts, we are here to help!

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply