- What is an Invoice?

- Why Are Invoices Important for Businesses?

- What Does a Great Invoice Look Like?

- What is a Receipt?

- The Need for Receipts

- Invoice vs Receipt: A Detailed Comparison

- Invoice vs Receipt: Understand the Purpose

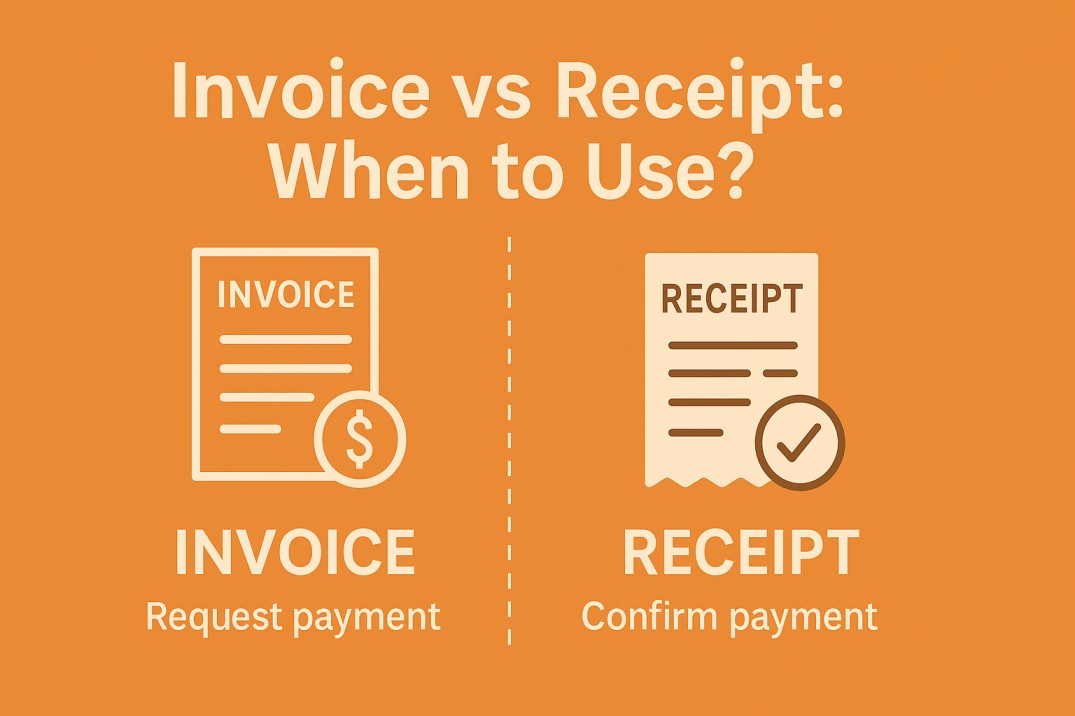

- Invoice vs Receipt: When to Use?

- How to Create an Invoice and a Receipt?

- Preparing a Receipt

- Final Thoughts (Invoice vs Receipt)

Being in charge of your finances may seem daunting, whether you have a business or simply monitoring your own expenses. Among the many documents used in financial transactions, invoices and receipts often cause confusion. On the surface, they appear similar, yet these two reports serve distinctly different functions and fulfill distinct roles within the money chain. Understanding the differences between invoices and receipts is essential for effective financial management, accurate record-keeping, and transparency. In this blog, we’ll compare between Invoice vs Receipt, why both are necessary, and how they work together. Whether you’re a business owner looking to get your ducks in a row or an individual looking to enhance your financial smarts, this guide will give you the clarity you’re looking for. Let’s break it down and dispel the confusion!

What is an Invoice?

An invoice is a formal document businesses use to detail the goods or services provided to a client, along with the amount due for payment. It serves as an official payment request that explicitly defines how much money the buyer must pay the seller and the terms of payment. Whether you own a small store or manage a bigger business, invoices are a necessity for making everything financially transparent and accountable.

Usually, an invoice will contain some key details, such as the date it was sent, a special invoice number to assist in keeping things straight, and both the seller’s and buyer’s names and contact information. It should also have a clear breakdown of what was delivered, unit price, overall amount payable, and payment conditions, e.g., when payment is due and what forms of payment are accepted. Some invoices may also include additional details such as taxes, discounts, or late payment penalties for better clarity.

Why Are Invoices Important for Businesses?

Invoices are more than just official documents, whether in paper or electronic form. They are central to the operation of businesses, their financial management, and relationships with customers. Without invoices, a business may face confusion, inefficiencies, and even legal issues. Let’s explore why invoices are the backbone of any successful business by looking at their significance in financial management, professionalism, and more.

Assisting in Proper Financial Tracing

Invoices are significant documents of your dealings with customers. They present detailed information regarding what has been sold, how much it costs, terms of payment, and due dates. This documentation also helps to monitor income and analyze revenue — making it easier to explore options like invoice financing if needed. With all sales and payments well-documented, you are able to escape discrepancies and have close control of your finances.

Serving as Legal Documentation

A validly issued invoice is not merely a payment request; it’s a legal document. If there are disputes or misunderstandings between you and a client, an invoice can be used as evidence of the agreement. It explicitly states the terms of the transaction, protecting both parties. And in tax audits or for legal purposes, invoices are a formal record of business transactions.

Upping Professionalism

Issuing clear, detailed, formal invoices does not just make transactions easier; it improves your reputation too. A professional invoice, with your company’s branding, terms of payment, and contact information, defines the way clients perceive you. When your invoicing process is well-organized, it indicates that you are well-organized and dependable, which can improve your business image in general.

Maintaining Strong Client Relationships

Invoices are a key part of clear communication with clients, especially when comparing proforma vs commercial invoices in international deals. They ensure that clients are aware of what they can expect from payments, due dates, and late payment penalties. A clear invoicing process minimizes confusion and helps resolve any potential disputes efficiently. By providing a smooth and timely invoicing process, you show respect for your clients’ time, which assists in developing long-term trust and loyalty.

Better Tax and Accounting Control

As tax season comes along, financial records must be precise. Invoices in good order simplify filing taxes, letting businesses easily calculate their income, costs, and tax owed. Additionally, they help ensure proper documentation when filing taxes — just like a compliant tax invoice structure demands.

What Does a Great Invoice Look Like?

Invoice Number

Every invoice must have a distinct identifier called the invoice number. This is crucial to both clients and businesses so that payments, accounts, and organization may be tracked, controlled, and monitored. Without a number, it can become quite difficult to distinguish one transaction from another.

Date of invoice

The invoice date indicates when the invoice was prepared. This information is important for determining due dates for payment, controlling cash flow, and ensuring communication with customers is explicit.

Sender and Receiver Information

A properly written invoice should express the contact information of both the sender (your company) and the recipient (your customer) clearly. This usually includes:

- Business name

- Address

- Phone number and email address

- Tax identification numbers, if required

Itemized List of Products or Services

Transparency in business transactions is crucial. Ensure that your invoice includes a detailed, itemized list containing:

- Each service or product that you delivered

- Unit prices

- Quantities

- Subtotals of each line item

This transparent breakdown not only comforts your clients but also serves to reduce any misunderstandings or disputes.

Total Amount

After listing down all the charges, determine the total amount that is due while ensuring to put in any applicable taxes, fees, or discounts. It would be a wise move to note the total figure in bold such that it comes out clearly visible and noticeable.

Payment Terms

To ensure smooth continuation and establish obvious expectations, take care to list down simple payment terms. These may include:

- The due date for payment (e.g., “Due in 30 days”)

- The forms of accepted payment (such as credit cards, bank transfers, or checks)

- Any late charge or early payment discount, if applicable.

Tax Information

Based on where your business is located and the nature of your business, ensure that you include any necessary tax information, including VAT or GST, and their correspondingly detailed breakdowns. Not only are you then complying with local authorities, but you’re also demonstrating your professionalism.

Personal Messages or Additional Information

Consider having a space for notes where you can include personalized messages, such as:

- A sincere thank-you letter to the client

- Important reminders

- Terminologies for future cooperation

This small extra can quite make client relations stronger and differentiate you from the competition.

Payment Instructions

Provide clear instructions on how the client may pay. Include:

- Bank account numbers for wire transfers

- Links to pay online

- Any relevant references or codes they may need

What is a Receipt?

A receipt is a plain but powerful document that acts as a proof of transaction. From buying a cup of coffee at your go-to café to buying office materials for your company, a receipt keeps track of what was purchased, the amount paid, and when it was purchased. In its basic form, a receipt offers transparency and clarity between buyers and sellers. It typically contains information like the name of the seller, the date of purchase, description of the goods or services, and the amount paid, as well as any discounts or taxes.

Receipts are significant in personal and business life. To the individual, it’s a useful means of keeping track of expenditures, staying within budgets, and even enabling returns or exchanges. Ever purchased an item and then later find out it doesn’t function or isn’t what you wanted? A receipt allows you to quickly correct the problem. For companies, receipts serve an important role — especially when compared to managing electronic invoices in digital accounting systems. They assist with tracking sales, inventory management, and tax preparation. During accounting or financial audits, proper receipts allow for accurate reports and can avoid expensive mistakes.

The Need for Receipts

Receipts tend to be undervalued in the chaos of everyday existence, but they serve a purpose far more important than being small slips of paper or electronic emails. Whether you are an entrepreneur, a freelancer, or merely an individual trying to keep track of household expenses, receipts are instrumental in keeping one on track and safe in monetary affairs. The reasons for why you should not let go of those small slips of paperwork are as follows.

Financial Tracking

- It is almost impossible to keep track of personal or business expenses without a proper record of purchases.

- Receipts help you track where your money is spent, offering a clear picture of your spending habits and making budgeting and saving easier.

- For companies, receipts play a vital role in tracking costs, overheads, and revenues.

- By segmenting your expenses through receipts, you can prevent overspending and find areas where you can save.

Proof of Purchase

- Your receipt is your official record that a purchase has been made. This acts as a useful protection for buyers and sellers alike.

- In the event of a disagreement over payment, your receipt is your main evidence.

- If you’re exchanging or returning something, most retailers will ask to see proof of purchase.

- Without a receipt, you have less bargaining power, particularly in circumstances where policies are firm on refunding or replacement.

Tax Reasons

- During tax time, your receipts will save you money and hassle.

- Receipts are proof of deductions, including donations to charity, business mileage, or business trips.

- They offer a record of income for business owners and freelancers to verify income and expenses.

- Precise receipts can avoid nightmares of audits. Keep them organized throughout the year so that you’re not panicking at the last minute.

Warranty and Repairs Claims

- Buying costly products such as electronics or appliances usually comes with a warranty.

- Receipts are the most important document needed when making a claim under warranty.

- They also assist in confirming eligibility for free repair or replacement.

- For instance, without a receipt, it becomes a frustrating experience to claim that your washing machine is still under coverage.

Prevention of Fraud

- Receipts are transparent and clear. Going through your receipts helps you detect errors, unauthorized transactions, or fraud.

- Ever been overcharged at the store? A receipt can quickly clear up the confusion.

- When suspicious charges pop up on your bank statement, receipts serve as evidence to substantiate disputes.

Invoice vs Receipt: A Detailed Comparison

| Aspect | Invoice | Receipt |

|---|---|---|

| Definition | A document issued by a seller to request payment from a buyer for goods or services. | A document issued by a seller to acknowledge that payment has been received from a buyer. |

| Purpose | To inform the buyer of the amount owed and provide payment details. | To serve as proof of payment and confirm the completion of a transaction. |

| Timing of Issuance | Issued before the payment is made; often provided upon delivery of goods or services. | Issued after the payment is made, immediately or shortly afterward. |

| Contents | Includes invoice number, seller and buyer details, description of goods/services, total amount payable, payment terms, and due date. | Includes receipt number, seller and buyer details, description of goods/services, total payment received, payment method, and date of transaction. |

| Legal Implications | Serves as a request for payment but cannot be used as legal proof of payment on its own. | Can be used as legal proof of payment in case of disputes or audits. |

| Examples | A business sending an invoice for bulk office supplies sold to a client. | A café issuing a receipt to a customer who paid for their coffee. |

Invoice vs Receipt: Understand the Purpose

When dealing with financial transactions, particularly as a consumer or business owner, you’ve probably encountered with invoices vs receipt. Though they appear to be identical on the surface, they’re used for distinct purposes. Below, we’ll discuss three crucial questions to shed light on the differences and purposes of these documents.

1. Is an Invoice a Proof of Purchase?

An invoice is not always evidence of purchase. An invoice can be thought of as a payment request and not as evidence of final payment. It includes information like the items or services rendered, the amount due, and how to pay.

Example:

- A freelance graphic designer might give a client an invoice after the completion of a project, requesting payment.

- Until the client has paid the invoice value, it can’t be used as proof of purchase.

- An invoice shows a transaction is taking place, but it does not verify payment has been made. Proof of purchase, however, needs evidence that payment was settled.

2. Can a Receipt Replace an Invoice?

The short answer is no, a receipt cannot substitute an invoice, since the two documents play different purposes. Here’s how they contrast:

Invoice:

- Issued prior to payment to ask for money due.

- Includes information about the transaction, such as item descriptions, quantities, and prices.

- Helpful in keeping track of outstanding payments and accounts receivable.

Receipt:

- Issued subsequent to payment as evidence of the transaction having been finalized.

- Verifies goods or services have been paid for, making it essential for warranties, returns, or tax purposes.

To demonstrate:

- If you buy a laptop, they might give you an invoice explaining the amount paid and terms of payment. They will give you a receipt acknowledging your payment after you’ve made the payment.

- Each document has a specific role, and it is not transferable.

3. Do You Need Both an Invoice and a Receipt?

Even though you never need both in all cases, the need for them depends upon the nature of the transaction.

Businesses

- Companies tend to send their customers invoices in order to get paid. Upon receiving the payment, they give a receipt as proof.

- Keeping both documents allows for an open and accurate accounting record for tax returns, audits, and settlement disputes.

Consumers:

- Usually, you do not require invoices unless you personally handle billing. You will mostly use receipts as proof of payment for returns, warranties, or personal budget monitoring.

Scenarios Where Both Are Required

When you hire a contractor, you need an invoice to keep track of the outstanding payment and require a receipt afterwards to record the payment made.

For big-ticket purchases, such as cars or machinery, both an invoice and a receipt guarantee that you have a complete paper trail.

Invoice vs Receipt: When to Use?

A receipt and an invoice have different uses in financial transactions. An invoice is sent prior to payment, usually by a seller or service provider, requesting payment for goods or services. It states information such as items sold, quantities, prices, terms of payment, and due dates, and acts as a formal request for payment.

Conversely, a receipt is produced when payment has been made and serves as evidence of the transaction. It indicates that the buyer has made a payment and contains information such as the amount paid, mode of payment, and payment date. In conclusion, use an invoice to request payment and a receipt to confirm payment.

How to Create an Invoice and a Receipt?

Making an invoice and a receipt is an easy process, but they should be professional, understandable, and must have all details required. A guide is as follows:

Making an Invoice

- An invoice is a document mailed to a customer requesting payment for services or goods rendered. An invoice is an official record of the transaction.

- Header Information: Place your company name, logo, and contact information at the top. Include the word “Invoice” in bold.

- Invoice Number: Provide a specific invoice number for tracking.

- Date: State the date of issue of the invoice and the date payment should be made.

- Client Details: Insert the receiver’s name, company name (if any), and contact information.

- Itemized List: Enumerate the products or services provided clearly, including:

Description of the each item/service

- Quantity

- Unit price

- Total price for each item

- Subtotal and Taxes: Compute the subtotal, then add taxes payable and display the total due amount.

- Payment Terms: Identify the payment methods (e.g., bank transfer, credit card) and terms (e.g., “Payment due within 30 days”).

- Additional Notes: Insert any notes as needed, including thank-you comments or late payment charges.

Preparing a Receipt

A receipt is made upon payment receipt, used as proof of the transaction.

- Header Information: Like an invoice, add your company name, logo, and contact information. Title the document “Receipt.”

- Receipt Number: Give a unique receipt number for record purposes.

- Date: Indicate when the payment was received.

- Payer Details: Add the name and contact details of the payor or business.

Payment Details: Clearly state:

- Description of goods/services paid

- Amount paid

- Method of payment (e.g., cash, credit card, bank transfer)

- Acknowledgment: Put a note affirming that the payment is received in full.

- Signature (Optional): Add a signature or stamp to authenticate, if necessary.

By doing these steps, you can make professional invoices and receipts that bring about clarity and keep proper records for your business transactions.

Final Thoughts (Invoice vs Receipt)

Knowing the primary comparison between invoice vs receipt is more than merely untangling financial jargon; it’s about laying a strong foundation for sound financial management, legal compliance, and professionalism. Whereas invoices are formal payment requests, assisting businesses in staying organized and monitoring pending income, receipts are evidence of transactions completed, providing clarity and security to both buyers and sellers. Every document contributes uniquely towards fulfilling transparency, adjudicating dispute, and making tax compliance feasible.

Whether you’re an entrepreneur looking to streamline business or an individual seeking greater financial acumen, being aware of when and how to utilize invoices and receipts can be the difference-maker. By adding detailed and clean invoices to your routines, you can increase your company’s professionalism while maintaining strong client relationships. Similarly, keeping receipts in order can save you time and aggravation come tax season, ultimately giving you a full and accurate picture of your finances.

As you move forward, apply these insights to your personal or business transactions to enhance organization, maintain transparency, and avoid costly mistakes. Economic success usually begins with getting a handle on the little things, and invoices and receipts are one such aspect of detail that can pay great dividends.

Create Invoices Instantly – Free & Easy!

Generate professional invoices in seconds with our Free Online Invoice Generator.

👉 Try the Invoice Generator Now

Leave a Reply